Share This Page

Drug Price Trends for CALAMINE CLEAR LOTION

✉ Email this page to a colleague

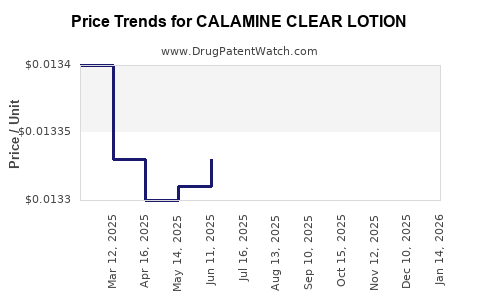

Average Pharmacy Cost for CALAMINE CLEAR LOTION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CALAMINE CLEAR LOTION | 70000-0397-01 | 0.01345 | ML | 2025-12-17 |

| CALAMINE CLEAR LOTION | 70000-0397-01 | 0.01340 | ML | 2025-11-19 |

| CALAMINE CLEAR LOTION | 70000-0397-01 | 0.01324 | ML | 2025-10-22 |

| CALAMINE CLEAR LOTION | 70000-0397-01 | 0.01326 | ML | 2025-09-17 |

| CALAMINE CLEAR LOTION | 70000-0397-01 | 0.01323 | ML | 2025-08-20 |

| CALAMINE CLEAR LOTION | 70000-0397-01 | 0.01330 | ML | 2025-07-23 |

| CALAMINE CLEAR LOTION | 70000-0397-01 | 0.01333 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Calamine Clear Lotion

Introduction

Calamine Clear Lotion occupies a niche within the dermatological and topical treatment market, primarily used to soothe mild skin irritations, insect bites, and sunburns. As a combination of zinc oxide and calamine, it offers anti-inflammatory, antipruritic, and astringent benefits. With mounting consumer awareness regarding skin health and increasing prevalence of dermatological conditions, understanding its market dynamics and price trajectory is vital for stakeholders.

Market Overview

Global Market Landscape

The dermatological care market is experiencing sustained growth, driven by factors such as increasing awareness of skin health, rising incidences of allergic dermatitis, and expanding access to OTC (over-the-counter) dermatology products. Specifically, the segment for topical antipruritics like calamine lotion has expanded, owing to their efficacy, affordability, and minimal side effects.

According to a report by Grand View Research, the global dermatology drugs market was valued at approximately USD 23.7 billion in 2021 and is expected to grow at a CAGR of 8.1% from 2022 to 2030. Within this, OTC products like calamine lotion comprise a significant share, owing to their widespread use in home-based skincare.

Regional Market Dynamics

-

North America: Dominates the market due to high consumer awareness, strong OTC retail presence, and favorable regulatory environment. The U.S. market alone accounts for a significant portion, with over-the-counter dermatology products seeing growth of approximately 7% annually.

-

Europe: Characterized by a mature market with steady demand; regulations are stringent, ensuring high product quality and safety.

-

Asia-Pacific: Rapidly expanding due to increased urbanization, rising disposable income, and healthcare accessibility. Developing economies like India and China show increased OTC dermatology product consumption.

Market Segmentation

- By Product Type: Prescription vs. OTC formulations; Calamine lotions like Calamine Clear Lotion are predominantly OTC.

- By Application: Skin irritation, insect bites, sunburns, allergic dermatitis.

- By Distribution Channel: Pharmacies, health stores, e-commerce platforms, supermarkets.

Competitive Landscape

Leading players in the calamine lotion market include Johnson & Johnson, Dabur India, Himalaya Drug Company, and locally prominent OTC dermatological brands. These companies leverage their established distribution networks, brand trust, and regulatory compliance to maintain market share.

Private-label brands and generics represent significant price-sensitive segments, intensifying competition. Innovation in formulation, such as adding moisturizers or hypoallergenic components, may enhance product appeal.

Regulatory Environment

In major markets, calamine lotions are classified as OTC, necessitating compliance with regional health authority regulations: the FDA in the U.S., EMA guidelines in Europe, and respective agencies in Asian countries. Regulatory standards influence formulation, labeling, and marketing, thus impacting pricing strategies.

Price Analysis and Projections

Current Pricing Trends

In developed markets, the average retail price for a 4 oz (approximately 118ml) bottle of Calamine Clear Lotion ranges from USD 4.50 to USD 8.00, depending on brand reputation, formulation additives, and distribution channels. Generic and private-label products are priced between USD 3.00 and USD 5.00.

In emerging markets, the same quantity typically retails for USD 1.50 to USD 3.50, driven by lower procurement costs and competitive intensity.

