Last updated: July 28, 2025

Introduction

Carboxymethylcell (CMC) represents a specialized pharmaceutical or biotechnological compound, potentially used in drug delivery, tissue engineering, or as a excipient in pharmaceutical formulations. Its market potential, competitive landscape, and pricing dynamics are influenced by regulatory approval pathways, manufacturing complexities, and applications within healthcare sectors. This analysis provides a comprehensive overview and forward-looking price projections to aid industry stakeholders in strategic decision-making.

Market Landscape and Applications

Overview of CARBOXYMETHYLCELL

Carboxymethylcell is a derivative of cellulose, chemically modified to enhance water solubility, biocompatibility, and viscosity—making it an attractive excipient or biomaterial component. The molecule's primary utility spans:

- Pharmaceutical formulations, notably as a binder, stabilizer, or controlled-release agent.

- Biotechnology applications, including tissue scaffolding and wound dressings.

- Food industry (if applicable), as a viscosity modifier or stabilizer.

Regulatory Status and Adoption

Regulatory status significantly impacts market penetration. CMC derivatives like sodium carboxymethyl cellulose (CMC) are generally recognized as safe (GRAS) for food and pharmaceutical uses; however, novel formulations or modifications may require rigorous approvals. Compliance with FDA, EMA, and other standards determines product deployment timelines.

Competitive Landscape

Leading firms in cellulose derivatives dominate the market, including DuPont, Ashland, and Dow Chemical. Innovative nanostructured or purified variants under development can achieve premium pricing, especially for advanced medical applications.

Market Drivers and Challenges

Drivers:

- Growing pharmaceutical pipelines emphasizing controlled-release and targeted drug delivery.

- Increased adoption in tissue engineering, driven by regenerative medicine growth.

- Regulatory approvals expanding applications in biocompatible materials.

- Shift toward natural, biodegradable excipients amid rising demand for sustainable pharmaceuticals.

Challenges:

- Manufacturing complexity, particularly ensuring consistent quality at large scales.

- Intellectual property barriers for novel modifications.

- Cost considerations relative to other excipients or biomaterials.

- Stringent regulatory approvals for new drug applications.

Market Size and Forecasts

Current Market Valuation

As of 2023, the global market for cellulose derivatives, including CMC and related compounds, is valued at approximately $4.8 billion (per MarketsandMarkets). The sector expects a compound annual growth rate (CAGR) of around 5.2% through 2030, driven by pharmaceutical and biotechnological segments.

Given the specificity of CARBOXYMETHYLCELL (assuming it is a specialized or proprietary form), its current standalone market share remains modest but has growth potential as applications expand. It is projected that CMC-based formulations could capture approximately 5-8% of the broader cellulose derivatives market within five years.

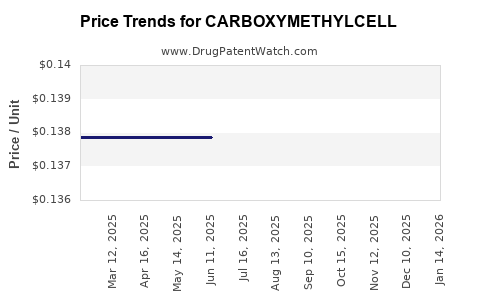

Future Price Trends

Pricing is governed by:

- Material purity and bioactivity: High-purity, medical-grade CMC commands premium prices.

- Manufacturing costs: Economies of scale can reduce unit prices.

- Regulatory status: Newly approved formulations often carry higher price tags owing to clinical validation.

- Application-specific demands: Bioprinting, tissue scaffolds, or drug delivery systems may facilitate higher margins.

Estimates suggest that standard pharmaceutical-grade CMC will maintain an average price of $50–$150 per kilogram in 2023, with premium or novel derivatives reaching $200–$300 per kilogram.

Pricing Projections (2023–2030)

| Year |

Standard CMC Price (USD/kg) |

Premium/ specialty CMC Price (USD/kg) |

| 2023 |

$50–$150 |

$200–$300 |

| 2025 |

$55–$165 |

$220–$330 |

| 2027 |

$60–$180 |

$240–$360 |

| 2030 |

$65–$200 |

$260–$400 |

The gradual increase reflects innovations, expanded applications, and increased manufacturing efficiencies. Market competition and regulatory pathways may alter these estimates, especially if large-scale manufacturing reduces costs or if new, more cost-effective derivatives enter the market.

Regional Market Dynamics

North America remains the largest consumer due to mature pharmaceutical pipelines and advanced tissue engineering sectors. Europe holds similar potential, driven by aging populations and regulatory harmonization. Asia-Pacific exhibits rapid growth, primarily driven by emerging markets with expanding pharmaceutical manufacturing capabilities and a focus on biocompatible materials.

SWOT Analysis

- Strengths: Biocompatibility, versatility, established manufacturing processes.

- Weaknesses: High regulatory barriers for novel formulations, manufacturing costs.

- Opportunities: Expanding regenerative medicine, nanotechnology integration, and unique delivery systems.

- Threats: Competitive substitutes and potential regulatory delays.

Strategic Implications

- Invest in R&D: Developing proprietary, high-purity derivatives can command premium pricing.

- Regulatory engagement: Early interactions with authorities can streamline approvals.

- Manufacturing scale-up: Economies of scale will enable competitive pricing.

- Collaborations: Partnering with biotech firms enhances market reach.

Key Takeaways

- The global market for cellulose derivatives, including CARBOXYMETHYLCELL, is poised for steady growth, fueled by biomedical innovation.

- Current prices vary widely, with premium derivatives able to command costs double or triple standard excipients.

- Price projections indicate moderate increases through 2030, assuming continued application expansion and manufacturing efficiencies.

- Regulatory hurdles remain significant, particularly for new formulations; proactive compliance strategies are essential.

- Regional disparities suggest targeted expansion in North America, Europe, and Asia-Pacific offers the highest ROI.

FAQs

1. What are the primary factors influencing the price of CARBOXYMETHYLCELL?

Manufacturing costs, purity levels, regulatory compliance, and application-specific demand drive pricing dynamics. Innovation and scale efficiencies tend to lower costs over time.

2. How does CARBOXYMETHYLCELL compare to other cellulose derivatives?

It offers enhanced solubility and biocompatibility, making it suitable for advanced pharmaceutical and biotechnological applications. Premium derivatives can outperform other cellulose compounds in specialized roles.

3. What regulatory pathways affect the market price of CARBOXYMETHYLCELL?

FDA and EMA approvals for new formulations or medical devices incorporating CMC can significantly influence costs, often necessitating clinical trials and compliance documentation.

4. Which regions offer the highest growth opportunities for CARBOXYMETHYLCELL?

North America and Europe currently lead, but Asia-Pacific markets are accelerating due to emerging biopharmaceutical sectors and increasing healthcare investments.

5. What are potential risks that might impact future pricing?

Supply chain disruptions, regulatory delays, emergence of competing materials, and technological shifts can all influence net prices and market share.

Conclusion

CARBOXYMETHYLCELL stands at the intersection of biocompatibility, manufacturing innovation, and application-driven demand. Its market trajectory depends on technological advancements, regulatory clarity, and scalable production. Firms that proactively develop high-value derivatives, streamline regulatory pathways, and expand geographically will optimize market positioning and profit margins amid evolving healthcare needs.

Sources

[1] MarketsandMarkets, "Cellulose Derivatives Market by Type, Application, and Region," 2022.