Last updated: July 28, 2025

Introduction

Bismuth, a brittle, silvery-white metal belonging to the pnictogen group, plays a crucial role in pharmaceutical applications, notably in gastrointestinal treatments such as bismuth subsalicylate (e.g., Pepto-Bismol). Its unique antimicrobial and anti-inflammatory properties are essential for managing ulcers, infections, and other gastrointestinal disorders. The global demand for bismuth-based drugs intersects with fluctuating raw material supply, manufacturing costs, regulatory shifts, and emerging competitors. This analysis explores the current market landscape, key drivers, supply chain dynamics, and future price trajectories for bismuth as a pharmaceutical ingredient.

Market Landscape

Global Production and Supply Chain

Bismuth is primarily extracted as a byproduct from lead, copper, and silver mining operations, with China dominating global output, accounting for approximately 75% of the world’s supply [1]. Other notable producers include Mexico, Peru, and the United States, but their contribution remains comparatively marginal. The concentration of supply in China presents geopolitical and regulatory risks that could influence pricing.

The refining process to produce high-purity pharmaceutical-grade bismuth involves complex steps, including smelting, electrorefining, and purification, which increase production costs. Fluctuations in raw mineral prices, environmental regulations, and mine closures directly impact the availability and cost of bismuth.

Pharmaceutical Market Dynamics

The use of bismuth compounds, primarily bismuth subsalicylate and bismuth subcitrate, sustains a steady demand. According to IQVIA data, the gastrointestinal drugs segment has seen consistent growth driven by increasing incidence of ulcers, gastritis, and Helicobacter pylori infections [2]. The global market for bismuth-based drugs is valued at approximately $2.5 billion, with an expected compound annual growth rate (CAGR) of around 4% over the next five years.

Emerging markets in Asia-Pacific, particularly India and China, have expanded their consumption driven by rising healthcare access and less stringent regulatory pathways for over-the-counter Bismuth formulations. Meanwhile, patent expirations of key products and the emergence of generic formulations exert downward pressure on prices, whereas supply constraints tend to push prices upward.

Factors Influencing Bismuth Pricing

Raw Material Availability and Cost

The cost of raw bismuth follows global mining outputs, with a notable scarcity during mine disruptions. For instance, temporary mine closures in China in 2021 caused a 15% surge in bismuth prices, reaching a peak of approximately $8 per kilogram [3]. These fluctuations often translate into variable packaging and manufacturing costs for pharmaceutical firms.

Regulatory Environment

Stringent environmental regulations, especially in China and the US, have increased operational costs of mining and refining. The push towards sustainable mining practices could further tighten supply, elevating prices. Conversely, improved recycling techniques for bismuth-containing waste may mitigate raw material scarcity in the future.

Technological Advances

Innovations in synthetic production and recycling may lower manufacturing costs, thereby stabilizing prices. Additionally, the development of alternative formulations that reduce dependency on bismuth could influence demand and price stability.

Demand and Market Penetration

Steady demand in developed markets, coupled with growing use in emerging economies, supports consumption levels. However, substitution with other antimicrobial agents or alternative pharmaceuticals could temper long-term demand growth.

Patent and Regulatory Status

Patent expirations of established bismuth-based drugs tend to increase market competition, leading to price declines. Conversely, new formulations with improved efficacy or reduced toxicity can demand premium pricing.

Price Projections

Short-term Outlook (Next 1-2 Years)

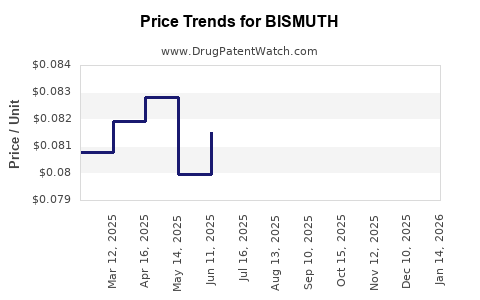

Current bismuth prices hover around $7-8 per kilogram, influenced by supply chain uncertainties stemming from geopolitical tensions and mining disruptions. Short-term projections suggest a slight increase of approximately 3-5%, reaching around $8.50 per kilogram by 2024, driven mainly by raw material scarcity and inflationary pressures in manufacturing.

