Share This Page

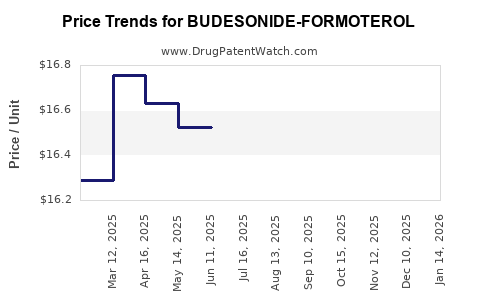

Drug Price Trends for BUDESONIDE-FORMOTEROL

✉ Email this page to a colleague

Average Pharmacy Cost for BUDESONIDE-FORMOTEROL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUDESONIDE-FORMOTEROL 160-4.5 | 00310-7370-20 | 19.78806 | GM | 2025-12-17 |

| BUDESONIDE-FORMOTEROL 80-4.5 | 00310-7372-20 | 17.47598 | GM | 2025-12-17 |

| BUDESONIDE-FORMOTEROL 160-4.5 | 00310-7370-20 | 19.43961 | GM | 2025-11-19 |

| BUDESONIDE-FORMOTEROL 80-4.5 | 00310-7372-20 | 17.06709 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BUDESONIDE-FORMOTEROL

Introduction

Budesonide-formoterol, a combination inhaler used primarily for managing asthma and chronic obstructive pulmonary disease (COPD), has experienced increased demand driven by evolving respiratory disease management protocols. This analysis examines current market dynamics, regulatory landscape, competitive positioning, pricing trends, and future projections to support strategic decision-making for stakeholders.

Market Overview

Product Profile:

Budesonide-formoterol combines an inhaled corticosteroid (budesonide) with a long-acting beta-agonist (formoterol) offering synergistic control of airway inflammation and bronchodilation. Its multiple therapeutic indications, including maintenance treatment for asthma and COPD, have contributed to its widespread adoption.

Market Size & Growth:

Global demand for combination inhalers achieved an estimated valuation of USD 5.2 billion in 2022, with a Compound Annual Growth Rate (CAGR) forecasted at approximately 6% through 2030. Key drivers include rising prevalence of respiratory disorders, increased awareness, and expanded prescribing guidelines[1].

Geographic Trends:

- North America: Dominates market share, owing to high COPD and asthma prevalence, advanced healthcare infrastructure, and favorable reimbursement policies.

- Europe: Exhibits robust growth owing to innovations and regulatory approvals.

- Asia-Pacific: Projected to outpace mature markets due to increasing urbanization, pollution-related respiratory conditions, and expanding healthcare access.

Regulatory and Patent Landscape

Regulatory Approvals:

Budesonide-formoterol formulations are approved by FDA, EMA, and other agencies, with indications aligned with inhaled corticosteroids combined with long-acting beta-agonists. Approved formulations include nebulizer solutions and dry powder inhalers, broadening market reach.

Patent and Exclusivity Status:

Most formulations are under patent exclusivity until 2025–2027. Patent expirations could promote biosimilar and generic entry, impacting market prices.

Competitive Landscape

Major Players:

- AstraZeneca: Market leader with Symbicort in Europe, though not a direct formulation of budesonide-formoterol.

- Mundipharma, Teva, Cipla: Offer generic versions or marketed formulations in various regions.

- Innovator vs. Generic Dynamics: Patent expiration in key markets spurs generic competition, exerting downward pressure on prices.

Market Differentiation:

- Brand reputation, formulation convenience, and device innovation influence market share.

- Entry of biosimilars and generics will intensify price competition.

Pricing Dynamics

Current Price Trends:

In high-income markets, the average annual cost of brand-name budesonide-formoterol inhalers ranges from USD 2,000 to USD 4,000 per patient, depending on formulation and insurance coverage[2].

Generic Impact:

Post-patent expiry, generic inhalers are priced approximately 30–50% lower, rapidly gaining market share. The reduced entry barrier accelerates price erosion.

Reimbursement & Payer Policies:

Insurance coverage significantly influences patient access and pricing strategies. Governments and private payers increasingly favor cost-effective generics to contain rising healthcare costs.

Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets with unmet respiratory disease needs.

- Development of fixed-dose combinations with novel delivery mechanisms.

- Implementation of digital health integration to enhance adherence.

Challenges:

- Patent cliffs leading to price competition.

- Non-adherence issues affecting market penetration.

- Regulatory hurdles in certain jurisdictions.

Price Projection Outlook (2023–2030)

Short-Term (2023–2025):

- Stabilization of current prices in established markets due to limited patent expiry.

- Moderate price reductions anticipated in regions with approval of generic formulations, up to 20–30%.

Mid to Long-Term (2026–2030):

- Significant price declines forecasted post-patent expiration, with generic prices potentially halving.

- Enhanced accessibility in emerging markets unlocks volume growth offsetting unit price declines.

- Continued innovation may maintain premium pricing for advanced inhaler devices and combination therapies.

Strategic Recommendations

-

For Manufacturers:

Invest in R&D for innovative inhaler delivery systems, biosimilars, and digital adherence solutions. Strengthen patent protections and consider lifecycle management to extend market exclusivity. -

For Payers and Policymakers:

Promote the adoption of generics and biosimilars, implement cost-containment policies, and support patient education initiatives to improve adherence and optimize healthcare spending. -

For Investors:

Monitor patent expiries closely and assess emerging biosimilar entrants’ impact on pricing. Diversify portfolios with investments in company pipelines focusing on inhaler innovations.

Key Takeaways

- The global budesonide-formoterol market is poised for steady growth driven by rising respiratory disorders and expanded indications.

- Patent expiration around 2025–2027 presents at least a 30–50% potential price decline due to generic competition.

- Geographical expansion, especially in emerging markets, offers substantial volume upside despite downward pricing pressures.

- Innovation in device technology and digital health integration represents a strategic avenue for sustaining premium pricing.

- Stakeholder collaboration on cost management and access policies will shape future market dynamics.

FAQs

1. When will generic versions of budesonide-formoterol be widely available?

Generic formulations are expected to enter the market post-patent expiry, anticipated between 2025 and 2027, depending on jurisdiction-specific patent rights[3].

2. How will patent expiries affect drug prices?

Patent expiries typically lead to significant price reductions—generics can be priced 30–50% lower—enhancing access but reducing revenue for innovator companies.

3. What is the growth potential of the budesonide-formoterol market in emerging economies?

Emerging markets exhibit high growth potential driven by rising disease prevalence, increasing healthcare infrastructure, and increasing affordability, potentially doubling market size over the next decade.

4. Are biosimilars a threat to existing formulations?

Yes, biosimilars and other generic inhalers are entering the market, exerting downward pressure on prices, especially post-patent expiration.

5. What innovation strategies are key for sustained market competitiveness?

Developing user-friendly inhaler devices, digital adherence platforms, and combination therapies with added benefits are vital for differentiation and maintaining premium pricing.

Sources

[1] Market Research Future. “Global Inhalers Market Analysis,” 2022.

[2] IQVIA. “Pharmaceutical Pricing & Reimbursement Report,” 2022.

[3] Regulatory agencies’ patent status and expiration data, 2022.

Disclaimer: This analysis reflects the most recent available data (up to 2023) and is subject to change with emerging market developments, regulatory decisions, and technological advancements.

More… ↓