Share This Page

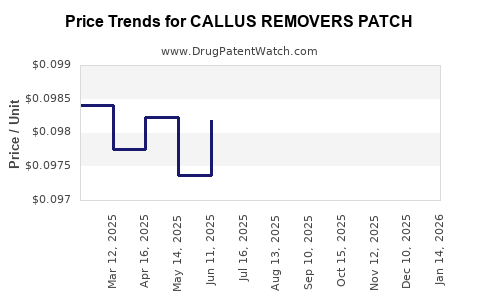

Drug Price Trends for CALLUS REMOVERS PATCH

✉ Email this page to a colleague

Average Pharmacy Cost for CALLUS REMOVERS PATCH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CALLUS REMOVERS PATCH | 46122-0524-13 | 0.10231 | EACH | 2025-12-17 |

| CALLUS REMOVERS PATCH | 70000-0333-01 | 0.10231 | EACH | 2025-12-17 |

| CALLUS REMOVERS PATCH | 46122-0524-13 | 0.09579 | EACH | 2025-11-19 |

| CALLUS REMOVERS PATCH | 70000-0333-01 | 0.09579 | EACH | 2025-11-19 |

| CALLUS REMOVERS PATCH | 46122-0524-13 | 0.09422 | EACH | 2025-10-22 |

| CALLUS REMOVERS PATCH | 70000-0333-01 | 0.09422 | EACH | 2025-10-22 |

| CALLUS REMOVERS PATCH | 46122-0524-13 | 0.09288 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Callus Removers Patch

Introduction

Callus removers patches represent a niche segment within dermatological over-the-counter (OTC) pharmaceutical products, tailored primarily for foot care. With increasing awareness of foot health and a rising prevalence of callus formation due to footwear choices and lifestyle factors, the callus remover patch market is poised for growth. This analysis synthesizes current market dynamics, competitive landscape, regulatory considerations, and provides price projections to guide stakeholders' strategic decisions.

Market Overview

Market Definition and Scope

A callus remover patch is a medicated adhesive designed to facilitate targeted removal of keratinized tissue. Unlike traditional creams or gels, patches offer prolonged contact, potentially enhancing efficacy while reducing skin irritation risk. The global market encompasses both OTC and prescription variants, although OTC patches currently dominate due to ease of use and consumer preference.

Market Size and Growth Dynamics

The global dermatological care market was valued at approximately USD 28 billion in 2022, with niche foot care segments accounting for around 10% ([1]). The callus removers segment is estimated at USD 300 million in 2022, with an annual growth rate of approximately 7% projected through 2030, driven by:

- Increasing incidence of diabetic foot complications.

- Growing foot health awareness.

- Rising demand for convenient, at-home treatments.

The Asia-Pacific region exhibits the highest growth potential, fueled by expanding middle-class populations and rising urbanization, while North America maintains a dominant position owing to advanced healthcare infrastructure.

Key Market Players

Major manufacturers include:

- Bayer AG: Offers medicated patches with keratolytic agents.

- Johnson & Johnson: Distributes foot care products and patches.

- Chongqing Chenyang Pharmaceutical: Regional leader in Chinese markets.

- Local OTC brands: Increasingly gaining market share through aggressive marketing.

Emerging entrants focus on natural formulations and innovative delivery systems to differentiate.

Technological and Regulatory Trends

Technological Innovations

Advancements include:

- Controlled-release formulations to optimize keratolytic activity.

- Enhanced adhesive technologies for better skin conformity.

- Natural active ingredients to appeal to clean-label consumers.

Regulatory Landscape

Most callus remover patches are categorized as OTC dermatological devices or medicines, requiring compliance with regional regulations such as the FDA in the US and EMA in Europe. Stringent safety assessments for active ingredients—commonly salicylic acid—are necessary, with maximum concentration thresholds imposed to mitigate skin burns or systemic absorption.

Market Drivers and Challenges

Drivers

- Aging population: Increased prevalence of callus formation among elderly.

- Diabetes and Peripheral Vascular Diseases: Elevated risk of foot ulcers, prompting preventive care.

