Share This Page

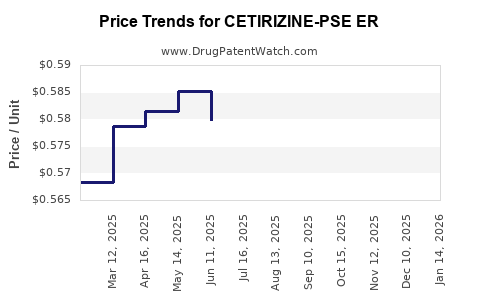

Drug Price Trends for CETIRIZINE-PSE ER

✉ Email this page to a colleague

Average Pharmacy Cost for CETIRIZINE-PSE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CETIRIZINE-PSE ER 5-120 MG TAB | 45802-0147-53 | 0.57122 | EACH | 2025-12-17 |

| CETIRIZINE-PSE ER 5-120 MG TAB | 00536-1279-35 | 0.57122 | EACH | 2025-12-17 |

| CETIRIZINE-PSE ER 5-120 MG TAB | 45802-0147-62 | 0.57122 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CETIRIZINE-PSE ER

Introduction

Cetirizine-PSE ER (Extended Release) is a combination pharmaceutical product that synergistically addresses allergic rhinitis and sinus congestion by combining cetirizine, a second-generation antihistamine, with pseudoephedrine extended release. The evolving landscape of allergy treatments, regulatory changes, and competitive dynamics shape its market trajectory. This analysis evaluates current market conditions, key drivers, competitive environment, regulatory influences, and provides price projections over the next five years.

Market Overview

The global allergy pharmacotherapy market, projected to reach USD 28.3 billion by 2027, is expanding at a CAGR of approximately 5.8% (2020-2027) [1]. The growth drivers include increasing prevalence of allergic diseases, rising awareness, and demand for combination therapies offering symptomatic relief with improved convenience.

Cetirizine-PSE ER occupies a niche within this space—serving a specific subset of patients with both allergic rhinitis and nasal congestion, particularly among adults and adolescents. Its preferred status is driven by its once-daily dosing, better compliance, and favorable side-effect profile relative to older antihistamines.

Market Dynamics

Prevalence and Demographic Trends

The rising incidence of allergic rhinitis—affecting approximately 20-30% of the global population—fuels demand for combination therapies [2]. Urbanization, pollution, and climate change contribute to increasing allergy burdens. The aging population further expands the patient base susceptible to sinus and allergy symptoms.

Regulatory Environment

Regulatory considerations significantly influence market accessibility. In many jurisdictions, pseudoephedrine formulations face restrictions due to its potential misuse for clandestine methamphetamine synthesis, impacting supply chains. However, branded combination products with controlled distribution pathways have maintained steady market presence.

Competitive Landscape

The market comprises branded formulations, generic equivalents, and alternative combination therapies such as loratadine with pseudoephedrine or newer nasal sprays. Leading pharmaceutical companies include Johnson & Johnson (Zyrtec-D), Sanofi, and Mylan. The competitive edge often hinges on efficacy, safety profile, patient convenience, and formulary positioning.

Market Penetration and Adoption

Cetirizine-PSE ER, being on formulary lists and backed by extensive clinical data supporting its safety profile, is favored in prescription settings. Its utilization is particularly prominent in regions with high allergy prevalence like North America and Europe. However, OTC availability varies, generally restricted or prescriptive in many markets due to pseudoephedrine regulations.

Price Analysis

Current Price Landscape

The current retail price for a typical 15-count pack of cetirizine-pseudoephedrine ER (10 mg/120 mg) ranges between USD 10-15 in the US, translating to approximately USD 0.67-1.00 per tablet. These prices are influenced by brand versus generic status, distribution channels, and regional pricing policies.

Pricing Factors

- Regulatory Restrictions: In markets with tight pseudoephedrine controls, limited supply impacts pricing stability.

- Market Competition: Entry of generics has driven down prices, with generic versions priced approximately 25-50% lower than brand name.

- Patent Landscape: Patent expirations or exclusivity periods influence pricing strategies.

- Operational Costs: Manufacturing, logistics, and compliance costs contribute to retail prices.

