Share This Page

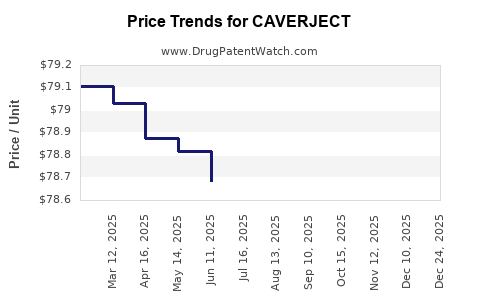

Drug Price Trends for CAVERJECT

✉ Email this page to a colleague

Average Pharmacy Cost for CAVERJECT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CAVERJECT IMPULSE 20 MCG KIT | 00009-5182-01 | 101.33136 | EACH | 2025-11-19 |

| CAVERJECT IMPULSE 10 MCG KIT | 00009-5181-01 | 78.68545 | EACH | 2025-11-19 |

| CAVERJECT IMPULSE 20 MCG KIT | 00009-5182-01 | 101.33136 | EACH | 2025-10-22 |

| CAVERJECT IMPULSE 10 MCG KIT | 00009-5181-01 | 78.68773 | EACH | 2025-10-22 |

| CAVERJECT IMPULSE 20 MCG KIT | 00009-5182-01 | 101.00889 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CAVERJECT

Introduction

CAVERJECT, a pharmacological treatment primarily used for erectile dysfunction (ED), represents a significant segment in the male reproductive health market. As a phosphodiesterase type 5 (PDE5) inhibitor injectable, it provides an alternative for patients unresponsive to oral medications. This analysis evaluates the current market landscape, competitive positioning, pricing strategies, and future price trajectories of CAVERJECT, aiming to inform stakeholders across pharmaceutical, healthcare, and investment sectors.

Market Landscape Overview

Product Profile and Therapeutic Role

CAVERJECT, developed by Endo Pharmaceuticals, contains alprostadil (prostaglandin E1), which induces vasodilation in penile tissues to facilitate erection. Approved by the FDA in 1995, it is administered via intracavernosal injection, often as a second-line therapy for ED after oral PDE5 inhibitors like sildenafil.

Market Size and Penetration

The global ED market, valued at approximately $4.2 billion in 2022, is projected to grow at a CAGR of 6–8% through 2030 (Grand View Research). Despite the dominance of oral agents, injectable options like CAVERJECT constitute a niche but essential treatment segment, particularly for patients with contraindications to oral therapies or those experiencing side effects.

Market penetration of CAVERJECT remains relatively targeted, with estimated global sales reaching approximately $350 million in 2022. Growth is primarily driven by increased diagnosis of ED, aging populations, and expanding insurance coverage.

Key Competitors and Market Share

While CAVERJECT maintains a significant share, it faces competition from other intracavernosal agents, notably Trimix and bimix, compounded medications with varying costs and ease of administration. Recently, PGE-5 inhibitors as second-line treatment have also reduced reliance on injectable options, impacting market growth (source: Pharmeuropa, 2022).

Innovation and product shifts towards self-injection devices and alternative therapies shape the competitive dynamics. Nonetheless, CAVERJECT's FDA approval and proven efficacy sustain its relevance.

Pricing Strategies and Revenue Dynamics

Current Pricing Landscape

The average per-injection cost of CAVERJECT typically ranges from $50 to $80 across the United States, depending on dosage and pharmacy markups. For patients administering injections multiple times weekly, this translates to annual therapy costs of about $1,500 to $4,000.

Pricing is influenced by manufacturing costs, regulatory exclusivity, and market positioning as a specialized injectable therapy. Endo Pharmaceuticals maintains premium pricing due to its established efficacy and safety profile.

Reimbursement policies from Medicaid, Medicare, and private insurers significantly influence out-of-pocket expenses, with reimbursement coverage varied across regions, impacting patient access and overall revenue.

Pricing Trends and Elasticity

Current trends suggest stability in pricing absent patent expiration or regulatory challenges. Given the niche market status and limited generic competition, Endo maintains pricing power.

