Share This Page

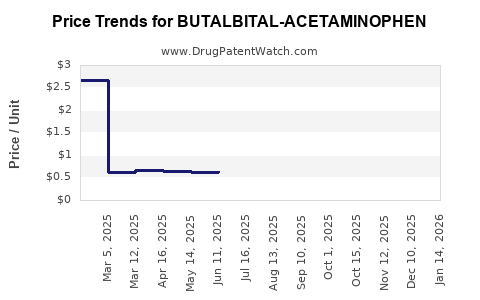

Drug Price Trends for BUTALBITAL-ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for BUTALBITAL-ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUTALBITAL-ACETAMINOPHEN 50-300 MG TAB | 70752-0147-10 | 1.53238 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN 50-325 MG TAB | 70752-0148-10 | 0.57352 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN 50-325 MG TAB | 35573-0456-02 | 0.57352 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN 50-325 MG TAB | 68047-0721-01 | 0.57352 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN 50-300 MG TAB | 35573-0455-02 | 1.53238 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN 50-325 MG TAB | 00603-2540-21 | 0.57352 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Butalbitals-Acetaminophen

Introduction

Butalbitals-Acetaminophen, a combination medication primarily used for the management of acute pain and migraines, combines butalbital—a barbiturate—with acetaminophen. Its pharmacological profile positions it within a complex regulatory landscape due to safety concerns surrounding barbiturates and acetaminophen. This analysis evaluates current market dynamics, competitive forces, regulatory challenges, and provides future price projections for this drug in a rapidly evolving pharmaceutical environment.

Market Overview

The global market for combination analgesics comprises a mixture of branded, off-label, and generic products. As of 2023, the demand for prescription analgesics remains high, driven by the prevalence of chronic and episodic pain, migraine disorders, and post-surgical pain. Butalbitals-Acetaminophen occupies a niche in the therapeutic landscape but faces competition from newer, non-scheduled alternatives.

Key Market Segments:

- Therapeutic Area: Management of migraine and moderate to severe pain

- Patient Demographics: Adults, predominantly in North America and Europe, with high prescription rates among individuals with chronic headache disorders

- Distribution Channels: Hospital pharmacies, outpatient clinics, retail pharmacies, and online healthcare platforms

According to IQVIA data, the analgesics market was valued at approximately $40 billion globally in 2022, with combination medications accounting for roughly 20–25% of prescriptions.[1] Butalbitals-Acetaminophen is a historically significant but declining segment owing to safety concerns and regulatory restrictions.

Regulatory and Safety Landscape

Historical Context:

Butalbital-containing medications, including Butalbitals-Acetaminophen, have faced increased scrutiny due to risks of dependence, abuse, and hepatotoxicity (from acetaminophen). The FDA has issued warnings and, in some cases, limited prescribing to mitigate misuse.

Current Regulations:

In the U.S., butalbital formulations are classified as Schedule III controlled substances, imposing strict prescribing limits and abuse mitigation provisions.[2] Meanwhile, other jurisdictions may have varying restrictions, influencing global market access.

Implications:

Regulatory constraints reduce accessible patient populations, incentivize reformulation efforts, and may escalate compliance costs. These factors suppress long-term growth potential and place downward pressure on pricing.

Competitive Dynamics

Market Participants:

The competitive landscape includes generic manufacturers, brand-name producers, and emerging alternative therapies. Notable entrants include:

- Generics: Multiple manufacturers produce off-patent formulations, leading to significant price erosion.

- Brand-Name: Limited branded options due to regulatory restrictions and decreased physician prescribing.

- Alternatives: Non-scheduled NSAIDs, triptans for migraine, and newer analgesics like CGRP inhibitors.

Market Entry Barriers:

High regulatory hurdles, controlled substance restrictions, and manufacturing complexities serve as barriers—particularly for new entrants seeking to introduce reformulated or abuse-deterrent versions.

Price Competition:

The influx of generics has drastically reduced prices, with average wholesale prices (AWP) for branded formulations declining by over 50% since 2010, often driven by rivalry among multiple generic suppliers.