Price Projections (2023-2028)

Based on market growth trends, regulatory developments, and competitive dynamics, the following projections are formulated:

| Year | Average Price per Pack (USD) | Comments |

|---|---|---|

| 2023 | 10-15 | Stable prices due to existing patent protections and stable supply chains. |

| 2024 | 9-14 | Introduction of generics reduces average prices; minor downward adjustments expected. |

| 2025 | 8-13 | Increased generic penetration; regional price variations persist. |

| 2026 | 8-12 | Regulatory tightening on pseudoephedrine may constrain supply, marginally elevating prices in some markets. |

| 2027 | 7-12 | Market stabilization; price erosion continues with new entrants. |

| 2028 | 7-11 | Fixed market share among generics; potential for slight price recovery in locked markets. |

Note: The above estimates assume current regulatory and market conditions remain relatively stable, with no disruptive events such as major breakthroughs or significant patent litigations.

Key Market Drivers and Constraints Influencing Price Projections

- Regulatory Restriction Impact: Countries like the US and Australia impose logging and quantity restrictions on pseudoephedrine; such controls can limit supply flexibility, influencing regional prices.

- Generic Market Expansion: As patents lapse, generic manufacturers will intensify efforts to offer cost-effective alternatives, exerting downward pressure.

- Consumer Preferences: Increasing preference for OTC products in some regions may influence market share, with potential price reductions in that segment.

- Emerging Markets: Growing awareness and expanding healthcare infrastructure in Asia-Pacific and Latin America open avenues for penetration, often at competitive, lower prices.

Regulatory and Market Risks

- Stringent pseudoephedrine legislation could limit product availability, affecting sales volumes and pricing.

- Possible shifts toward safer, non-stimulant decongestants might impact demand.

- Patent litigations or exclusivities can temporarily sustain higher pricing in certain jurisdictions.

- Public health campaigns against pseudoephedrine misuse may lead to further restrictions.

Opportunities for Market Growth

- Line Extension Development: Formulating low-dose or pediatric variants could expand the patient base and justify premium pricing.

- Digital Health Integration: Digital adherence tools and telemedicine can improve compliance and foster brand loyalty.

- Strategic Partnerships: Collaborations with regional distributors and local regulatory authorities can facilitate market entry and stabilization.

Conclusion

The Cetirizine-PSE ER market exhibits steady growth aligned with the broader allergy treatment sector. Price erosion driven by generic competition is expected to continue, with wholesale and retail prices declining gradually over the forecast period. However, regulatory restrictions around pseudoephedrine could create localized price swings. Companies that adapt to evolving legislation, innovate formulations, and optimize distribution are positioned to sustain profitability.

Key Takeaways

- Market size and growth: The global allergy treatment market's expansion presents opportunities for Cetirizine-PSE ER, especially in high-breaches regions.

- Pricing trends: Expect gradual decreases in retail prices driven by generic entry, with regional variations influenced by regulatory constraints.

- Regulatory landscape: Stringent pseudoephedrine controls may tighten supply chains, impacting prices and availability.

- Competitive strategies: Differentiation through formulations, patient-centric innovations, and strategic partnerships can mitigate price erosion.

- Future outlook: Continued market penetration balanced against regulatory restrictions supports a stable yet competitive pricing environment through 2028.

FAQs

1. How do pseudoephedrine regulations impact the pricing of Cetirizine-PSE ER?

Stringent pseudoephedrine regulations limit supply channels and distribution, potentially increasing procurement costs and retail prices in restrictive markets. Conversely, relaxed regulations facilitate broader access and price stability.

2. Are generic versions of Cetirizine-PSE ER available, and how do they influence market prices?

Yes, generic formulations are increasingly available, exerting downward pressure on prices due to competition and lower manufacturing costs, typically reducing patient costs by 25-50%.

3. What factors could cause Cetirizine-PSE ER prices to trend upward in certain regions?

Regulatory tightening, supply chain disruptions, patent litigations, or a shift in demand favoring branded formulations can lead to localized price increases.

4. How will emerging markets influence the product’s pricing and market share?

Growing allergy prevalence and improving healthcare infrastructure create expansion opportunities, often at lower price points driven by regional pricing strategies and economic factors.

5. What is the potential for new formulations or extended indications to affect market and prices?

Innovative formulations, such as pediatric or low-dose variants, can expand the market, potentially supported by premium pricing, especially if they address unmet needs or enhance compliance.

Sources:

[1] Research and Markets, “Global Allergy Diagnostics and Treatment Market Forecast,” 2021.

[2] World Allergy Organization, “Worldwide Prevalence of Allergic Rhinitis,” 2020.

More… ↓