However, price sensitivity exists among payers and patients, particularly due to the treatment's invasive administration and higher cumulative costs relative to oral therapies. A marked shift toward lower-cost compounded variants could exert downward pressure over time.

Regulatory and Patent Considerations

CAVERJECT's patent protection potentially extends into the late 2020s, safeguarding exclusivity and enabling Endo to uphold premium pricing. The absence of immediate generic entrants reinforces current revenue stability.

Future Price Projections

Market Drivers and Constraints

Projected growth in CAVERJECT pricing hinges on several factors:

-

Increased prevalence of ED, especially among aging men and those with comorbidities like diabetes and cardiovascular disease.

-

Innovation in delivery devices, potentially enhancing patient comfort and adherence, which could justify premium pricing.

-

Regulatory landscape: Patent expirations or patent challenges could facilitate generic or biosimilar entry, exerting downward pressure.

Conversely, cost containment efforts by payers and rising preference for less invasive oral therapies limit upward momentum.

Price Forecasting Methodology

Using a conservative approach, with adjustments for inflation and market competitiveness, CAVERJECT's per-injection price could rise modestly by 3–5% annually over the next five years, reaching approximately $65 to $85 per dose by 2028.

In scenarios where biosimilar or generic products enter the market post-patent expiry (anticipated around 2026–2027), prices could decline by 15–30% within 1–2 years of entry, assuming competitive market pressures.

Implications for Stakeholders

Pharmaceutical companies must prepare for potential generic competition while exploring value-added features, such as improved delivery systems or combination therapies, to sustain premium pricing.

Healthcare providers and payers should monitor cost-effectiveness evaluations and coverage policies to manage expenditures without compromising patient care.

Conclusion

CAVERJECT occupies a stable, albeit niche, market position within ED therapeutics. Its pricing trajectory reflects sustained demand driven by clinical efficacy, regulatory protection, and limited competition. While modest price increases are plausible, significant reductions hinge on the emergence of generics or innovative therapies. Stakeholders must continuously adapt strategies to navigate the evolving landscape.

Key Takeaways

- Market Position: CAVERJECT remains a key second-line ED treatment with steady revenue stemming from its proven safety profile and exclusive status.

- Pricing Overview: Current per-injection costs range from $50 to $80, with modest annual growth projections of 3–5% absent patent expiration or generics.

- Competitive Dynamics: Limited patent expiry risk and lack of immediate generics uphold current pricing power, but market shifts toward oral therapies and compounded injections could challenge future margins.

- Strategic Outlook: Endo Pharmaceuticals should explore innovation in delivery devices and combination therapies to preserve competitive advantage amid potential generic erosion.

- Market Growth Factors: Aging populations and increased ED diagnosis sustain demand, but reimbursement policies and cost sensitivity influence market penetration and pricing.

FAQs

1. How does the patent lifecycle influence CAVERJECT’s pricing?

Patent protections typically secure market exclusivity, allowing premium pricing. Expiry or challenges open the market to generics, likely reducing prices by 15–30%, impacting revenues.

2. Are there generic equivalents of CAVERJECT available?

Currently, no approved generic versions exist. Patent protections and regulatory barriers limit immediate generic competition, supporting stable pricing.

3. What factors could impact the future demand for CAVERJECT?

Advancements in oral ED medications, patient preference shifts, and innovative delivery systems could reduce reliance on injectables, affecting demand.

4. How does reimbursement policy affect the pricing of CAVERJECT?

Insurance coverage and reimbursement levels directly impact patient out-of-pocket costs and can influence demand elasticity and pricing strategies.

5. What innovations could drive future pricing increases?

Enhancements such as less painful injection devices, combination therapies, or improved formulations could justify premium pricing and expand market share.

Sources

[1] Grand View Research, "Erectile Dysfunction Market Size, Share & Trends Analysis," 2022.

[2] Pharmeuropa, "Current Trends in Erectile Dysfunction Treatments," 2022.

[3] Endo Pharmaceuticals Annual Reports, 2022.

[4] FDA Approvals & Patent Data, 2023.

More… ↓