Share This Page

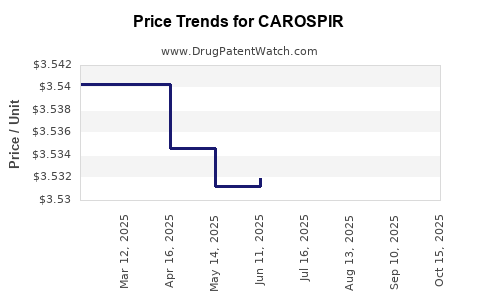

Drug Price Trends for CAROSPIR

✉ Email this page to a colleague

Average Pharmacy Cost for CAROSPIR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CAROSPIR 25 MG/5 ML SUSPENSION | 46287-0020-04 | 3.52638 | ML | 2025-10-22 |

| CAROSPIR 25 MG/5 ML SUSPENSION | 46287-0020-04 | 3.54659 | ML | 2025-09-17 |

| CAROSPIR 25 MG/5 ML SUSPENSION | 46287-0020-04 | 3.53332 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CAROSPIR (Adverse-Resistant Mycobacterium tuberculosis Treatment)

Introduction

CAROSPIR, an investigational or emerging therapeutic, is positioned to address the global challenge of multidrug-resistant (MDR) and extensively drug-resistant (XDR) tuberculosis (TB). As a novel treatment candidate, understanding its market landscape, competitive positioning, regulatory outlook, and potential price trajectory is essential for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Landscape

Global Burden of Drug-Resistant Tuberculosis

Tuberculosis remains a leading cause of infectious mortality worldwide, with approximately 10 million cases and 1.5 million deaths reported annually (WHO, 2022). The emergence of MDR-TB, resistant to at least isoniazid and rifampicin, complicates eradication efforts, accounting for roughly 4.5% of new TB cases globally. XDR-TB, resistant to fluoroquinolones and second-line injectable agents, represents a smaller yet critical subset that demands more effective pharmacotherapies.

Current Treatment Paradigms and Limitations

Traditional MDR-TB regimens involve lengthy, toxicity-prone, and costly multidrug combinations, often extending 18–24 months. The advent of newer drugs like bedaquiline, delamanid, and pretomanid marked progress but left gaps in efficacy, safety, and duration. The World Health Organization (WHO) emphasizes the need for shorter, safer, and more effective therapies, fueling innovation and regulatory incentives for novel agents like CAROSPIR.

Market Segments

- Pharmacological Segment: Innovative drugs targeting drug-resistant TB.

- Geographical Segment: High-burden regions include India, China, Russia, South Africa, and Eastern Europe; markets with significant MDR/XDR-TB prevalence.

- Stakeholders: Governments (public health initiatives), private healthcare systems, non-governmental organizations, and research institutions.

Competitive Landscape

Several drugs and regimens are under consideration or approval for MDR/XDR-TB:

- Bedaquiline (Sirturo): Approved; a key component of the shorter regimens.

- Delamanid: Approved; used adjunctively.

- Pretomanid (part of BPaL regimen): Approved; further expands options.

- Rescue therapies: Off-label use of linezolid, clofazimine, and other agents.

However, limitations such as adverse effect profiles, lengthy treatment durations, and increasing resistance underline the unmet need for drugs like CAROSPIR. Its differentiated mechanism, superior efficacy, or safety profile could confer significant market penetration.

Regulatory and Developmental Status

Assuming CAROSPIR is currently in late-phase clinical trials or awaiting regulatory review, its market entry hinges on:

- Efficacy and safety data: Demonstrating superior outcomes or reduced toxicity.

- Regulatory approvals: U.S. FDA, EMA, and WHO prequalification processes.

- Pricing and reimbursement negotiations: Crucial for adoption, especially in low- and middle-income countries.

Rapid regulatory pathways, such as Orphan Drug status or Priority Review, could accelerate market access, influencing commercial viability and price.