Medium-term Outlook (3-5 Years)

Assuming steady demand growth and stable supply, prices are expected to stabilize around $8.50–$9.50 per kilogram. However, if new recycling methods or synthetic production approaches become commercially viable, prices could decline by 10–15%, improving profit margins for end-product manufacturers.

Long-term Outlook (Beyond 5 Years)

Potential supply constraints and intensified environmental regulations may cause bismuth prices to rise gradually, potentially reaching $10–$12 per kilogram by the late 2020s. Conversely, technological innovations and increased recycling could cap prices or cause slight declines, maintaining average costs in the $7–$9 range.

Key Influencing Factors

- Mining Regulation and Environmental Policies: Stricter regulations could reduce supply, pushing prices higher.

- Recycling Technology Adoption: Expansion could decrease raw material dependency.

- Demand Trends: Increased use in gastrointestinal and potentially other therapeutic areas could sustain or elevate prices.

- Global Economic Conditions: Inflation and trade tariffs could influence raw material costs.

Strategic Considerations for Stakeholders

- Pharmaceutical Developers should monitor raw material supply chains and consider switching to recycled bismuth sources to mitigate cost volatility.

- Manufacturers must evaluate the cost-benefit of investing in alternative formulations that may reduce bismuth dependency.

- Investors need to analyze geopolitical and regulatory developments that could influence supply stability and, consequently, market prices.

Key Takeaways

- The bismuth market is predominantly supply-constrained, with China as the critical producer, exposing the industry to geopolitical risks.

- Demand remains stable, supported by ongoing gastrointestinal treatments and expanding emerging market consumption.

- Prices are expected to see modest increases short-term, with potential stabilization or decline in the medium term due to technological and recycling advancements.

- Regulatory and environmental policies constitute significant risk factors, potentially disrupting supply and affecting prices.

- Stakeholders should adopt integrated supply chain strategies, including recycling and synthetic alternatives, to navigate potential volatility.

Conclusion

The future of bismuth pricing hinges on balancing supply constraints driven by geopolitical and environmental factors against steady demand from pharmaceutical markets. Continuous innovation and sustainability efforts are pivotal in stabilizing prices and ensuring supply security. Stakeholders who proactively adapt to evolving supply-demand dynamics and regulatory landscapes will secure strategic advantages in this niche yet vital market segment.

FAQs

1. How significant is China’s dominance in the global bismuth market?

China supplies approximately 75% of the world's bismuth, making it a critical player whose policies and mining activities profoundly influence global prices and supply stability [1].

2. What are the primary uses of bismuth in medicine?

Bismuth is mainly used in gastrointestinal medications, including bismuth subsalicylate, to treat ulcers, diarrhea, and infections like H. pylori. Its antimicrobial and anti-inflammatory properties underpin these applications.

3. How can recycling impact bismuth prices?

Recycling reduces dependence on mined bismuth, alleviating supply constraints and potentially lowering costs through creating secondary sources, which could moderate price fluctuations over time.

4. What risks could cause bismuth prices to escalate?

Regulatory changes, mine disruptions, environmental policies, and geopolitical conflicts in major producing regions could restrict supply, causing prices to rise.

5. Are there alternatives to bismuth in pharmaceutical applications?

While alternative antimicrobials exist, bismuth’s unique efficacy in gastrointestinal treatments makes substitutes challenging, underpinning a relatively stable demand.

Sources

[1] US Geological Survey, "Mineral Industry Surveys: Bismuth," 2022.

[2] IQVIA, "Pharmaceutical Market Analysis," 2022.

[3] Metal Prices, "Bismuth Price Trends," 2022.