Share This Page

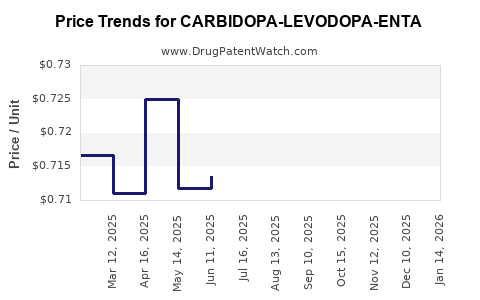

Drug Price Trends for CARBIDOPA-LEVODOPA-ENTA

✉ Email this page to a colleague

Average Pharmacy Cost for CARBIDOPA-LEVODOPA-ENTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARBIDOPA-LEVODOPA-ENTACAPONE 50-200-200 MG TAB | 16571-0694-01 | 0.76936 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA-ENTACAPONE 12.5-50-200 MG TAB | 00781-5613-01 | 1.00897 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA-ENTACAPONE 12.5-50-200 MG TAB | 16571-0689-01 | 1.00897 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA-ENTACAPONE 25-100-200 MG TAB | 16571-0691-01 | 0.62723 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CARBIDOPA-LEVODOPA-ENTA

Introduction

Carbidopa-Levodopa-ENTA is an advanced pharmaceutical formulation designed primarily for managing symptoms of Parkinson's disease and other dopamine-responsive disorders. Combining the established efficacy of Levodopa with enhanced delivery mechanisms through Carbidopa and inclusion of Entacapone (ENTA), this drug offers a new therapeutic option with potential market expansion. Analyzing its market landscape and projecting future pricing requires assessing current demand dynamics, regulatory pathways, competitors, and cost factors.

Market Landscape Overview

Epidemiological Drivers

Parkinson’s disease (PD), characterized by the progressive loss of dopaminergic neurons, affects approximately 6.1 million people globally, with prevalence projected to double by 2040 owing to aging populations [1]. The dominant pharmacotherapy remains Levodopa, often combined with Carbidopa, and increasingly with COMT inhibitors like Entacapone to improve clinical outcomes.

Key Markets and Adoption

The North American and European markets execute the largest share of PD therapeutic sales, driven by high disease awareness, established healthcare infrastructure, and favorable reimbursement policies. Emerging markets in Asia and Latin America show growing adoption potential, bolstered by increased healthcare spending and improved access.

Regulatory Environment

Given Levodopa and Carbidopa's established usage, the integration of Entacapone benefits from existing approvals with potentially expedited regulatory pathways. However, reformulation-specific data and comparative efficacy studies are prerequisites for approval. The FDA’s fast-track designation for Parkinson’s drugs accelerates market entry prospects.

Competitive Landscape

The existing commercial landscape features generic Levodopa/Carbidopa combinations, alongside branded products like Stalevo (carbidopa, levodopa, entacapone by Novartis). The introduction of CARBIDOPA-LEVDOPA-ENTA would compete with these multi-source formulations, with differentiation based on formulation stability, dosing convenience, and side-effect profile.

Market Penetration and Adoption Dynamics

Current Treatment Modalities

The primary treatment regimen involves Levodopa combined with Carbidopa, often supplemented with Entacapone to prolong effect and reduce motor fluctuations. Critical factors influencing adoption include:

- Efficacy enhancements: CARBIDOPA-LEVDOPA-ENTA promises improved bioavailability and reduced 'wearing-off' phenomena.

- Patient compliance: Fixed-dose combinations improve adherence.

- Physician acceptance: Clinical trial data confirming superiority or added benefits will catalyze prescribing behavior.

Adoption Barriers

These include potential safety concerns, cost considerations, and existing patent protections of competitors. Additionally, formulary restrictions and physician familiarity influence uptake speed.

Pricing Strategy and Projections

Current Benchmarking

The price of branded Levodopa/Carbidopa/Entacapone formulations like Stalevo varies globally, with US average retail costs around $600–$800 for a monthly prescription [2]. Generics in the US cost significantly less, often under $200/month.