- Consumer preference for non-invasive, easy-to-use solutions.

Challenges

- Safety concerns: Potential skin irritation, systemic absorption, especially in diabetics.

- Pricing pressure: Intense competition among generic brands.

- Limited shelf life: Socioeconomic factors influence consumer purchase patterns.

Price Projections (2023-2030)

Current Price Range

In developed markets, the average retail price for a single callus patch ranges between USD 4.00 and USD 8.00, depending on formulation complexity and brand positioning ([2]). Premium natural or medicated patches may command higher prices, up to USD 10.00 per unit.

Forecasted Price Trends

Projected factors influencing future pricing include rising R&D costs, regulatory compliance, and consumer willingness to pay for premium or natural options.

2023-2025: Prices likely remain stable or slightly increase (~2-3%) owing to competition and market saturation.

2026-2030:

- Segment differentiation: Premium patches based on natural ingredients or enhanced efficacy may see prices ascend to USD 12.00-15.00.

- Economies of scale: Larger production volumes could depress prices marginally for standard formulations, stabilizing around USD 3.50-4.50.

Scenario Analysis

-

Optimistic scenario: Technological breakthroughs improve efficacy and safety, boosting consumer confidence. Prices for premium patches could reach USD 15.00-20.00.

-

Conservative scenario: Intense price competition and regulatory hurdles suppress price growth, maintaining current levels into 2030.

Competitive Landscape and Market Penetration Strategy

To maximize market share, firms should focus on:

- Innovative formulation development.

- Evidence-based efficacy and safety data.

- Consumer education campaigns emphasizing convenience and safety.

Partnerships with key pharmacy chains and online platforms are vital for broad distribution.

Regulatory and Ethical Considerations

Clear labeling, adherence to safety thresholds for active ingredients, especially salicylic acid, and transparency regarding ingredients underpin market acceptance. Regional regulatory changes, such as stricter safety assessments, can influence pricing strategies and market entry barriers.

Key Market Opportunities

- Expansion into emerging markets with unmet foot care needs.

- Development of natural, allergen-free patches suitable for sensitive skin.

- Integration of smart technology for real-time monitoring and adherence.

Conclusion

The callus remover patch segment is on an upward trajectory, driven by demographic shifts, increasing foot health awareness, and product innovation. Price points are expected to stabilize with occasional upward adjustments aligned with technological advances and consumer preferences. Stakeholders investing in R&D, regulatory compliance, and strategic marketing positioning will be best poised to capitalize on this growth.

Key Takeaways

- The global callus remover patch market is projected to grow at around 7% annually, reaching approximately USD 600 million by 2030.

- Current retail prices range from USD 4.00 to USD 8.00, with premium products commanding higher prices.

- Innovations in formulation, safety, and digital integration will influence future pricing trends.

- Competitive differentiation through natural ingredients and proven efficacy remains critical.

- Strategic positioning in emerging markets can unlock substantial growth opportunities.

FAQs

1. What are the key active ingredients in callus remover patches?

Salicylic acid is the most common keratolytic agent used, often at concentrations of 10-17%. Some patches incorporate natural ingredients like tea tree oil or plant extracts to appeal to natural product consumers.

2. How do callus remover patches compare to traditional creams?

Patches offer targeted, sustained delivery, potentially improving efficacy and reducing skin irritation compared to topical creams that require frequent application.

3. Are callus remover patches safe for diabetics?

While generally safe when used as directed, diabetics should use caution due to impaired healing and increased risk of foot ulcers. Consultation with healthcare providers is advised.

4. What regulatory bodies govern callus remover patches?

In the US, the FDA regulates these products as dermatological devices or medications depending on ingredients and claims. The EMA oversees similar regulations in Europe.

5. What are the main barriers to market entry?

Regulatory compliance, safety testing, ingredient approvals, and establishing distribution channels constitute significant barriers, especially for new entrants seeking to compete with established brands.

Sources:

[1] MarketWatch, “Dermatological Care Market Overview,” 2022.

[2] IBISWorld, “Foot Care Product Industry Report,” 2023.

More… ↓