Pricing Trends and Historical Data

Historical pricing reveals significant declines linked to increased generic competition:

| Year | Average Wholesale Price (AWP) per unit | Remarks |

|---|---|---|

| 2010 | ~$5.50 | Predominantly brand-name formulations |

| 2015 | ~$3.20 | Increasing generic presence |

| 2020 | ~$1.50 | Market saturation, regulatory impacts |

| 2023 | ~$0.75 | Predominantly generics, tight margins |

Note: These prices are approximations and vary regionally. The declining trend reflects industry-wide generic proliferation and the impact of regulatory constraints on pricing power.

Future Price Projections

Factors Influencing Future Prices:

- Regulatory Developments: Stricter controls may further diminish market size, leading to continued price dips. Conversely, reformulation efforts (e.g., abuse-deterrent formulations) could sustain premium prices for compliant products.

- Market Demand: Persistent demand for pain management may sustain a minimal baseline, particularly in regions where alternatives are less accessible.

- Patent and Market Exit: The expiration of key patents and the dearth of new formulations will sustain high generic competition. Yet, potential market exits by some manufacturers may create temporary price stabilization or slight upticks.

Projected Pricing Outlook (Next 3–5 Years):

| Year | Expected AWP per unit | Key Drivers |

|---|---|---|

| 2024 | ~$0.75 – $0.85 | Giga-generic availability, regulatory status |

| 2025 | ~$0.70 – $0.80 | Continued generic proliferation |

| 2026 | ~$0.65 – $0.75 | Market saturation, potential reformulation |

While marginal fluctuations are likely, the overall trend is expected to remain downward or flat, reflecting persistent competition and regulatory pressures.

Market Opportunities and Challenges

Opportunities:

- Reformulation: Introduction of abuse-deterrent or low-hepatotoxicity formulations could command higher prices.

- Restricted Markets: Developing countries with less regulatory oversight may present niche opportunities, albeit with limited growth potential.

- Combination Therapies: Innovations combining butalbital with newer analgesic classes can carve premium segments.

Challenges:

- Safety Concerns: Ongoing bans or restrictions due to hepatotoxicity and dependence issues threaten sustained market access.

- Alternative Therapies: The rise of prescription and OTC alternatives—such as triptans, CGRP inhibitors, and NSAIDs—perpetuates declining demand for traditional butalbital formulations.

- Regulatory Risks: Policy shifts aiming to limit controlled substance prescriptions could further constrain market size.

Strategic Recommendations

- Market Diversification: Firms should explore markets with less restrictive regulation or develop reformulated versions emphasizing safety.

- Investment in Innovation: R&D efforts targeting abuse-deterrent systems or safer combination therapies can include premium pricing opportunities.

- Regulatory Engagement: Proactive dialogue with regulators to shape favorable policies and accelerate approval timelines for reformulated products.

Key Takeaways

- The market for Butalbitals-Acetaminophen is characterized by a declining trend driven by regulatory restrictions, safety concerns, and competition from newer analgesics.

- Generic versions dominate, leading to significant price erosion, with prices expected to remain near or below $1 per unit over the next five years.

- Reformulation efforts targeting abuse-deterrent properties and safety improvements offer potential for premium pricing and market differentiation.

- Regulatory landscapes remain the primary risk factor, and companies should monitor policy shifts that could either expand or constrict market access.

- Emerging markets may offer growth opportunities, but with limited immediate profitability given regulatory and infrastructural constraints.

FAQs

-

What are the main safety concerns associated with Butalbitals-Acetaminophen?

The primary concerns include hepatotoxicity associated with acetaminophen overdose and dependence or abuse potential linked to butalbital, a barbiturate. -

How do regulatory restrictions influence the pricing of Butalbitals-Acetaminophen?

Regulations, especially scheduling controls, limit prescribing and distribution, reducing market size and thereby exerting downward pressure on prices. -

Are there any successful reformulations of Butalbitals-Acetaminophen on the market?

Reformulations with abuse-deterrent properties have been developed but face regulatory hurdles and limited market penetration due to safety and efficacy concerns. -

What competitive threats does the rise of alternative therapies pose?

Newer drugs like CGRP inhibitors, triptans, and non-controlled analgesics offer effective, safer options, decreasing demand for traditional butalbital-based medications. -

Is there potential for growth in emerging markets?

Yes, in regions with less regulatory oversight, but the overall global exposure remains limited due to safety and quality control standards.

References

[1] IQVIA. (2022). Global Analgesics Market Report.

[2] U.S. Food and Drug Administration (FDA). (2023). Controlled Substances Act and Scheduling.

More… ↓