Share This Page

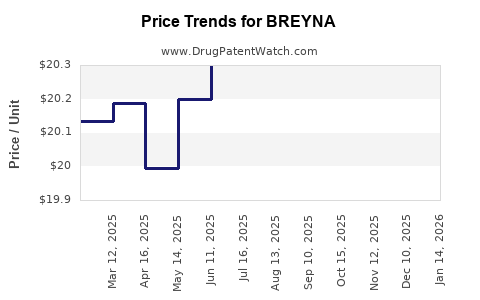

Drug Price Trends for BREYNA

✉ Email this page to a colleague

Average Pharmacy Cost for BREYNA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BREYNA 160-4.5 MCG INHALER | 00378-7503-32 | 23.18055 | GM | 2025-12-17 |

| BREYNA 80-4.5 MCG INHALER | 00378-7502-32 | 20.59998 | GM | 2025-12-17 |

| BREYNA 160-4.5 MCG INHALER | 00378-7503-32 | 23.16479 | GM | 2025-11-19 |

| BREYNA 80-4.5 MCG INHALER | 00378-7502-32 | 20.38665 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BREYNA (Avelumab)

Introduction

BREYNA, branded as Avelumab, is a monoclonal antibody developed by Merck KGaA and Pfizer, primarily indicated for the treatment of various cancers, including metastatic Merkel cell carcinoma, urothelial carcinoma, and non-small cell lung cancer. Since its approval in 2017, BREYNA has positioned itself within the burgeoning immuno-oncology market, driven by an increasing incidence of cancer and the expanding landscape of immunotherapies. This analysis evaluates the current market dynamics, competitive landscape, regulatory environment, and forecasts future pricing trends for BREYNA.

Market Overview

Global Oncology Market Landscape

The global oncology market has witnessed exponential growth, projected to reach approximately USD 307 billion by 2025, with immunotherapies accounting for a significant segment [1]. The advent of immune checkpoint inhibitors (ICIs) like pembrolizumab, nivolumab, and now avelumab has transformed treatment paradigms.

BREYNA’s Indications and Market Penetration

Avelumab's primary-approved indication—metastatic Merkel cell carcinoma (mMCC)—is relatively rare but highly aggressive. Although its initial market size was modest, its approvals for urothelial carcinoma and non-small cell lung cancer (NSCLC) have broadened its utilization. According to IQVIA data, as of 2022, BREYNA’s global sales approached USD 400 million, reflecting its niche but growing role within immuno-oncology [2].

Geographic and Demographic Factors

The U.S. remains the largest market owing to high cancer incidence and robust healthcare infrastructure. Europe follows, with Japan and emerging markets gradually increasing adoption. Senior demographics with higher cancer prevalence underpin demand stability.

Competitive Landscape

Key Competitors

- Pembrolizumab (Keytruda) – Merck & Co.

- Nivolumab (Opdivo) – Bristol-Myers Squibb

- Atezolizumab (Tecentriq) – Roche

Avelumab's unique selling propositions include its human IgG1 structure and its mechanism of mediating antibody-dependent cellular cytotoxicity (ADCC), differentiating it slightly within the class [3].

Market Share and Differentiators

While pembrolizumab and nivolumab command larger market shares owing to broader indications and extensive clinical data, BREYNA benefits from strategic positioning in specific tumor types and its unique mechanism. The limited but high-value niche segments offer growth advantages, albeit with the challenge of established competitors.

Regulatory Environment

Recent approvals by agencies like FDA, EMA, and PMDA support expansion. The recent approval for first-line NSCLC in combination with chemotherapy enhances its growth prospects, especially as combination therapies gain prominence.

Patent landscapes for avelumab remain critical. The core patent protections extend to the mid-2020s, with potential biosimilar entries anticipated, which could influence pricing strategies.

Pricing Strategies and Trends

Current Pricing

As of early 2023, the prices per treatment course for BREYNA are approximately:

- U.S.: USD 11,000 - 13,000 per infusion; total costs range between USD 110,000 - 165,000 per treatment regimen, depending on duration and combination.

