Share This Page

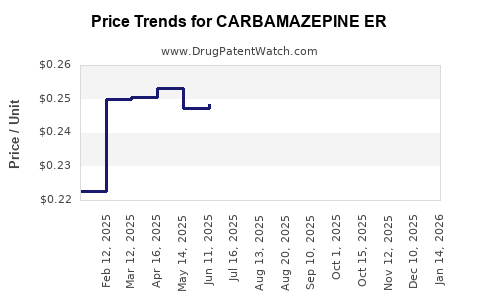

Drug Price Trends for CARBAMAZEPINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for CARBAMAZEPINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARBAMAZEPINE ER 400 MG TABLET | 71930-0074-12 | 0.71148 | EACH | 2025-12-17 |

| CARBAMAZEPINE ER 100 MG CAP | 51672-4151-01 | 1.10642 | EACH | 2025-12-17 |

| CARBAMAZEPINE ER 100 MG CAP | 50268-0170-13 | 1.10642 | EACH | 2025-12-17 |

| CARBAMAZEPINE ER 100 MG CAP | 50268-0170-11 | 1.10642 | EACH | 2025-12-17 |

| CARBAMAZEPINE ER 100 MG CAP | 60505-2805-07 | 1.10642 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Carbamazepine ER

Introduction

Carbamazepine Extended Release (ER) is a vital anticonvulsant medication primarily used in the management of epilepsy, bipolar disorder, and trigeminal neuralgia. As a widely prescribed generic, its market dynamics influence pharmaceutical companies, healthcare providers, and investors. This analysis explores current market conditions, competitive landscape, regulatory factors, and forecasts future pricing trends for Carbamazepine ER.

Market Overview

Indications and Usage

Carbamazepine ER is indicated for partial seizures, generalized tonic-clonic seizures, trigeminal neuralgia, and bipolar disorder maintenance therapy. Its extended-release formulation offers improved patient adherence and reduced dosing frequency compared to immediate-release counterparts, supporting consistent therapeutic levels.

Market Size and Growth Drivers

The global epilepsy drug market, valued at approximately USD 4.4 billion in 2021, is projected to grow at a CAGR of 4-6% through 2028 [1], driven by rising prevalence of neurological disorders, advancing diagnostic capabilities, and increased awareness. Carbamazepine ER constitutes a significant share due to its long-standing efficacy and generic availability. The shift towards extended-release formulations further enhances its adoption.

Key Market Players

Major manufacturers include Teva Pharmaceuticals, Mylan (now part of Viatris), Sandoz, and Lupin. These companies leverage patent expirations to expand generic supply, intensifying market competition. Brand-name formulations like Tegretol XR (Novartis) hold a smaller segment post-patent expiry, mainly catering to specific patient populations needing branded options.

Regulatory and Patent Landscape

Patent Status

Carbamazepine's original patents expired decades ago, facilitating a competitive generic market. However, specific ER formulations may have had patent protections or exclusivities, influencing market entry timelines. As of recent years, patents have mostly expired, fostering increased generic penetration.

Regulatory Trends

The approval process for generic ER formulations involves demonstrating bioequivalence, with agencies like the FDA and EMA standardizing requirements. Recent regulatory advancements facilitate quicker approval pathways for formulary enhancements, influencing market pricing and competitiveness.

Pricing Dynamics

Current Price Benchmarks

- Brand-name Carbamazepine XR: Historically priced higher, with cost per tablet ranging from USD 2.50 to USD 4.00 depending on strength and region.

- Generic Carbamazepine ER: Significantly lower, often below USD 1.00 per tablet, due to intense competition.

Cost Factors

Pricing is affected by manufacturing costs, regulatory compliance, market competition, and healthcare reimbursement policies. The commoditization of generics has driven prices downward, especially in mature markets like the U.S. and Europe.

Insurance and Reimbursement Impact

Reimbursement policies influence patient access and pharmacy stocking decisions, indirectly affecting market pricing. Favorable coverage for generics accentuates price competition, further reducing costs.

Market Trends and Price Projection

Current Trends

- Increased adoption of generic ER formulations.

