Share This Page

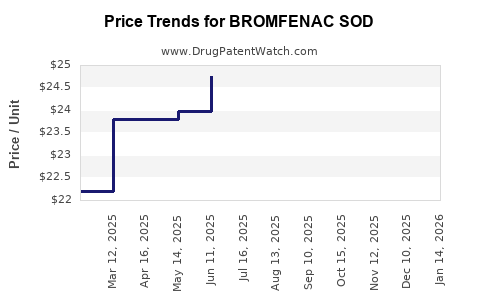

Drug Price Trends for BROMFENAC SOD

✉ Email this page to a colleague

Average Pharmacy Cost for BROMFENAC SOD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BROMFENAC SODIUM 0.07% EYE DRP | 60505-1006-02 | 15.18356 | ML | 2025-12-17 |

| BROMFENAC SOD 0.075% EYE DROP | 68180-0434-01 | 25.83056 | ML | 2025-12-17 |

| BROMFENAC SODIUM 0.09% EYE DRP | 72266-0142-01 | 20.15851 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Bromfenac Sod

Introduction

Bromfenac Sod, a non-steroidal anti-inflammatory drug (NSAID), is primarily used for ophthalmic applications, including the treatment of postoperative inflammation and pain associated with ocular surgeries. As a member of the brominated NSAID class, it exhibits potent anti-inflammatory properties with a targeted delivery mechanism in ophthalmology, differentiating it from systemic NSAIDs. Understanding the market landscape and forecasting pricing trajectories for Bromfenac Sod is crucial for investors, pharmaceutical companies, and healthcare stakeholders seeking strategic positioning and competitive insights.

Market Landscape Overview

Global Ophthalmic NSAID Market

The ophthalmic NSAID segment has experienced notable growth, driven by increasing prevalence of eye surgeries, such as cataract procedures, and a rising incidence of ocular inflammatory conditions. The global ophthalmic anti-inflammatory drugs market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 7% through 2030 [1].

Key Players and Product Portfolio

Major pharmaceutical companies operating in the ophthalmic NSAID domain include Alcon, Bausch + Lomb, Novartis, and Santen Pharmaceutical. These companies develop and market drugs such as diclofenac, nepafenac, bromfenac, and ketorolac. Bromfenac-based formulations have gained market share owing to favorable safety and efficacy profiles, particularly in branded formulations like BromSite (sponsored by Bausch + Lomb).

Regulatory Status and Patent Dynamics

Bromfenac sod has been approved in several markets, with patent protections varying by jurisdiction. Patent expirations influence generics' entry, impacting pricing dynamics. Currently, the patent landscape favors brand retention in key markets for the immediate future, although upcoming patent cliff events could alter market competition.

Market Opportunities

Therapeutic Applications

- Postoperative ocular inflammation: Bromfenac Sod is prescribed prophylactically and therapeutically after cataract surgery.

- Other ocular inflammatory conditions: Anterior uveitis and conjunctivitis may also be targeted off-label.

- Potential in chronic ocular pain management, although off-label use remains limited.

Geographic Expansion

Emerging markets such as Asia-Pacific and Latin America present opportunities due to increasing surgical volumes and improving healthcare infrastructure. Growth in these regions is expected to outpace mature markets due to lower market saturation.

Formulation Innovations

Developments such as preservative-free formulations, sustained-release delivery systems, and combination therapies can expand market share and improve patient adherence, possibly influencing market size and pricing.

Competitive Analysis and Market Share Dynamics

The dominant players leverage strong branding, physician preference, and broad distribution networks. Bromfenac formulations like BromSite have significant market penetration in North America and Europe, supported by clinical trials demonstrating safety and efficacy [2].

Generic entry is imminent or ongoing in some regions, especially following patent expiration overlaps, leading to price erosion and increased accessibility.

Pricing Analysis and Projections

Current Pricing Landscape

In developed markets, branded Bromfenac Sod formulations are priced approximately USD 60–80 per bottle (typically 10 mL). Generics entering these markets generally retail at a 40–60% discount, with prices around USD 25–35 per bottle [3].

