Last updated: July 27, 2025

Introduction

Caffeine, a central nervous system stimulant, is the most widely consumed psychoactive substance globally, primarily found in coffee, tea, soft drinks, energy drinks, and dietary supplements. Its pervasive presence in consumer markets and OTC products underscores its significance in both health and commercial sectors. This report examines current market dynamics, regulatory landscape, supply chain considerations, and projects future pricing trends for caffeine.

Market Overview

Global Consumption and Production

Caffeine's global market is driven by increasing consumption of coffee and energy drinks, alongside expanding pharmaceutical and functional food applications. The International Coffee Organization tallies annual coffee consumption at over 1.7 billion 60-kg bags, indicative of the massive origin of caffeine sources [1]. The synthetic caffeine market, utilized in beverages, pharmaceuticals, and dietary supplements, is valued at USD 620 million as of 2022, with a compound annual growth rate (CAGR) of approximately 5% projected through 2030 [2].

Major caffeine-producing countries include Brazil, Vietnam, Colombia, and Indonesia, with supply chains heavily reliant on coffee bean harvests and synthetically produced caffeine manufacturing facilities. The synthetic process, mainly via methylation of dimethylurea, ensures a reliable supply independent of agricultural fluctuations, but fluctuates based on raw material prices, energy costs, and regulatory factors.

Market Drivers

- Rising Energy and Functional Drink Markets: The proliferation of energy drinks in North America and Asia Pacific fuels caffeine demand.

- Pharmaceutical and Dietary Supplement Growth: Caffeine's inclusion in over-the-counter drugs, weight-loss products, and nootropics sustains stable demand.

- Consumer Trends: Increasing health-conscious behaviors favor moderate caffeine consumption, but the popularity of low-calorie, functional beverages sustains market presence.

Competitive Landscape

The caffeine market's primary players include Ajinomoto, Caffeine Trading Co., and AkzoNobel, which dominate synthetic caffeine manufacturing. Agricultural producers, including Neumann Kaffee Gruppe, supply raw coffee beans and extract natural caffeine.

Regulatory Environment

Global regulation significantly impacts caffeine sourcing, manufacturing, and labeling. The US Food and Drug Administration (FDA) classifies caffeine as generally recognized as safe (GRAS) for intended uses [3]. Similarly, the European Food Safety Authority (EFSA) regulates caffeine's inclusion in foods and supplements, with maximum recommended levels established in some categories [4].

Recent regulatory scrutiny over high-caffeine energy drinks and potential health risks may influence market supply chains and pricing structures over the next decade, particularly in regions imposing stricter controls.

Supply Chain and Raw Material Trends

Synthesis costs, raw material prices, and energy expenses directly affect caffeine pricing. The synthetic process involves demand for urea, methyl chlorides, and other chemicals, whose prices fluctuate with global oil and natural gas markets [5].

Agricultural caffeine sources, like coffee, are subject to climate impacts, pests, and geopolitical issues. Crop yields have shown variability, influencing natural caffeine availability and, consequently, market stability.

Pricing Analysis and Projections

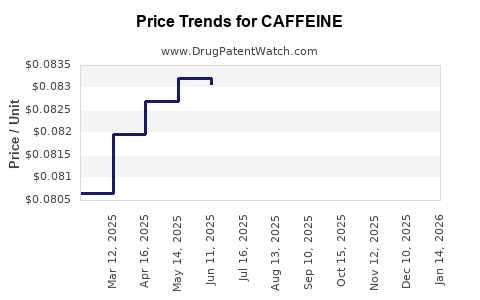

Historical Price Trends

From 2010 to 2020, synthetic caffeine prices have generally ranged between USD 12 to USD 20 per kilogram, with periodic spikes linked to supply disruptions or raw material cost fluctuations [6]. Natural caffeine prices tend to be higher, owing to extraction costs and smaller market volumes.

Current Price Levels

As of 2022, synthetic caffeine wholesale prices sit around USD 15-18 per kilogram, with retail prices averaging USD 20-25 per kilogram depending on purity and form (powder, liquid). The demand surge from energy drinks and pharmaceuticals has temporarily stabilized or increased prices despite raw material volatility.

Future Price Projections (2023-2030)

Based on market analysis, the following trends are anticipated:

- Moderate Increase Due to Supply Constraints: Anticipated compounded annual growth of approximately 3-4%, reaching USD 20-25 per kilogram by 2030.

- Impact of Raw Material Costs: Fluctuations in energy prices and raw chemical inputs will influence margins, potentially causing short-term price spikes.

- Regulatory Pressures: Increased regulations, especially on high-caffeine products, might constrain supply or lead to formulation shifts, affecting pricing and demand patterns.

Scenario Analysis

- Base Case: Steady demand growth, supply chain stability, and moderate raw material cost increases lead to gradual price escalation.

- Disruption Scenario: Environmental or geopolitical factors hinder supply, causing volatility and potential price surges beyond USD 25 per kilogram temporarily.

- Regulatory Tightening: Stricter rules on high-caffeine products could reduce end-user demand, exerting downward pressure on prices or prompting formulators to seek alternative stimulants.

Implications for Stakeholders

Manufacturers should monitor raw material markets and regulatory updates, adjusting procurement and pricing strategies accordingly. Investors may find opportunities in synthetic caffeine production firms, especially in regions with rising energy costs or raw material access issues. Brand owners in energy and supplement sectors must navigate regulatory changes and consumer preferences to optimize product formulations and pricing.

Key Takeaways

- The caffeine market is poised for modest growth, driven by energy, functional foods, and pharmaceutical sectors.

- Raw material costs, supply chain stability, and evolving regulations are primary factors influencing pricing.

- Synthetic caffeine remains the dominant form, with prices projected to rise gradually to USD 20-25 per kilogram by 2030.

- Market volatility is possible amid environmental, geopolitical, or regulatory shocks, creating both risks and opportunities.

- Stakeholders should adopt flexible sourcing strategies and stay attuned to regulatory trends to optimize margins.

FAQs

-

What influences caffeine pricing the most?

Raw material costs (energy, chemicals), supply chain logistics, and regulatory restrictions significantly affect caffeine prices.

-

Is natural caffeine more expensive than synthetic caffeine?

Yes, natural caffeine extracted from coffee or tea is generally priced higher due to extraction complexity and smaller production scales.

-

How might regulations impact caffeine markets in the future?

Stricter regulations on high-caffeine products could reduce demand or restrict formulations, potentially decreasing prices or prompting industry shifts.

-

Are there emerging markets or applications for caffeine?

Yes, the growing wellness industry and nootropic markets present new opportunities for caffeine incorporation beyond traditional uses.

-

What risks should investors consider in the caffeine market?

Supply chain disruptions, regulatory changes, and shifts in consumer preferences are primary risks to market stability and pricing.

Citations

- International Coffee Organization. (2022). World Coffee Consumption Data.

- MarketWatch. (2022). Synthetic Caffeine Market Size and Growth.

- FDA. (2022). GRAS Notification for Caffeine.

- EFSA Journal. (2021). Caffeine Safety and Regulation.

- ICIS. (2022). Chemical Market Trends and Raw Material Costs.

- Bloomberg. (2021). Caffeine Price Analysis and Market Trends.