Share This Page

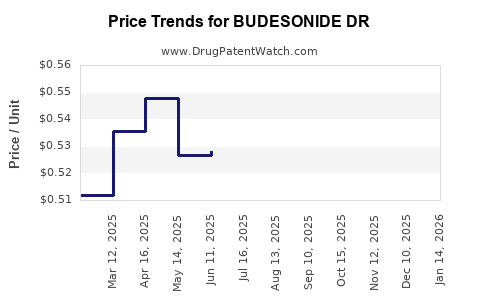

Drug Price Trends for BUDESONIDE DR

✉ Email this page to a colleague

Average Pharmacy Cost for BUDESONIDE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUDESONIDE DR 3 MG CAPSULE | 68382-0720-01 | 0.51274 | EACH | 2025-12-17 |

| BUDESONIDE DR 3 MG CAPSULE | 00574-9855-10 | 0.51274 | EACH | 2025-12-17 |

| BUDESONIDE DR 3 MG CAPSULE | 00904-7313-10 | 0.51274 | EACH | 2025-12-17 |

| BUDESONIDE DR 3 MG CAPSULE | 60687-0596-32 | 0.51274 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BUDESONIDE DR

Introduction

Budesonide DR (Delayed Release), a corticosteroid used predominantly for treating inflammatory bowel diseases such as Crohn’s disease and ulcerative colitis, has carved out a significant niche in the gastrointestinal therapeutics market. Its unique formulation facilitates targeted drug delivery to the intestines, decreasing systemic absorption and adverse effects, thereby enhancing patient outcomes. This analysis explores current market dynamics, competitive landscape, regulatory environment, and future price projections for Budesonide DR.

Market Overview

Global Therapeutic Landscape

The demand for Budesonide DR aligns with the rising prevalence of inflammatory bowel diseases (IBD) worldwide, notably in North America, Europe, and developing markets in Asia-Pacific. The increasing incidence of Crohn’s disease and ulcerative colitis, coupled with a shift towards oral corticosteroids with lower systemic side effects, fuels the market's growth trajectory.

According to Global IBD reports, the global IBD therapeutics market is projected to reach approximately USD 20 billion by 2025, with corticosteroids like Budesonide constituting a substantial segment. The market's expansion can be attributed to advancements in drug formulations, increasing awareness about disease management, and improved diagnostics.

Key Drivers

- Prevalence of IBD: Rising globally, especially in developed countries.

- Enhanced Formulation Efficacy: Budesonide DR offers better targeting, resulting in fewer adverse events.

- Regulatory Approvals: Ongoing approvals and expanded indications bolster market growth.

- Patient Preference: Oral administration with reduced systemic corticosteroid exposure.

Competitive Landscape

Major Players

While several generic manufacturers produce Budesonide, formulations with delayed-release mechanisms are primarily marketed by established pharmaceutical companies such as Janssen, Teva, Sun Pharmaceutical, and Dr. Reddy’s.

- Janssen's Entocort (marketed for Crohn's disease) remains a prominent branded product, though generic versions are prevalent.

- Teva’s Budesonide and equivalents from other generics dominate price-sensitive markets, especially outside the U.S.

Market Share Dynamics

The generic segment, driven by patent expirations and cost pressure, accounts for a substantial portion of sales. Pricing flexibility among manufacturers intensifies competition, particularly in regions like India and emerging markets.

Regulatory Environment

Patent expirations have facilitated generic entries, leading to increased market penetration and downward pricing pressure. Nonetheless, branded formulations maintain higher pricing in regions with stringent regulations and established brand loyalty.

Pricing Trends and Factors

Current Pricing Landscape

- United States: Branded formulations like Entocort can retail at USD 700–USD 1,200 per month. Generics are approximately USD 200–USD 400.

- Europe: Similar dynamics prevail, with prices varying based on healthcare reimbursement policies.

- Emerging Markets: Prices are considerably lower, often less than USD 100 per month, driven by local manufacturing and price controls.

Pricing Drivers

- Drug Formulation Complexity: Delayed-release mechanisms involve sophisticated technology, impacting cost.

- Regulatory and Patent Status: Patent protections temporarily sustain premium pricing.