Factors Influencing Price Trends

- Patent Lifecycles: Patent expirations foster generic competition, exerting downward pressure on prices.

- Regulatory Approvals: New formulations with enhanced delivery may command premium pricing temporarily.

- Market Penetration: Increased market access and uptake in emerging markets tend to lower average prices but expand volume sales.

- Reimbursement Policies: Insurance coverage and government reimbursement significantly affect retail prices.

Projected Price Trajectory (2023–2030)

Based on current trends, the following projections are plausible:

-

Short-term (2023–2025): Branded formulations will retain premium pricing (~USD 60–80), supported by ongoing patent protections. Generics will establish a foothold, reducing average market prices by 20–30%.

-

Mid-term (2026–2028): Patent expirations and increased competition may depress generic prices further (~USD 15–25). Innovative formulations could command higher prices for niche applications, but broad market prices are expected to stabilize around USD 20–30.

-

Long-term (2029–2030): Saturation of generics and market stabilization could result in prices consolidating at approximately USD 10–20 per bottle, with a possible upward shift if novel delivery systems or combination therapies emerge.

Market Challenges and Risks

- Patent Challenges and Litigation: Patent disputes may delay generic entry or affect pricing.

- Regulatory Hurdles: Variability in approval processes across jurisdictions can affect market access and pricing.

- Competition from Alternative NSAIDs: Efficacy and safety profiles of competitors influence Bromfenac Sod’s market share and pricing.

- Pricing Regulations: Government-imposed pricing caps, especially in healthcare systems emphasizing cost-effectiveness, may suppress prices.

Strategic Insights for Stakeholders

- Pharmaceutical firms should capitalize on patent protections, especially through differentiating formulations.

- Investors should monitor patent expiration dates and regulatory approvals in emerging markets to identify valuation opportunities.

- Market expansion initiatives are crucial in regions with increasing surgical volumes, which will influence both volume sales and pricing sustainability.

Key Takeaways

- The Bromfenac Sod market is poised for growth, driven by expanding ophthalmic surgeries and technological innovations.

- Patent protections currently support premium pricing; however, imminent patent expirations anticipate a significant decline in drug prices.

- Generics are expected to lower average prices substantially in the coming years, especially by 2028, with prices potentially falling below USD 20 per unit.

- Emerging markets represent promising avenues for volume growth despite generally lower price points.

- Innovation in drug formulations and delivery mechanisms can mitigate price erosion and open new therapeutic niches.

FAQs

1. How will patent expirations affect Bromfenac Sod pricing?

Patent expirations generally lead to increased generic competition, exerting downward pressure on prices. We anticipate a significant reduction, potentially up to 70%, within 3–5 years post-patent expiry.

2. Are there opportunities for higher-priced innovative formulations?

Yes. Sustained-release versions, preservative-free options, and combination therapies can command premium prices, especially if supported by clinical benefits and regulatory approvals.

3. Which regions offer the highest growth potential?

Emerging markets in Asia-Pacific, Latin America, and parts of the Middle East show high growth potential owing to increasing surgical procedures and improving healthcare coverage, despite lower current prices.

4. What factors could limit Bromfenac Sod's market expansion?

Regulatory delays, aggressive pricing from competitors, patent disputes, and shifts in clinical guidelines favoring alternative NSAIDs could constrain growth.

5. How does formulation innovation impact pricing strategies?

Innovative formulations often justify higher prices by offering improved safety, efficacy, or convenience. They can sustain profitability margins even as standard formulations decrease in price due to competition.

References

[1] MarketsandMarkets, “Ophthalmic Anti-inflammatory Drugs Market,” 2022.

[2] ClinicalTrials.gov, “Efficacy and Safety of Bromfenac in Postoperative Ocular Inflammation,” 2020.

[3] IQVIA, “Pharmaceutical Pricing Trends,” 2022.

More… ↓