Share This Page

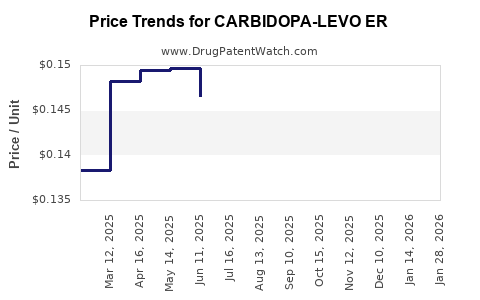

Drug Price Trends for CARBIDOPA-LEVO ER

✉ Email this page to a colleague

Average Pharmacy Cost for CARBIDOPA-LEVO ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARBIDOPA-LEVO ER 25-100 TAB | 60219-2033-01 | 0.11349 | EACH | 2025-12-17 |

| CARBIDOPA-LEVO ER 25-100 TAB | 50228-0460-10 | 0.11349 | EACH | 2025-12-17 |

| CARBIDOPA-LEVO ER 25-100 TAB | 51079-0978-20 | 0.11349 | EACH | 2025-12-17 |

| CARBIDOPA-LEVO ER 25-100 TAB | 00378-0088-01 | 0.11349 | EACH | 2025-12-17 |

| CARBIDOPA-LEVO ER 25-100 TAB | 51079-0978-01 | 0.11349 | EACH | 2025-12-17 |

| CARBIDOPA-LEVO ER 25-100 TAB | 16729-0078-01 | 0.11349 | EACH | 2025-12-17 |

| CARBIDOPA-LEVO ER 25-100 TAB | 50228-0460-01 | 0.11349 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Carbidiopa-Levō ER

Introduction

Carbidopa-Levodopa Extended Release (ER) represents a cornerstone in the pharmacological management of Parkinson’s disease, offering sustained symptom control through a prolonged-release formulation. Its strategic importance within the neurological therapeutics sector underscores rising interest from pharmaceutical companies, investors, and healthcare providers. This report provides a comprehensive market analysis and price projection for Carbidiopa-Levō ER, examining current dynamics, competitive landscape, regulatory factors, and future economic trends that influence its market trajectory.

Market Overview

Global Parkinson's Disease Treatment Landscape

Parkinson’s disease affects over 10 million people worldwide, with an increasing prevalence driven by aging populations among developed regions. The cornerstone therapy involves replenishing dopamine levels, primarily via Levodopa combined with Carbidopa, which inhibits peripheral conversion, increasing central nervous system availability. Extended-release formulations like Carbidiopa-Levō ER aim to enhance patient compliance and reduce motor fluctuations associated with immediate-release variants.

Current Market Size and Growth Trajectory

As of 2022, the global Parkinson’s disease therapeutics market was valued at approximately USD 4.6 billion, with an anticipated CAGR of 6.7% through 2028 (source: MarketsandMarkets). Carbidiopa-Levō ER's contribution is significant, especially in mature markets like North America and Europe, where high prescription volumes and advanced healthcare infrastructure support sustained demand. The rising prevalence, coupled with an aging demographic, is projected to sustain a steady upward growth trajectory for this drug class.

Key Market Players

Major pharmaceutical companies in this space include:

- AbbVie: With its product Stalevo (Levodopa, Carbidopa, Entacapone), AbbVie holds a dominant position.

- Sun Pharmaceutical Industries: Offers generic versions in multiple markets.

- Sun Pharma's competitors include Teva, Mylan, and Hospira.

While brand-name formulations have traditionally led the market, generic expansion and biosimilar development are intensifying price competition, influencing market dynamics.

Regulatory Environment and Market Penetration

Approval Status and Patent Landscape

Most Carbidiopa-Levō ER formulations are off-patent or nearing patent expiry, opening the market to generics. Regulatory authorities such as the FDA and EMA have approved multiple generic versions, which have exerted pressure on pricing. However, proprietary formulations with extended-release profiles, annotation-specific delivery mechanisms, or combination therapies retain premium pricing due to perceived therapeutic advantages.

Reimbursement and Pricing Policies

Pricing strategies in developed nations are heavily influenced by reimbursement frameworks. Favorable reimbursement policies in the US (Medicare/Medicaid) and Europe encourage formulary inclusion, impacting retail prices and market access.

Price Dynamics and Market Drivers

Pricing Trends

The average wholesale price (AWP) of Carbidiopa-Levō ER has historically declined due to generic competition, with discounts often exceeding 50% in mature markets. Brand-name ER formulations command a premium—ranging from 15% to 40% higher—reflecting formulation complexity and clinical differentiation.