Factors Influencing Future Prices

-

Raw Material Costs: Zinc oxide and calamine prices are influenced by mining activity, supply chain disruptions, and regional demand. Volatility in raw material costs can directly impact product pricing.

-

Manufacturing and Compliance Costs: Regulatory changes demanding higher safety standards or reformulation to meet new guidelines may increase production costs.

-

Market Competition: Entry of low-cost generic brands and increased private-label penetration exert downward pressure on retail prices.

-

Consumer Trends: Growing preference for natural or hypoallergenic formulations may prompt formulators to innovate, potentially adjusting pricing due to R&D investments.

-

Distribution and Logistics: E-commerce growth introduces opportunities for cost savings; however, last-mile logistics can add to operational costs, influencing retail prices.

Price Projection (2023–2028)

-

Baseline Scenario: A moderate annual increase of 2-3% in retail prices in developed markets, driven by inflation, raw material costs, and regulatory adjustments.

-

Optimistic Scenario: Price stability or slight decreases in response to intensified competition and market saturation; private-label brands could push prices down by 5%.

-

Pessimistic Scenario: Supply chain disruptions or raw material shortages could inflate costs, resulting in price hikes of up to 5-7%.

In emerging markets, prices are projected to remain relatively stable or decline slightly due to increased local manufacturing and competition, with annual changes averaging around 2%.

Market Opportunities and Risks

Opportunities

- Expansion in Asian markets through partnerships with local distributors.

- Product innovation incorporating natural ingredients or dermatologically tested claims.

- E-commerce channels reducing overhead costs and enabling competitive pricing.

Risks

- Stringent regulatory barriers delaying product launches.

- Price wars damaging profit margins.

- Shifts in consumer preferences toward alternative or natural remedies for skin irritations.

- Raw material cost volatility impacting profitability.

Consumer Preferences and Influencer Impact

Evolving consumer preferences favor transparent labeling, natural ingredients, and proven efficacy. Digital influencers and dermatology endorsements play a significant role in shaping demand, especially among younger demographics. This trend necessitates strategic marketing to maintain price competitiveness and brand differentiation.

Conclusions and Strategic Recommendations

- Pricing Strategy: Companies should consider a tiered pricing approach, balancing affordability in emerging markets with premium positioning in developed economies.

- Product Differentiation: Innovation around natural ingredients, hypoallergenic formulations, or added moisturizers can command higher price points.

- Distribution Channels: Enhanced E-commerce penetration can offer price advantages and broader reach.

- Regulatory Preparedness: Staying ahead of compliance requirements minimizes risks of costly reforms or recalls.

Key Takeaways

- Calamine Clear Lotion remains a staple OTC dermatological remedy with steady demand across global markets.

- Price projections indicate moderate growth in developed markets, with potential declines driven by intense competition and private-label proliferation.

- Raw material costs, regulatory environments, and consumer trends are critical determinants of future pricing landscapes.

- Market expansion in Asia-Pacific and through e-commerce channels offers significant revenue opportunities.

- Innovation and strategic positioning are crucial for maintaining profitability amid market saturation.

FAQs

1. What are the primary drivers of demand for Calamine Clear Lotion?

Demand is primarily driven by consumers seeking affordable, effective solutions for skin irritations, insect bites, and sunburns. Increased awareness and accessibility of OTC dermatology products further fuel demand.

2. How do raw material prices impact the retail cost of Calamine Lotion?

Fluctuations in zinc oxide and calamine costs directly influence manufacturing costs. Rising raw material prices often lead to higher retail prices unless offset by efficiencies or competitive strategies.

3. What are the key regulatory considerations affecting Calamine Lotion pricing?

Regulations govern formulation standards, labeling, manufacturing practices, and marketing claims. Compliance costs can add to production expenses, affecting retail prices.

4. How is the market for Calamine Clear Lotion expected to evolve over the next five years?

The market is expected to experience modest growth with increased competition, particularly in emerging markets. Product innovation and expansion via e-commerce are anticipated to be growth drivers.

5. What strategies should manufacturers adopt to succeed in this market?

Focus on product differentiation, leveraging natural ingredients, cost-effective distribution channels, and proactive regulatory compliance are critical for market success.

References

[1] Grand View Research, “Dermatology Drugs Market Size, Share & Trends Analysis Report,” 2022.

[2] Statista, “OTC skincare products sales worldwide,” 2022.

[3] United States Food and Drug Administration (FDA), “Over-the-Counter (OTC) Drug Regulation,” 2023.

[4] MarketWatch, “Global Skin Care Market Outlook,” 2022.

This comprehensive market analysis and forecast aim to support stakeholders in making informed, strategic decisions regarding Calamine Clear Lotion product development, marketing, and investment.

More… ↓