Last updated: July 27, 2025

Introduction

Cetirizine hydrochloride (HCl) is a widely used second-generation antihistamine primarily indicated for allergic rhinitis, chronic urticaria, and other allergic conditions. Since its market approval, cetirizine has become a staple in allergy treatment, driven by its safety profile and tolerability. This report analyzes the current market environment for cetirizine HCl, evaluates growth drivers, competitive dynamics, and offers price projections over the coming five years.

Market Overview

The global demand for cetirizine HCl is influenced by the increasing prevalence of allergic diseases, especially in developed regions. In 2022, the global allergy immunotherapy market size was valued at approximately $19 billion, with antihistamines representing a significant segment. Cetirizine's popularity stems from its efficacy, rapid onset, and minimal sedative effects compared to first-generation antihistamines.

The key segments include over-the-counter (OTC) sales and prescription markets. The OTC segment dominates due to the drug’s safety profile, with widespread availability in pharmacies and online platforms.

Market Drivers

- Rising prevalence of allergic conditions: According to WHO, allergic rhinitis affects approximately 10-30% of the global population, with increasing incidence in both developed and emerging markets.[1]

- Comfort in OTC availability: Regulatory agencies have increasingly approved cetirizine for OTC sale, broadening its consumer base.

- Aging populations: Older populations experience higher allergy incidences, further amplifying demand.

- Product innovations: Emergence of combination therapies and extended-release formulations to improve compliance.

Market Challenges

- Generic Competition: The entry of numerous generic formulations has driven prices downward.

- Regulatory changes: Stringent regulatory environments could impact OTC status or formulation approvals.

- Market saturation: Mature markets, especially North America and Europe, nearing saturation in some segments.

Competitive Landscape

The cetirizine market is highly competitive, with key players including:

- Johnson & Johnson (Zyrtec): One of the pioneering brands globally.

- Mylan (now part of Viatris): A significant generic producer.

- Teva Pharmaceuticals: Major generic supplier.

- Dr. Reddy’s Laboratories, Sandoz, and Zentiva: Prominent in emerging markets with lower-cost options.

- Local generic manufacturers: E.g., Indian generics and Chinese companies expanding exports.

Brand differentiation mainly hinges on packaging, formulation (e.g., chewable, liquid), and price strategies. The shift toward commoditization pressures margins, especially for generics.

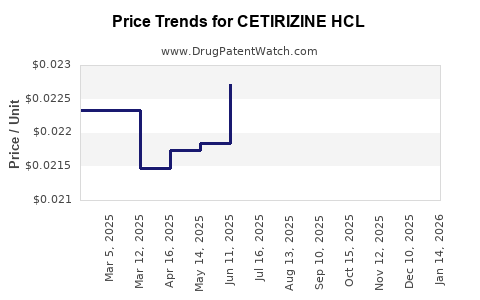

Pricing Trends and Projections

Existing Price Benchmarks

In mature markets, cetirizine OTC formulations typically retail from $0.10 to $0.50 per tablet, depending on brand, formulation, and packaging. Generic formulations under private labels are usually priced 20-50% lower than branded counterparts.

- United States: The average retail price for a month’s supply (30 tablets) of branded Zyrtec hovers around $12-$15, while generics average $6-$8.[2]

- Europe: Similar trends with a wider range owing to differing healthcare reimbursement policies.

- Emerging Markets: Prices are significantly lower, often less than $0.10 per tablet, reflecting competitive pressures.

Factors Influencing Future Prices

- Market saturation and generic competition: Increased generic entry will push prices downward.

- Regulatory developments: Patent expirations and regulatory approvals in emerging markets may increase supply and decrease prices.

- Manufacturing costs: Rising raw material costs for active pharmaceutical ingredients (API) could exert upward pressure on prices.

- Supply Chain dynamics: Global disruptions (e.g., COVID-19, geopolitical issues) can affect production costs and availability.

