Share This Page

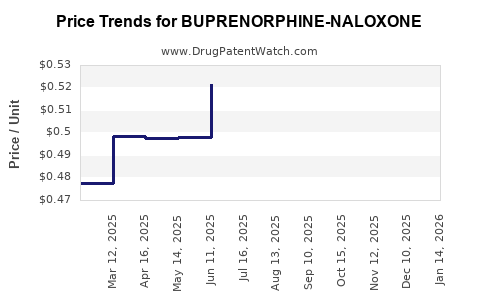

Drug Price Trends for BUPRENORPHINE-NALOXONE

✉ Email this page to a colleague

Average Pharmacy Cost for BUPRENORPHINE-NALOXONE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUPRENORPHINE-NALOXONE 8-2 MG SL TABLET | 65162-0415-03 | 0.69697 | EACH | 2025-11-19 |

| BUPRENORPHINE-NALOXONE 12-3 MG SL FILM | 00378-8768-16 | 4.14805 | EACH | 2025-11-19 |

| BUPRENORPHINE-NALOXONE 12-3 MG SL FILM | 00378-8768-93 | 4.14805 | EACH | 2025-11-19 |

| BUPRENORPHINE-NALOXONE 12-3 MG SL FILM | 43598-0581-30 | 4.14805 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Buprenorphine-Naloxone

Introduction

Buprenorphine-naloxone, marketed under brands such as Suboxone®, is a cornerstone medication in the treatment of opioid use disorder (OUD). Its combination formulation mitigates misuse potential and enhances patient compliance, making it a preferred choice for clinicians globally. With the escalating opioid epidemic, understanding the market dynamics and future pricing trends for buprenorphine-naloxone is critical for pharmaceutical companies, payers, policymakers, and healthcare providers.

This comprehensive analysis examines the current market landscape, key drivers, competitive environment, regulatory influences, and price projection models over the next five years, offering strategic insights for stakeholders.

Market Landscape Overview

Global Market Size and Growth Trajectory

The global buprenorphine-naloxone market was valued at approximately $1.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8-10% through 2028. This growth trajectory is fueled by increased recognition of opioid dependence as a public health crisis, expanding access to medication-assisted treatment (MAT), and regulatory relaxations in certain jurisdictions.

North America dominates, accounting for roughly 70% of the market share**, driven by high opioid overdose mortality rates, extensive healthcare infrastructure, and favorable reimbursement landscape. Europe and Asia-Pacific regions are witnessing accelerated adoption, owing to regulatory approvals and rising awareness.

Key Market Drivers

- Rising Opioid Epidemic: The United States reports over 80,000 opioid-related deaths annually ([1]), augmenting demand for effective treatments like buprenorphine-naloxone.

- Regulatory Approvals and Policy Reforms: Policies such as the Drug Addiction Treatment Act (DATA 2000) in the U.S. facilitate prescribing buprenorphine formulations, broadening access.

- Increasing Insurance Coverage and Reimbursement: Many payers now cover MAT drugs comprehensively, removing financial barriers.

- Innovations in Formulations: The introduction of extended-release injectable versions and combination therapies enhances adherence.

Competitive Landscape

Major Players and Market Share

- Reckitt Benckiser (marketed as Suboxone®) holds approximately 60-70% of the market share.

- Alvogen and Sun Pharmaceuticals are notable competitors, offering generic versions.

- Several smaller biotech firms are developing alternative formulations, including implants and depot injections.

Patent and Regulatory Status

The initial patents for Suboxone® expired in the U.S. by 2022, leading to a surge in generic formulations. However, branded formulations continue benefiting from data exclusivity and market perception, influencing pricing strategies.

Distribution Channels

- Specialty clinics and addiction treatment centers are primary channels.

- Increasing availability through primary care providers broadens reach.

- Online pharmacies and telemedicine are emerging distribution avenues, especially post-COVID-19.

Pricing Dynamics

Current Price Structure

- Brand-Name Pricing: Suboxone® sublingual film typically retails at $300-$400 per month’s supply.

- Generics: Prices have declined to approximately $150-$250, due to increased competition.

- Insurance Impact: Reimbursement rates vary; private insurers often cover significant portions, while cash prices are higher.

Factors Influencing Pricing

- Patent and Exclusivity: Patent expiry leads to price erosion through generics.

- Manufacturing Costs: Complex manufacturing processes for sublingual films influence base costs.

- Market Competition: Entry of generics reduces prices, often by 30-50%, impacting revenue projections.

- Regulatory and Policy Changes: Policies promoting generic use further compress margins.

- Access Programs: Patient assistance programs affect commercial pricing and plan reimbursements.