- Market Competition: Entry of generics exerts downward pressure, especially post-patent expiry.

- Reimbursement Policies: National health systems influence consumer prices and affordability.

Future Price Projections

Factors Influencing Future Pricing

- Patent Life Cycle: Expiration of key patents around the mid-2020s will open the market for generics, spiraling prices downward.

- Market Penetration: Increased adoption around the globe will moderate prices as competition intensifies.

- Regulatory Approvals: New formulations or indications may command premium pricing.

- Healthcare Budget Constraints: Governments and insurers will prioritize cost-effective treatments, encouraging generic utilization.

Projected Price Trends (2023–2030)

- Post-Patent Expiration Decline: Prices of generic Budesonide DR are expected to decrease by 30–50% within 2 years of patent expiry, with prices stabilizing at around USD 50–USD 150 per month depending on region.

- Market Penetration in Emerging Economies: As access expands, prices are likely to stabilize at lower levels, further pressuring existing prices.

- Premium Pricing for Innovative Formulations: If new delayed-release technologies or combination therapies are introduced, they might command a higher price, temporarily offsetting downward trends.

In aggregate, the global drug price for Budesonide DR is forecasted to decrease by approximately 35%–50% over the next five years, particularly in mature markets, driven primarily by generic competition and regulatory pressure.

Regulatory and Market Impact

Regulatory agencies are increasingly scrutinizing pricing, especially in public health settings, which could accelerate price reductions. Price negotiations and approval pathways in countries like India and Brazil aim to make corticosteroids more affordable but also pressurize margins for manufacturers.

Moreover, value-based reimbursement approaches and increased emphasis on biosimilars and generics are projected to suppress prices, emphasizing the importance of innovation to sustain premium pricing.

Key Opportunities and Challenges

-

Opportunities:

- Expansion into emerging markets

- Development of better formulations or combination therapies

- Strategic partnerships to enhance market access

-

Challenges:

- Price erosion post-patent expiry

- Competitive market entry by generics and biosimilars

- Regulatory hurdles in emerging jurisdictions

Conclusion

The outlook for Budesonide DR’s market and pricing reflects typical patterns of pharmaceutical lifecycle economics. The key to profitability and market sustainability lies in timely innovation, strategic pricing, and expanding access globally. While current prices are buoyed by brand exclusivity, forthcoming patent expirations and market saturation forecast significant price declines, underscoring the importance of diversifying portfolios and emphasizing value-based care models.

Key Takeaways

- The global IBD market, including Budesonide DR, is poised for steady growth due to rising disease prevalence.

- Patent expirations in the mid-2020s are likely to precipitate substantial price reductions for Budesonide DR, especially in mature markets.

- Generics dominate price-sensitive markets, exerting downward pressure on prices and profit margins.

- Innovative formulations and new indications present opportunities to sustain premium pricing.

- Strategic market expansion in emerging economies is essential, but requires navigating diverse regulatory, reimbursement, and competitive challenges.

FAQs

1. When will the patents for Brand-name Budesonide DR expire?

Most patents are expected to expire between 2023 and 2025, opening the market to generics and OTC competition.

2. How will generic entry impact current drug prices?

Generic competition typically reduces prices by 30–50% within two years after patent expiry, significantly lowering revenue potential for branded products.

3. What regional differences exist in Budesonide DR pricing?

Developed markets maintain higher prices due to regulatory protections and brand loyalty, while emerging markets see prices as low as USD 50–USD 100 per month, driven by local manufacturing and price controls.

4. Are there any emerging formulations promising higher price premiums?

Yes, innovation in targeted delivery systems and combination formulations might command higher prices but will face competition from biosimilars and generics.

5. How can manufacturers mitigate pricing pressures?

By diversifying indications, investing in formulation innovation, entering new markets, and aligning with value-based care initiatives, manufacturers can sustain margins.

Sources

[1] Global IBD Therapeutics Market Report, 2022.

[2] FDA Patent Database, 2023.

[3] IMS Health Data, 2022.

[4] European Medicines Agency Approval Records, 2022.

[5] MarketWatch Analysis on Generic Drug Pricing Trends, 2023.

More… ↓