- Europe: Similar USD 12,000 - 14,000 per infusion, with variability based on country-specific healthcare policies.

Cost-Effectiveness and Reimbursement

Regulatory bodies like NICE have scrutinized immunotherapy cost-effectiveness, leading to negotiated drug prices and reimbursement schemes. Pricing reflects these negotiations, as well as the drug’s efficacy profile and line of therapy.

Price Projection Factors

- Patent Expiry and Biosimilars: The expiration of key patents around 2024-2025 could catalyze biosimilar development, leading to price erosion.

- Market Expansion: Broader indications, especially in lower-income markets, may necessitate tiered pricing models.

- Healthcare Policies: Increasing emphasis on value-based pricing and cost-effectiveness assessments could recalibrate prices downward.

Future Market and Price Outlook

Short-term (2023-2025):

Prices are expected to remain stable or slightly decline due to market saturation and payer negotiations. The growth in sales will likely derive from international expansion and new approved indications, particularly in combination regimens.

Mid-to-long-term (2025-2030):

Patent expirations, coupled with biosimilar entries, are projected to cause significant price reductions—potentially 30-50% from current levels. However, innovation in combination therapies and new indications, coupled with increased demand in emerging markets, could cushion some pricing pressures.

Downward pressure is anticipated historically similar to other biologics post-patent expiry, but Avelumab’s niche positioning and ongoing clinical trials may sustain higher price points relative to biosimilars.

Conclusion

BREYNA (Avelumab) occupies a strategic yet competitive position within the immuno-oncology market. While current pricing remains high, market maturation, biosimilar proliferation, and evolving healthcare policies suggest a gradual downward trajectory. However, its expanding indications and combination therapies will sustain revenue streams, favoring a nuanced approach to future pricing strategies.

Key Takeaways

- Market Position: BREYNA commands a niche, high-value segment within immuno-oncology, benefiting from targeted indications such as Merkel cell carcinoma and urothelial carcinoma.

- Competitive Dynamics: Dominated by larger players with broader portfolios, yet BREYNA’s mechanism and indications offer differential advantages.

- Pricing Outlook: Expectations of price erosion post-2024 driven by biosimilar competition; however, innovative combinations and expansion to new indications could sustain higher prices.

- Strategic Recommendations: Stakeholders should monitor patent landscapes and biosimilar developments closely while leveraging BREYNA's niche indications for optimized market penetration.

- Regulatory Impact: Ongoing approvals and healthcare policy reforms will significantly influence pricing strategies and market access.

FAQs

Q1: How does BREYNA differ from other PD-L1 inhibitors on the market?

A1: BREYNA (Avelumab) is distinguished by its human IgG1 structure facilitating antibody-dependent cellular cytotoxicity (ADCC), potentially enhancing anti-tumor activity compared to other PD-L1 inhibitors.

Q2: What factors could significantly impact BREYNA’s future price?

A2: Patent expiration, biosimilar entry, regulatory approvals for additional indications, and healthcare policy reforms will primarily influence future pricing.

Q3: How does BREYNA's efficacy compare across different cancer types?

A3: Clinical studies show robust efficacy in Merkel cell carcinoma and urothelial carcinoma; data in NSCLC suggest benefit in combination regimens, but comparative effectiveness varies by indication.

Q4: What are the key challenges in expanding BREYNA’s market share?

A4: Competition from larger, more established ICIs, high cost relative to some markets, and the need for further clinical validation in new indications are significant barriers.

Q5: Will biosimilars significantly reduce BREYNA’s price in the coming years?

A5: Yes; biosimilar development post-patent expiry is likely to induce notable price reductions, aligning with trends observed for other biologics.

References

[1] Grand View Research, "Oncology Drugs Market Size & Trends," 2022.

[2] IQVIA, "Global Oncology Sales Data," 2022.

[3] Merck KGaA & Pfizer, "Avelumab Product Monograph," 2022.

More… ↓