Share This Page

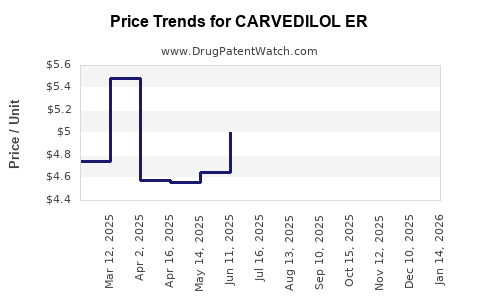

Drug Price Trends for CARVEDILOL ER

✉ Email this page to a colleague

Average Pharmacy Cost for CARVEDILOL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARVEDILOL ER 10 MG CAPSULE | 57664-0663-83 | 6.14567 | EACH | 2025-12-17 |

| CARVEDILOL ER 10 MG CAPSULE | 16714-0227-01 | 6.14567 | EACH | 2025-12-17 |

| CARVEDILOL ER 10 MG CAPSULE | 00115-1248-08 | 6.14567 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Carvedilol ER

Introduction

Carvedilol Extended-Release (ER) is a non-selective beta-adrenergic blocker with alpha-1 blocking activity, primarily prescribed for managing hypertension and heart failure. The drug's unique pharmacokinetic profile, approved indications, and competitive positioning within the cardiovascular therapeutic landscape influence its market dynamics and pricing. This analysis synthesizes current market trends, regulatory factors, competitive landscape, and potential price trajectories to inform stakeholders of growth prospects and investment considerations.

Market Overview

Current Market Landscape

Carvedilol ER’s market derives from its sustained-release formulation, which provides simplified dosing regimens, improved patient adherence, and possibly enhanced clinical outcomes over immediate-release formulations. The global beta-blocker market, valued at approximately USD 8.6 billion in 2021, is expected to grow at a CAGR of 4.3% through 2028, driven by rising cardiovascular disease (CVD) prevalence and expanding indications for beta-blockers such as post-myocardial infarction management and heart failure treatment [1].

Within this landscape, carvedilol maintains a significant share owing to its proven efficacy, safety profile, and manufacturer patent protections. The patient population requiring long-term management of hypertension and heart failure is increasing, with notable prevalence in aging demographics—particularly in North America, Europe, and parts of Asia.

Key Market Players and Competitors

Major players include Pfizer, Mylan (now part of Viatris), and Teva Pharmaceuticals, among others that offer both branded and generic carvedilol products. The advent of generic versions post-patent expiry has intensified price competition, exerting downward pressure on average prices. Nonetheless, branded ER formulations tend to command premium pricing due to convenience and perceived efficiency.

Regulatory and Patent Landscape

Patent protections for branded carvedilol ER formulations have generally expired or are nearing expiry, facilitating generic entry. This transition increases market share for generics, leading to price erosion but broadens access, potentially expanding overall utilization. Regulatory pathways for biosimilars and generics remain straightforward in major markets, accelerating penetration.

Market Dynamics Influencing Price Trends

Pricing Strategies

Brand-name carvedilol ER, before patent expiration, maintained high list prices (~USD 200–300 per month), driven by added value in dosing convenience and clinical support. Post-patent expiry, generic competition has driven prices downward, often reducing costs by 50–80%. Pharmacies and payers benefit from lower prices, incentivizing increased prescription rates.

Market Penetration and Utilization

The shift toward generic formulations and the expansion of indications in heart failure have expanded volume sales. Data indicate that generic carvedilol accounts for over 70% of prescriptions in the United States, with prices stabilizing at lower levels. However, branded ER versions retain niche appeal in certain markets where physician and patient preference favor branded products due to perceived efficacy or formulation differences.

Regulatory Approvals and Innovation

Emerging formulations, such as novel ER delivery systems or fixed-dose combination therapies incorporating carvedilol, may influence pricing by introducing premium offerings. Evolving regulatory standards emphasizing bioequivalence and clinical efficacy will govern the development and commercialization of such innovations.

