Share This Page

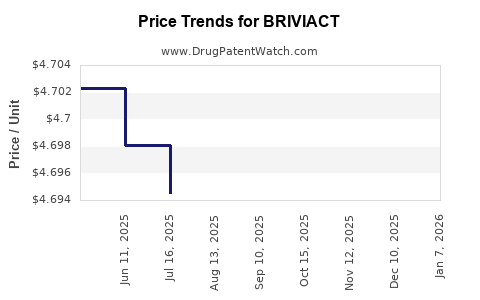

Drug Price Trends for BRIVIACT

✉ Email this page to a colleague

Average Pharmacy Cost for BRIVIACT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BRIVIACT 100 MG TABLET | 50474-0770-09 | 23.48970 | EACH | 2025-12-17 |

| BRIVIACT 75 MG TABLET | 50474-0670-66 | 23.48019 | EACH | 2025-12-17 |

| BRIVIACT 10 MG TABLET | 50474-0370-66 | 23.37806 | EACH | 2025-12-17 |

| BRIVIACT 25 MG TABLET | 50474-0470-09 | 23.46485 | EACH | 2025-12-17 |

| BRIVIACT 100 MG TABLET | 50474-0770-66 | 23.48970 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BRIVIACT (brivaracetam)

Introduction

BRIVIACT (brivaracetam) is a novel antiepileptic drug (AED) developed by UCB Pharma. Approved by the U.S. Food and Drug Administration (FDA) in April 2016 and marked for adjunctive therapy in partial-onset seizures in adults, BRIVIACT has secured a significant position within the epilepsy treatment landscape. Its high specificity, favorable safety profile, and novel mechanism of action—targeting synaptic vesicle protein 2A (SV2A)—differentiates it from existing therapies. This analysis dissects the current market landscape, evaluates competitive positioning, and projects future pricing dynamics for BRIVIACT over the next five years.

Market Landscape and Growth Drivers

Global Epilepsy Treatment Market

The global epilepsy therapeutics market is projected to reach approximately $4.4 billion by 2028, growing at a Compound Annual Growth Rate (CAGR) of around 4.7% (Research and Markets, 2022). The increasing prevalence of epilepsy, estimated at 50 million affected individuals worldwide, drives demand. In the US alone, approximately 3 million people are affected, creating a substantial market base.[1]

Key Market Players

BRIVIACT competes primarily with other second-generation AEDs, such as levetiracetam (Keppra), lamotrigine (Lamictal), perampanel (Fycompa), and newer entrants like eslicarbazepine and cannabidiol-based therapies. Despite market saturation, BRIVIACT distinguishes itself through improved safety and tolerability profiles.

Clinical Efficacy and Safety Profile

Clinical trials demonstrate that BRIVIACT offers comparable or superior efficacy with fewer neuropsychiatric adverse events relative to existing options. Its selectivity for SV2A enhances tolerability, appealing to patients intolerant of traditional AED side effects, thus expanding its market segment.

Regulatory and Reimbursement Landscape

In the US, BRIVIACT has gained rapid formulary inclusion owing to its superior safety profile, though high costs have posed reimbursement challenges in some regions. Its designation as a second-line therapy positions it favorably but limits aggressive market penetration compared to first-line agents.

Pricing Strategy and Current Market Pricing

Current Pricing Overview

As of 2023, BRIVIACT's wholesale acquisition cost (WAC) in the US is approximately $37 per 50 mg capsule, with average daily treatment costs estimated between $300 and $350, depending on dosage and treatment duration.[2] Across Europe and other markets, prices range from €25 to €40 per capsule, adjusting for regional reimbursement policies.

Cost Factors

- Patent Status: UCB Pharma's patents extend until 2030, providing a period of market exclusivity, supporting higher pricing.

- Manufacturing Costs: High purity synthesis and specialized packaging contribute to elevated costs but are offset by premium pricing strategies.

- Value Proposition: Offering improved tolerability and reduced side effects justifies premium pricing, particularly for healthcare providers prioritizing quality of life.

