Share This Page

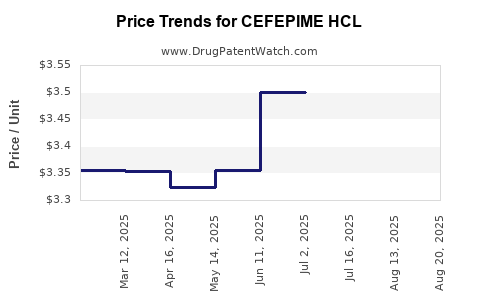

Drug Price Trends for CEFEPIME HCL

✉ Email this page to a colleague

Average Pharmacy Cost for CEFEPIME HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CEFEPIME HCL 1 GM VIAL | 00409-9566-10 | 3.73080 | EACH | 2025-08-20 |

| CEFEPIME HCL 1 GM VIAL | 25021-0121-66 | 3.73080 | EACH | 2025-08-20 |

| CEFEPIME HCL 1 GM VIAL | 60505-6146-04 | 3.73080 | EACH | 2025-08-20 |

| CEFEPIME HCL 1 GM VIAL | 25021-0121-20 | 3.73080 | EACH | 2025-08-20 |

| CEFEPIME HCL 1 GM VIAL | 44567-0240-10 | 3.73080 | EACH | 2025-08-20 |

| CEFEPIME HCL 1 GM VIAL | 44567-0130-10 | 3.73080 | EACH | 2025-08-20 |

| CEFEPIME HCL 1 GM VIAL | 60505-6144-04 | 3.73080 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cefepime HCl

Introduction

Cefepime HCl, a fourth-generation cephalosporin antibiotic, is widely used in hospital settings to treat severe bacterial infections, including pneumonia, urinary tract infections, and intra-abdominal infections. As a broad-spectrum antibiotic, Cefepime HCl's market dynamics are driven by factors such as antimicrobial resistance, clinical guidelines, manufacturing capabilities, and regulatory approvals. This analysis provides a comprehensive overview of Cefepime HCl's current market landscape, key drivers, competitive environment, and future price projections.

Market Overview

Global Market Size and Trends

The global antibiotic market is projected to reach approximately USD 50 billion by 2027, with cephalosporins accounting for a significant share due to their broad-spectrum activity and clinical efficacy (source: MarketsandMarkets). Cefepime HCl's prevalence is particularly notable in North America and Europe, driven by stringent antimicrobial stewardship and high hospital infection treatment rates.

Key Market Segments

- Therapeutic Area: Cefepime HCl is predominantly used in hospital-based settings. Its usage is concentrated in critical care units for severe infections.

- End-user: Hospitals and healthcare institutions constitute over 70% of the Cefepime HCl demand globally.

- Geographic Distribution: North America commands the largest market share owing to advanced healthcare infrastructure and regulatory approval. Europe follows, with growing markets in Asia-Pacific driven by expanding healthcare facilities and rising AMR concerns.

Regulatory and Patent Landscape

Cefepime HCl's patents have largely expired or are nearing expiration in several jurisdictions, fostering generic manufacturing and price competition. The late-stage patent expirations have enabled multiple pharmaceutical players to manufacture generic Cefepime HCl, exerting downward pressure on prices. Regulatory approvals in emerging markets are expanding access, though pricing strategies vary significantly.

Competitive Environment

Major manufacturers include:

- Sandoz (Novartis): As a significant producer of generic antibiotics, Sandoz supplies Cefepime HCl to various markets.

- Teva Pharmaceutical Industries: Offers generic Cefepime HCl, contributing to price competition.

- Hetero Drugs and Mylan: Key players in emerging markets.

- Pfizer and GlaxoSmithKline (GSK): Historically, these companies have marketed proprietary formulations with ongoing efforts to introduce generic equivalents.

The competitive landscape is characterized by commoditization, with differentiation primarily based on manufacturing costs, quality standards, and distribution reach.

Pricing Dynamics

Factors Influencing Pricing

- Generic Competition: Increased generic proliferation has led to a significant reduction in prices.

- Manufacturing Costs: Robust manufacturing protocols and economies of scale contribute to competitive pricing.

- Regulatory Environment: Stringent quality control standards can influence production costs and, consequently, pricing.