- Growing acceptance of once-daily dosing regimens improving adherence.

- Price erosion due to rising generic supply and market saturation.

- Regional disparities, with emerging markets experiencing higher price volatility owing to procurement policies.

Future Price Projections (2023–2028)

Based on market saturation, patent expirations, and regulatory trends, generic Carbamazepine ER prices are expected to decline modestly by 5-8% annually in mature markets [2]. This decline reflects intensified competition and manufacturing efficiencies.

In emerging markets, pricing may stabilize or slightly fluctuate due to supply chain limitations, regulatory hurdles, and pricing controls. The introduction of biosimilars or newer formulations with optimized delivery could further influence prices.

Potential Catalysts

- Expiration of remaining regional patents or exclusivities.

- Policy shifts favoring generics and biosimilars in various jurisdictions.

- Introduction of value-added formulations or fixed-dose combinations.

Price stabilization or modest declines are anticipated as market saturation peaks and competition intensifies, implying a continued downward trend in unit costs.

Competitive Landscape and Market Entry Considerations

Market Entry Barriers

- Regulatory approval complexities for ER formulations.

- Manufacturing capacity and quality validation costs.

- Established brand and generic market shares.

Opportunities for New Entrants

- Developing cost-effective manufacturing processes.

- Offering differentiated products with improved pharmacokinetics.

- Targeting emerging markets with price-sensitive strategies.

Risk Factors

- Regulatory delays or rejections.

- Price-driven margin pressures.

- Market commoditization attrition.

Conclusion

Market Outlook

Carbamazepine ER remains a cornerstone in epilepsy and neuropathic pain management, with its generic variants dominating the market due to affordability and proven efficacy. The current market is characterized by intense competition leading to sustained price reductions, chiefly in developed regions. As patent protections abate, and regulatory pathways evolve, prices are forecasted to decline steadily, aligning with the broader generic drug trend.

Price expectations suggest a gradual decrease of approximately 5-8% annually over the next five years in mature markets. Innovative formulations or indications may temporarily disrupt this trend, but overall, the market will maintain its commoditized nature, emphasizing volume and cost-efficiency.

Key Takeaways

- Market Dominance by Generics: Post-patent expiration, carbamazepine ER's market is primarily driven by generic manufacturers offering lower-cost alternatives.

- Steady Price Decline: Prices are projected to decrease by roughly 5-8% annually in mature markets, driven by increased competition and manufacturing efficiencies.

- Emerging Markets Growth Potential: Higher prices and less saturation present growth opportunities, albeit with regulatory and supply chain challenges.

- Regulatory and Patent Expiry Impact: Patent expirations and streamlined approval processes will accelerate generic entry, further depressing prices.

- Innovation and Market Dynamics: Slight shifts due to new formulations or biosimilars could temporarily impact pricing but are unlikely to reverse the downward trajectory significantly.

FAQs

1. What factors influence the price of Carbamazepine ER?

Pricing is primarily influenced by manufacturing costs, patent status, market competition, regulatory approvals, and reimbursement policies. Increased generic competition exerts significant downward pressure.

2. When do most Carbamazepine ER patents expire?

The original patents for Carbamazepine have mostly expired, with some regional patents on specific ER formulations expiring within the last decade, opening avenues for generic competition.

3. How does market competition impact prices?

Higher competition among generic manufacturers leads to reduced prices as firms vie for market share, often driving costs down by 5-8% annually.

4. Are there regional variations in Carbamazepine ER pricing?

Yes. Developed markets tend to have lower prices due to high competition and regulatory efficiencies, while emerging markets may retain higher prices due to supply chain and regulatory hurdles.

5. What future innovations could disrupt the Carbamazepine ER market?

Developments such as novel formulations with improved bioavailability, fixed-dose combinations, or biosimilars could temporarily influence prices, but their overall impact is expected to be limited in the context of continuing generic competition.

References

- MarketResearch.com. Global Epilepsy Drug Market Forecast 2021-2028.

- IQVIA. Pharmaceutical Pricing and Market Trends Report.

More… ↓