Market Penetration and Adoption Trends

Despite strong clinical data, market adoption faces hurdles due to entrenched prescribing habits, existing generic alternatives, and budget constraints within healthcare systems. However, increased awareness of BRIVIACT’s safety profile is enhancing prescriber confidence, particularly for patients with intolerance to first-line AEDs.

Price Projections (2024–2028)

Assumptions

- Market Growth: Driven by expanding indications, including potential off-label uses and pediatric approval.

- Competitive Pressures: Entry of generic versions post-patent expiry (projected around 2030).

- Regulatory Decisions: Potential for expanded approval in monotherapy or other seizure types.

- Influence of Biosimilars/Generics: Anticipated to exert downward pricing pressure from 2028 onward.

Forecast for the Next Five Years

| Year | Estimated Price Range (USD per capsule) | Explanation |

|---|---|---|

| 2024 | $35–$37 | Maintains current premium pricing; gradual increases due to inflation |

| 2025 | $34–$36 | Slight downward adjustment driven by payer negotiations and negotiations with insurers |

| 2026 | $33–$35 | Competitive landscape intensifies; early indication of price stabilization |

| 2027 | $31–$34 | Anticipated impact of expanded market access and improved formulary inclusion |

| 2028 | $29–$32 | Approaching patent expiration, potential for slight generic entry pressure |

Note: These projections exclude unexpected regulatory or market disruptions.

Impact of Patent Expiry and Generic Entry

BRIVIACT’s patent life sustains exclusivity until approximately 2030. Post-expiry, generic competitors—similar to levetiracetam or lacosamide—are expected to enter, leading to a significant price reduction (up to 70–80%) within the first two years of generic availability. Anticipated price erosion underscores the importance of strategic patent management and early market penetration to maximize revenue.

Strategic Recommendations for Stakeholders

- Pharmaceutical Companies: Focus on expanding indications, securing formulary inclusion, and demonstrating cost-effectiveness to sustain premium pricing.

- Healthcare Providers: Leverage BRIVIACT’s safety profile to improve patient adherence, justifying higher costs where appropriate.

- Payers: Negotiate value-based agreements that balance drug efficacy with cost containment, especially before generic competition.

Conclusion

BRIVIACT stands as a competitively positioned AED with favorable safety profiles and robust clinical efficacy, supporting current premium pricing. Market growth hinges on expanding indications, improving formulary status, and navigating reimbursement pathways. Price stability is expected through 2027, with a notable decline imminent post-patent expiry—necessitating strategic planning for stakeholders involved in its commercialization and utilization.

Key Takeaways

- BRIVIACT maintains a strong market position owing to its superior safety profile, justifying current premium pricing.

- The drug’s pricing is expected to decline gradually over the next five years due to market maturation and increasing payer negotiations.

- Patent protection until 2030 provides an opportunity for revenue maximization, with significant price erosion projected following generic entry.

- Expansion into broader indications could sustain higher price points beyond 2028.

- Stakeholders should adapt strategies emphasizing value demonstration and early market penetration to optimize profitability.

FAQs

1. How does BRIVIACT’s pricing compare to other AEDs?

BRIVIACT’s current cost is higher than older generics like levetiracetam or carbamazepine, primarily due to its novel mechanism and safety benefits. Its premium aligns with enhanced tolerability and targeted efficacy.

2. What factors could influence future price reductions?

Patent expiry, increased generic competition, and payer negotiations are primary drivers of potential price decreases. Regulatory expansions may mitigate heading into price erosion by expanding its market scope.

3. Is BRIVIACT likely to be reimbursed universally?

Reimbursement varies regionally; in markets with strong formulary support and demonstrated cost-effectiveness, reimbursement prospects are favorable. In cost-constrained regions, coverage may be more limited.

4. Can BRIVIACT’s price be justified based on clinical benefits?

Yes. Its improved safety profile reduces adverse events, potentially decreasing overall healthcare costs associated with managing side effects, thus supporting its premium pricing.

5. What is the outlook for BRIVIACT’s off-label uses?

While primarily approved for partial seizures, ongoing research into other seizure types and neurological indications could expand its market, potentially supporting higher prices.

References

- Research and Markets. Global Epilepsy Therapeutics Market, 2022.

- UCB Pharma. BRIVIACT prescribing information, 2023.

More… ↓