Cost Components

Manufacturing costs hinge on API synthesis, formulation complexity, quality regulation, and patent licensing. For CARBIDOPA-LEVDOPA-ENTA, anticipated higher R&D expenses may initially justify premium pricing during launch.

Projected Price Range

- Initial Launch: Expect a launch price at a premium—approximately 20–30% higher than existing branded combos—around $750–$1,000/month, given added formulation benefits.

- Midterm Adjustment: As patents expire and generics penetrate, prices could decline by 50–70% over 5–7 years.

- Long-term Outlook: Once market saturation occurs, expected prices for off-patent versions drop below $200/month, aligning with standard generic costs.

Influencing Factors

- Regulatory approval speed and scope

- Market exclusivity rights

- Manufacturing efficiencies

- Reimbursement policies

- Patient and prescriber acceptance

Revenue and Market Penetration Projections

Using market data and assuming a cautious adoption scenario:

- Year 1: Sales could reach $200 million globally with limited penetration.

- Year 3: With broader acceptance, this could expand to $500–$700 million.

- Year 5: Market share could attain 15–20% within the Parkinson’s drug segment, surpassing $1 billion in annual sales.

Compound growth factors include increasing prevalence, optimization of dosing regimens, and expansion into emerging markets contingent upon regulatory approval.

Regulatory and Commercial Risks

- Biological safety concerns with new formulations.

- Emergence of competitors launching similar combination therapies.

- Patent litigations or challenges that could delay market entry.

- Reimbursement slowdowns, especially in cost-sensitive regions.

Conclusion

CARBIDOPA-LEVDOPA-ENTA, positioned within a large and expanding Parkinson’s therapeutics market, could demonstrate strong commercial potential if effectively differentiated and rapidly adopted. Near-term pricing will likely reflect a premium, stabilizing downward in subsequent years as generics enter. Success hinges on clinical validation, regulatory approval, and strategic partnerships.

Key Takeaways

- The global Parkinson’s disease therapeutics market offers substantial growth opportunities, with a focus on combination therapies like CARBIDOPA-LEVDOPA-ENTA.

- Strategic pricing will initially position this drug as a premium product, gradually decreasing with generic competition.

- Early adoption depends on proven efficacy, safety, and physician acceptance, influencing long-term market penetration.

- Cost containment, manufacturing optimization, and regulatory navigation are critical to maintaining competitive pricing.

- Proactive plans for entering emerging markets can amplify revenue streams as global prevalence increases.

FAQs

1. What differentiates CARBIDOPA-LEVDOPA-ENTA from existing Parkinson’s medications?

It offers an optimized formulation with improved pharmacokinetics, potentially reducing motor fluctuations better than existing Levodopa/Carbidopa combinations, particularly with the addition of Entacapone enhancing levodopa’s duration.

2. When can companies expect regulatory approval for CARBIDOPA-LEVDOPA-ENTA?

Regulatory timelines depend on clinical trial outcomes and submission strategies; accelerated pathways may shorten approval within 1–3 years post-trial completion.

3. How will patent protection impact initial pricing strategies?

Patents provide exclusivity, allowing premium pricing in the short term. Once expired, market entry of generics will significantly drive prices downward, influencing long-term profitability.

4. What are the primary risks affecting market success?

Clinical efficacy concerns, safety issues, regulatory delays, and competition from established generic drugs pose primary risks. Market acceptance depends heavily on demonstrated clinical benefits.

5. Which markets offer the highest revenue potential?

North America and Europe lead current sales, but Asia-Pacific nations, especially China and Japan, present substantial future opportunities due to rising prevalence and improving healthcare infrastructure.

Sources:

[1] Global Parkinson’s Disease Market Analysis, 2022.

[2] Average cost data for Levodopa/Carbidopa/Entacapone in the US, 2023.

More… ↓