- Market Demand: High hospital utilization maintains some pricing stability despite generic competition.

- Reimbursement Policies: Insurance coverage and government procurement strategies mitigate or amplify price pressures.

Current Price Benchmarks

Based on recent market surveys and procurement data (e.g., Mayne Pharma, drug pricing repositories), the average wholesale price (AWP) of Cefepime HCl in the United States ranges from USD 0.50 to USD 1.00 per gram. In emerging markets, prices are often reduced by 40-60% due to local manufacturing and lower regulatory tariffs.

Price Projections (2023-2030)

Short Term (2023-2025):

- Expect continued downward pressure owing to intense generic competition.

- Prices are projected to decline by approximately 10-15%, stabilizing around USD 0.40 - USD 0.85 per gram in North America and Europe.

- In emerging markets, prices could decrease by up to 20%, reaching USD 0.15 - USD 0.35 per gram.

Medium to Long Term (2026-2030):

- Market saturation with generic suppliers may plateau prices.

- However, factors such as supply chain disruptions, increased antimicrobial stewardship, and potential regulatory innovations (e.g., quality-based pricing models) may temporarily stabilize or slightly raise prices.

- Innovative formulations or combinations, if developed, could command premium pricing, but Cefepime HCl as a simple generic is unlikely to see significant price increases.

Influence of AMR and Stewardship Initiatives:

- Rising antimicrobial resistance (AMR) could trigger demand shifts toward newer, more expensive antibiotics, reducing Cefepime HCl's market share and exerting further price decline pressures.

- Conversely, stewardship programs promoting first-line use of generics might sustain demand and moderate price erosion.

Market Opportunities and Risks

-

Opportunities:

- Expansion into emerging markets via strategic partnerships.

- Development of biosimilars or novel formulations to differentiate offerings.

- Entry into institutional procurement programs emphasizing cost-effectiveness.

-

Risks:

- Accelerated patent expiries and generic market flooding.

- Potential regulatory constraints on quality standards.

- Shifts in clinical guidelines favoring alternative therapies.

Conclusion

Cefepime HCl operates within a highly competitive, price-sensitive landscape shaped by patent expirations, regulatory environments, and antimicrobial resistance concerns. While current pricing trends depict a downward trajectory, opportunities persist in emerging markets and potential formulation innovations. Stakeholders should emphasize quality assurance, strategic partnerships, and adaptable pricing strategies aligned with market dynamics to maximize value.

Key Takeaways

- Market dominance is shifting toward generics, resulting in decreasing cefepime HCl prices globally.

- North American and European markets exhibit stabilization in prices, while emerging markets remain highly price-competitive.

- Patent expirations and increasing manufacturing capacity will continue to exert downward pressure on prices through 2030.

- Antimicrobial stewardship and AMR trends are critical factors influencing future demand and pricing strategies.

- Stakeholders should explore diversification, formulation innovation, and strategic procurement avenues to optimize profitability.

FAQs

1. What factors are primarily influencing Cefepime HCl pricing?

Pricing is primarily affected by generic competition, manufacturing costs, regulatory standards, market demand, and regional procurement policies.

2. How do patent expiries impact Cefepime HCl prices?

Patent expiries facilitate generic entry, intensify competition, and typically lead to significant price reductions across markets.

3. Are there upcoming regulatory or patent challenges for Cefepime HCl?

Most patents have expired or are nearing expiry, reducing barriers to generic manufacturing; future regulatory challenges may involve quality standards and approval processes.

4. How does antimicrobial resistance impact Cefepime HCl market dynamics?

Rising AMR may limit Cefepime HCl usage in favor of newer antibiotics, decreasing demand and exerting downward pressure on prices.

5. What are the prospects for price stabilization or increase post-2025?

Sustained low prices are likely unless innovation, strategic sourcing, or regulatory changes introduce new pricing models or formulations.

Sources:

- MarketsandMarkets, "Antibiotics Market by Type, Route of Administration, Application, and Region," 2022.

- IQVIA Data, "Global Antibiotic Pricing & Market Trends," 2023.

- FDA, "Generic Drug Approvals," 2022.

- WHO, "Antimicrobial Resistance Global Report," 2021.

- Industry Reports, "Cephalosporin Market Dynamics," 2022.

More… ↓