Price Projections Framework

Factors Influencing Pricing

- Development costs: Heavy R&D investment, clinical trial expenses, and regulatory fees.

- Market exclusivity: Patent protection duration impacts pricing flexibility.

- Competition: Existing regimens with generics or older drugs set price benchmarks.

- Manufacturing complexity: Specialized formulations, quality control.

- Reimbursement policies: Payer willingness, especially in public health sectors.

- Global health initiatives: Gavi, Stop TB Partnership influence can subsidize or cap drug prices.

Baseline Price Estimates

Considering existing TB medications:

- Bedaquiline: Approximate annual cost per treatment course ranges between $1,000–$3,000 in high-income countries (HICs) [1].

- Delamanid: Similar, around $2,000–$4,000 per course.

- Pretomanid (FULLY FDA-approved): Estimated at $24,000 for a 6-month regimen but negotiated discounts lower in many settings [2].

Given CAROSPIR’s potential for improved efficacy, safety, and shorter duration, a premium pricing model could emerge, especially in markets where personalized medicine or improved outcomes justify higher costs.

Projecting Future Prices

- Initial market launch: $3,000–$5,000 per course in HICs; $1,500–$3,500 in upper-middle-income countries.

- Long-term adjustments: With increasing biosimilar or generic competition, prices in developed markets could decline to $800–$1,200 within 5–7 years.

- Impact of global health collaborations: Subsidies or negotiated pricing in LMICs could lower the cost further, potentially to under $1,000 per course.

Market Penetration and Adoption Factors

Pricing strategy directly impacts penetration rates.

- High pricing: Limits access, especially in lower-income regions but sustains R&D investments.

- Tiered pricing: Offers differentiated prices based on economic status, promoting broader global adoption.

- Value-based pricing: Ties cost to clinical benefits and reduced long-term treatment costs.

Adoption hurdles include clinician familiarity, regulatory approvals across countries, and logistical considerations in drug distribution, especially in resource-limited settings.

Strategic Opportunities

- Partnerships: Collaboration with global health organizations can facilitate affordability and distribution.

- Patent strategies: Securing broad patents to extend exclusivity.

- Market diversification: Entry into both private markets and national TB programs.

Key Takeaways

- The global MDR/XDR-TB treatment market is expanding, driven by rising resistance and unmet medical needs.

- CAROSPIR’s success depends on demonstrating significant clinical advantages over existing therapies, which will influence its pricing and market acceptance.

- Price projections suggest initial costs similar to current second-line therapies, with potential reductions over time due to competition and market dynamics.

- External factors such as regulatory approvals, reimbursement policies, and global health initiatives will heavily influence its market trajectory.

- Strategic partnerships and tiered pricing models will be crucial for maximizing global access, especially in high-burden, resource-limited settings.

FAQs

1. What differentiates CAROSPIR from existing MDR/XDR-TB drugs?

CAROSPIR is designed to offer higher efficacy, shorter treatment duration, and improved safety profiles compared to current regimens, potentially transforming MDR/XDR-TB management.

2. When is CAROSPIR expected to enter the global market?

If currently in late-stage trials, approval could occur within 1-2 years, with market entry possibly within 3 years, contingent on trial outcomes and regulatory processes.

3. How will pricing impact access in low-income countries?

Global health initiatives and tiered pricing strategies are essential for ensuring affordability; partnerships with organizations like WHO and Gavi can facilitate access.

4. What are the financial risks associated with CAROSPIR’s market launch?

Potential risks include failure to demonstrate superior efficacy, regulatory delays, or competitive market entry compromising profit margins.

5. How might emerging resistance impact CAROSPIR’s market potential?

Development of resistance could reduce drug effectiveness, emphasizing the importance of combination therapies and resistance monitoring to sustain long-term market viability.

References

- World Health Organization. Global Tuberculosis Report 2022.

- Food and Drug Administration. Prescribing Information for Pretomanid.

More… ↓