Price Projections

Near-Term Outlook (1–3 Years)

The immediate trajectory favors sustained pricing declines for branded carvedilol ER due to patent expiry and generic competition. Market analysts project a 30–50% reduction in list prices for branded formulations within this period. Volume growth, driven by broadening indications and aging populations, partially offsets unit price erosion.

Medium to Long-Term Projections (3–5 Years Post-Patent)

Over five years, expect continued price stabilization at lower levels for generic carvedilol. However, niche markets—such as specialty formulations, specific patient subgroups, or combination therapies—may sustain higher prices. The entry of biosimilars and the development of new ER formulations could introduce premium offerings, potentially stabilizing prices for select segments.

External Influences on Pricing

- Reimbursement Policies: Payers' emphasis on cost containment will sustain competitive pricing pressures.

- Healthcare Access: Increased adoption in emerging markets could elevate sales volumes, diluting the impact of price reductions.

- Innovative Delivery Systems: Proprietary, patent-protected ER technologies or combination products could command premium prices even amid generic competition.

Emerging Market Opportunities

Growth in high-burden regions, notably Asia-Pacific, Latin America, and Africa, presents substantial opportunities. Local manufacturers often capitalize on lower manufacturing costs, creating even more competitive pricing environments. Price projections for these markets suggest a gradual decline in branded prices, with generics increasingly capturing market share.

Key Challenges and Risks

- Price Erosion: Rapid generic entry post-patent expiry continues to pressure prices.

- Regulatory Hurdles: Variations in regulatory standards across jurisdictions may delay product launches or reformulations.

- Market Saturation: High existing utilization levels could limit future volume growth.

- Patent Litigation: Ongoing patent challenges or disputes may influence timing and pricing of generic entrants.

Conclusion

The carvedilol ER market is primarily characterized by declining prices driven by generic competition and patent expiries, but sustained demand exists owing to its clinical utility in managing pervasive cardiovascular conditions. While branded prices are forecast to decline significantly in the short term, innovative formulations and expanding indications could introduce premium pricing opportunities. Stakeholders should navigate the dynamically evolving landscape, balancing the benefits of cost-effective generics against the potential for technological innovation to sustain premium market segments.

Key Takeaways

- The carvedilol ER market faces substantial price declines post-patent expiration, with generics dominating in mature markets.

- Volume growth driven by expanding indications and aging populations offsets moderate pricing erosion, sustaining revenue streams.

- Innovation in delivery mechanisms and combination therapies may create new premium pricing avenues amid ongoing price pressures.

- Geographic diversification, especially into emerging markets, presents opportunities for growth despite overall downward pricing trends.

- Competitive dynamics emphasize the importance of strategic patent management, formulation differentiation, and regulatory agility to maintain market relevance.

FAQs

1. What factors are most influential in determining carvedilol ER pricing?

Market exclusivity, patent status, generic competition, manufacturing costs, regulatory approval, and reimbursement policies primarily influence pricing.

2. How does patent expiry affect the pricing of carvedilol ER?

Patent expiry facilitates generic entry, significantly reducing prices, often by up to 80%, making the drug more accessible but decreasing revenues for brand owners.

3. Are there any emerging formulations of carvedilol ER that could command higher prices?

Yes, proprietary ER delivery systems, fixed-dose combinations, and bioavailability-enhanced formulations could justify premium pricing, especially if supported by clinical benefits.

4. What is the outlook for carvedilol ER in emerging markets?

Growth potential remains high due to increasing cardiovascular disease burden and lower manufacturing costs, supporting volume gains despite lower prices.

5. How might regulatory trends impact future price projections?

Streamlined approval processes can accelerate generic entries, exerting downward pressure, but regulatory support for innovative formulations could sustain higher prices for new products.

References

[1] MarketsandMarkets. Beta-Blockers Market Analysis. 2022.

More… ↓