Future Price Projections (2023-2028)

Price Trends

It is anticipated that the average retail prices for buprenorphine-naloxone formulations will decline progressively:

| Year | Estimated Average Monthly Price (USD) | Comment |

|---|---|---|

| 2023 | $180 - $250 | Post-patent expiration, increased generics |

| 2024 | $150 - $230 | Market saturation, price competition |

| 2025 | $130 - $210 | Continued generic penetration |

| 2026 | $120 - $200 | Market normalization |

| 2027 | $110 - $190 | Stable trend, minor pricing adjustments |

| 2028 | $100 - $180 | Potential innovation-driven premium offerings |

Factors Modulating Price Decline

- Emergence of New Formulations: Extended-release injectables and implantable forms (e.g., Probuphine®) may command higher prices, offsetting branded formulation declines.

- Reimbursement Policies: Shifts favoring generic utilization across payers accelerate price reductions.

- Regulatory Approvals: Expanded indications and simplified prescribing protocols increase market access, leading to volume-driven revenue rather than price premiums.

- Market Entry of Biosimilars: Although not directly applicable, biosimilar-like dynamics could influence pricing in specialized formulations.

Market Opportunities and Challenges

Opportunities

- Development of novel delivery systems (long-acting injectables, implants) with premium pricing.

- Expansion into emerging markets with rising OUD incidence.

- Integration with digital health tools for adherence and monitoring.

Challenges

- Stringent regulatory requirements for new formulations.

- Potential for price wars amongst generic manufacturers.

- Policy shifts favoring cost containment may suppress prices.

- Stigma and regulatory barriers in certain geographies hamper market expansion.

Regulatory and Policy Impact

Regulatory agencies like the FDA and EMA are supporting expanded indications and easier access pathways. Notably:

- FDA's approval of extended-release formulations (e.g., Sublocade®) offers premium markets but at higher prices.

- India and China are facilitating generic manufacturing, which may drastically reduce global prices.

Policy initiatives aiming to curb opioid misuse, such as mandatory prescriber certifications and expanded Medicaid coverage, are expected to sustain demand but could influence pricing strategies favorably for payers.

Key Market Drivers and Their Impact on Price Trajectories

| Driver | Impact on Prices | Description |

|---|---|---|

| Patent expiration | Downward pressure | Entry of generics reduces prices |

| Innovation in formulations | Possible premium prices | Long-acting injections and implants can command higher premiums |

| Payer reimbursement policies | Stabilization or reduction | Widespread coverage leads to price competition |

| Geographic expansion | Volume-driven growth | Market penetration in emerging economies may sustain revenues despite low prices |

| Regulatory environment | Price stabilization or reduction | Ease of approval facilitates competition, lowering prices |

Conclusion

The buprenorphine-naloxone market is poised for continued growth driven by evolving regulatory landscapes, increasing global recognition of opioid use disorder, and innovations in drug delivery. The impending patent expirations and increased generic competition will exert downward pressure on prices, with a projected decline of approximately 40-50% over the next five years. However, emerging high-value formulations and expanding access in new markets present opportunities to offset margin compression.

Stakeholders should focus on innovation, strategic pricing, and market diversification to optimize revenue streams amidst these dynamics. Policymakers and payers will play a pivotal role in shaping the future landscape, balancing affordability with innovation incentives.

Key Takeaways

- The global buprenorphine-naloxone market is expanding at a CAGR of ~8-10%, driven by the opioid epidemic and regulatory reforms.

- Prices are expected to decline by approximately 40-50% from 2023 to 2028 mainly due to generic entry and increased competition.

- Innovative formulations like long-acting injectables and implants present premium pricing opportunities.

- Policy environments favoring widespread access will influence both volume and price trends.

- Strategic investments in novel delivery systems and market expansion are vital for maintaining profitability.

FAQs

Q1: What impact will patent expirations have on buprenorphine-naloxone prices?

A: Patent expirations typically lead to increased generic competition, resulting in substantial price reductions—often 30-50%—as multiple manufacturers enter the market.

Q2: Are new formulations like long-acting injectables likely to command higher prices?

A: Yes. Long-acting injectable formulations, such as Sublocade®, target adherence improvements and convenience, allowing for higher pricing compared to oral formulations.

Q3: How does the regulatory environment influence market prices?

A: Favorable regulatory policies and approvals expedite market entry for generics and innovative products, increasing competition and driving prices downward.

Q4: What emerging markets have potential for buprenorphine-naloxone growth?

A: Countries in Asia-Pacific, Latin America, and Africa with rising opioid dependency rates and expanding healthcare infrastructure represent significant growth opportunities.

Q5: How can manufacturers mitigate declining prices?

A: By investing in novel formulations, expanding into new markets, optimizing supply chain efficiencies, and engaging in value-added services like digital adherence tools.

References

[1] National Institute on Drug Abuse (NIDA). Opioid Crisis. 2022.

More… ↓