Market Drivers

- Increasing Parkinson’s disease prevalence globally fuels demand.

- Enhanced patient compliance with ER formulations promotes brand loyalty.

- Advancements in delivery technology improve pharmacokinetic profiles, supporting premium pricing.

- Healthcare policy changes favoring cost-effective treatments favor generics, exerting downward pressure on prices.

Market Challenges

- Competition from alternative delivery platforms, including implantables and novel drug delivery systems.

- Patent expiries leading to heightened generic competition and price erosion.

- Price sensitivity among payers influencing reimbursement levels.

Future Price Projections

Forecast Assumptions

- Market Maturity: Ongoing patent expirations will result in increased generic penetration over the next 5 years.

- Innovation: Introduction of extended-release formulations with improved efficacy or convenience could command premium prices.

- Pricing Trends: Steady decline in brand-name prices, with generic prices stabilizing at approximately 60-70% of brand prices.

Projected Price Trends (2023-2028)

| Year | Estimated Average Wholesale Price (USD) | Notes |

|---|---|---|

| 2023 | $250 - $300 | Market stabilization post-patent expiry |

| 2024 | $200 - $250 | Increased generic competition |

| 2025 | $180 - $220 | Entry of biosimilars, further price erosion |

| 2026 | $150 - $200 | Adoption of optimized formulations |

| 2027 | $130 - $180 | Market saturation, price normalization |

| 2028 | $120 - $160 | Overall price stabilization, focus on value-based care |

Note: These projections are subject to regional regulatory changes, patent litigation outcomes, and advances in delivery technology.

Competitive and Market Expansion Opportunities

The growth of generic manufacturers and biosimilar entry widens accessibility but constrains profit margins for brand-name providers. Conversely, innovative extended-release formulations or combination therapies offer potential premium pricing but require significant R&D investments. Market expansion into emerging economies presents growth opportunities driven by rising disease burden and limited healthcare infrastructure.

Impacts of Geopolitical and Economic Factors

- Supply Chain Disruptions: Global supply chain constraints could temporarily inflate prices.

- Pricing Regulations: Governments' focus on drug affordability strives to cap prices, especially in publicly funded health systems.

- Currency Fluctuations: International sales will be affected by exchange rate volatility, influencing regional price variations.

Key Takeaways

- The market for Carbidiopa-Levō ER is mature, with declining prices driven largely by increasing generic competition.

- Strategic differentiation via formulation innovation remains critical to maintaining premium pricing.

- Aging demographics and rising Parkinson’s disease prevalence ensure sustained demand, especially in high-income countries.

- Price projections indicate a gradual decline over the next five years, stabilized by market saturation and regulatory pressures.

- Manufacturers should explore value-added features or combination therapies to command higher prices amid aggressive generic penetration.

FAQs

1. How does patent expiry influence Carbidiopa-Levō ER pricing?

Patent expirations open the market to generic manufacturers, significantly reducing prices, sometimes by over 50%. This intensifies competition and compresses profit margins for original innovators.

2. Are there upcoming formulations that could command higher prices?

Yes. Innovations such as controlled-release platforms with improved pharmacokinetics, combination drugs, or drug delivery devices can sustain premium pricing through clinical benefits.

3. How do healthcare policies in major markets impact pricing trends?

Policies emphasizing affordability and cost-effectiveness often lead to price negotiations, reimbursement caps, and preferential formulary inclusion, generally driving prices downward.

4. What role does geographic expansion play in future market growth?

Emerging markets present growth opportunities as Parkinson’s disease awareness increases, and healthcare access improves, though price sensitivities are higher, leading to dominant generic presence.

5. Will biosimilars or new entrants disrupt the Carbidiopa-Levō ER market?

While biosimilars primarily target biologics, the trend toward innovative delivery systems and combination therapies may alter market dynamics, but legacy formulations are unlikely to be fully displaced in the short term.

Sources

[1] MarketsandMarkets. "Parkinson’s Disease Treatment Market," 2022.

[2] U.S. Food and Drug Administration. Drug Approvals and Patent Status.

[3] IQVIA. "Global Pharmaceutical Market Data," 2022.

[4] European Medicines Agency. Regulatory Status Reports, 2022.

[5] PhRMA. "Biopharmaceutical Industry Outlook," 2022.

More… ↓