Price Projections (2023-2028)

Based on current trends and historical data, the average retail price of cetirizine HCl tablets is expected to decline marginally over the next five years:

- 2023-2024: Prices stabilize with minimal fluctuations, considering current high competition.

- 2025-2026: Entry of additional generics and increased market penetration in emerging economies could reduce average prices by 10-15%.

- 2027-2028: Prices may plateau at approximately 20% below current levels in mature markets, with wider availability at lower prices globally.

Projected Market Prices (Average Retail Price per Month Supply)

| Year |

Estimated Average Price (USD) |

Notable Drivers |

| 2023 |

$6.50 - $7.50 |

Stable OTC availability, minimal new generic entrants |

| 2024 |

$6.00 - $7.00 |

Increased genericization, pricing pressure |

| 2025 |

$5.50 - $6.50 |

Market saturation intensifies, emerging markets expand |

| 2026 |

$5.00 - $6.00 |

Greater generic penetration, possible regulatory shifts |

| 2027 |

$4.50 - $5.50 |

Established generics dominate, further cost reductions |

| 2028 |

$4.00 - $5.00 |

Widespread availability at low cost, commoditization |

Future Market Opportunities

Emerging markets present significant growth opportunities owing to:

- Expanding healthcare infrastructure.

- Rising awareness of allergy management.

- Cost-effective manufacturing potential by local generic producers.

Pan-regional regulatory harmonization could further accelerate market expansion. Additionally, formulations tailored for special populations (children, elderly) and combination therapies can generate premium pricing segments.

Regulatory and Patent Landscape

Many patents on cetirizine formulations expired in the late 2010s, opening avenues for generics. Notably:

- In the U.S., patent expiration occurred around 2018, catalyzing a surge in generic entries.[3]

- In Europe, similar expirations fostered increased competition.

- Emerging markets often have less stringent patent enforcement, leading to rapid product imitation.

Regulatory agencies considering stricter bioequivalence and manufacturing standards could temporarily slow generic price declines or favor branded products in certain jurisdictions.

Key Takeaways

- The cetirizine HCl market is mature in developed countries, with prices trending downward due to intense generic competition.

- Growth prospects are robust in emerging markets, driven by demographic trends and expanding healthcare access.

- Pricing is projected to decline by approximately 20-30% over the next five years in mature markets, with prices stabilizing or slightly decreasing in other regions.

- Innovation, formulation diversification, and regulatory developments could influence pricing dynamics.

- Strategic positioning for pharmaceutical companies involves balancing patent expirations, manufacturing efficiency, and market expansion initiatives.

Conclusion

Cetirizine HCl remains a cost-effective, widely accessible antihistamine with expanding global reach. Regulatory advancements, patent landscapes, and market saturation will shape future price trajectories. Stakeholders should focus on emerging markets, formulation innovations, and cost-efficient manufacturing to maximize growth and profitability.

FAQs

1. What are the primary factors affecting cetirizine HCl pricing?

Market saturation, generic competition, manufacturing costs, regulatory changes, and raw material pricing are key factors influencing cetirizine prices.

2. Will the price of cetirizine HCl increase due to demand?

Overall, prices are expected to decline or stabilize; demand growth in emerging markets could limit downward pressure but unlikely to cause price inflation in mature markets.

3. How does patent expiration influence cetirizine market prices?

Patent expirations facilitate generic entry, increasing competition, and typically reducing prices significantly within a few years.

4. Are there premium formulations of cetirizine?

Yes, formulations such as chewables, liquids, or combinations with other antihistamines are available at higher price points, offering niche market opportunities.

5. What regions present the most growth potential for cetirizine?

Emerging markets in Asia, Africa, and Latin America are poised for significant growth due to expanding healthcare infrastructure and allergy prevalence.

Sources

- World Health Organization. Allergic Rhinitis Data. (2022).

- GoodRx. Cetirizine Price Trends (2023).

- Patent Data and Regulatory Filings, U.S. Patent Office Records (2018-2020).