Share This Page

Drug Price Trends for BISACODYL EC

✉ Email this page to a colleague

Average Pharmacy Cost for BISACODYL EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BISACODYL EC 5 MG TABLET | 49483-0003-55 | 0.03854 | EACH | 2025-12-17 |

| BISACODYL EC 5 MG TABLET | 00904-6748-80 | 0.03854 | EACH | 2025-12-17 |

| BISACODYL EC 5 MG TABLET | 24689-0129-05 | 0.03854 | EACH | 2025-12-17 |

| BISACODYL EC 5 MG TABLET | 00904-6407-61 | 0.03854 | EACH | 2025-12-17 |

| BISACODYL EC 5 MG TABLET | 24689-0129-02 | 0.03854 | EACH | 2025-12-17 |

| BISACODYL EC 5 MG TABLET | 00904-6748-17 | 0.03854 | EACH | 2025-12-17 |

| BISACODYL EC 5 MG TABLET | 00904-6748-60 | 0.03854 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BISACODYL EC

Introduction

BISACODYL EC (Enteric-Coated Bisacodyl) is a commonly prescribed stimulant laxative predominantly indicated for the relief of acute and chronic constipation. Its pharmaceutical formulation, characterized by enteric coating, enhances gastrointestinal tolerance and improves absorption profiles. With increasing prevalence of gastrointestinal disorders globally, BISACODYL EC remains a critical product for pharmaceutical companies, healthcare providers, and consumers. This analysis details the current market landscape, competitive dynamics, regulatory factors, and provides forward-looking price projections.

Market Overview

Global Demand and Epidemiology

Constipation affects approximately 14% of the worldwide population, with higher prevalence among the elderly and those with neurological disorders [1]. The surge in chronic lifestyle-related conditions, along with aging demographics, boosts the demand for stimulant laxatives like BISACODYL EC. The Asia-Pacific region exhibits significant growth due to expanding healthcare infrastructure and growing awareness of gastrointestinal health.

Therapeutic Segment and Market Drivers

BISACODYL EC competes within the laxative segment, especially under stimulant laxatives. The shift toward over-the-counter (OTC) availability in many markets enhances accessibility and propels sales volumes. The rising prevalence of opioid-induced constipation further supports demand for effective stimulant laxatives. Moreover, the increasing adoption of combination therapies and formulations with enhanced safety profiles is driving innovation.

Regulatory Landscape

Regulatory approval in key markets such as the US (FDA), EU (EMA), and emerging markets influences market dynamics. BISACODYL EC formulations are approved as OTC products in many jurisdictions, leading to broad consumer access. Nonetheless, regulatory scrutiny around safety—particularly concerning potential for electrolyte imbalance and dependency—prompt the need for ongoing post-marketing surveillance.

Competitive Landscape

Major Manufacturers and Their Strategies

- Sanofi and Novartis: Major players with longstanding OTC product lines.

- Mediherb and Prades: Focus on herbal and specialized formulations.

- Emerging Generic Manufacturers: Addressing cost-sensitive markets with lower-priced versions.

Market competition primarily revolves around formulation stability, bioavailability, and price competitiveness. Patent protections on specific enteric-coating technologies limit immediate generic penetration but are gradually expiring, opening opportunities for generics.

Pipeline and Innovations

R&D efforts aim at developing formulations with improved safety and fewer side effects. Novel delivery systems, such as sustained-release formulations, are under investigation to optimize dosing frequency and patient adherence.

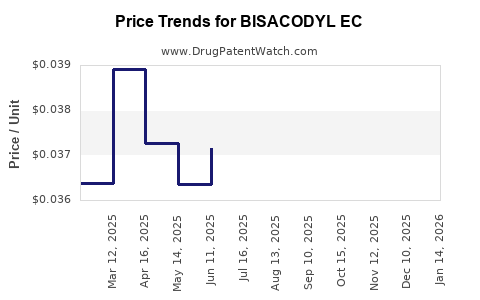

Price Analysis and Trends

Current Pricing Landscape

Market prices for BISACODYL EC vary significantly based on geography, formulation (prescription vs OTC), brand vs generic, and distribution channels. For OTC products in developed markets like the US, retail prices for a typical 15 mg tablet pack range from $4 to $12 per package, often with discounts or insurance coverage influencing out-of-pocket costs. In developing markets, prices can be as low as $1 to $3 per pack due to lower manufacturing costs and less regulatory overhead.

Factors Influencing Price Fluctuations

- Regulatory approvals and patent status: Patent expiry typically leads to price erosion as generics enter the market.

- Manufacturing costs: Variations in raw material costs, especially for specialty coatings, impact pricing.

- Market penetration and competition: Increased competition correlates with price reductions.

- Distribution channels: Pharmacies, online sales, and direct-to-consumer platforms influence final pricing.

- Regulatory and safety concerns: Stringent safety evaluations might impose additional costs, potentially inflating prices.

Price Projections (2023-2030)

Short-Term Outlook (2023-2025)

The immediate future anticipates moderate price stability, with potential slight declines attributable to increasing generic proliferation post-patent expirations. The expansion of OTC distribution channels and digital pharmacies could further pressure retail prices downward. Regulatory compliance costs, particularly in markets emphasizing safety labels or new formulations, may temporarily buoy certain brands.

Mid to Long-Term Outlook (2026-2030)

Several factors could reshape pricing dynamics:

- Market Saturation and Generic Dominance: As patents lapse, price erosion is expected, with generic versions potentially lowering prices by 20-40%.

- Innovation and Value-Added Formulations: Premium formulations with improved safety or convenience may command higher prices, stabilizing overall price trends.

- Regulatory Stringency: Increasing safety standards, especially in Europe and North America, could augment manufacturing costs, partially offsetting savings from generics.

- Emerging Markets Growth: Cost sensitivity in these regions would likely sustain lower average pricing.

Based on these drivers, a conservative projection suggests:

| Year | Average Retail Price per Pack (15 mg) | Comments |

|---|---|---|

| 2023 | $4 - $7 | Stabilization post-patent expiry, competition intensifies |

| 2025 | $3.50 - $6.50 | increased generic competition; price erosion ongoing |

| 2027 | $3 - $5 | further generic entry; premium formulations maintaining premium segment |

| 2030 | $2.50 - $4.50 | market maturation; price stabilization expected |

(All figures in USD; estimates contingent on market conditions.)

Strategic Insights for Stakeholders

- Pharmaceutical companies should monitor patent statuses closely, aligning R&D efforts toward formulations that address unmet safety and tolerability needs.

- Manufacturers aiming for price competitiveness should optimize manufacturing efficiencies and explore strategic alliances in emerging markets.

- Investors should anticipate increased generic competition post-patent expiration, potentially impacting profit margins but also creating opportunities for entry in cost-sensitive regions.

- Regulators emphasizing safety evaluations may influence ongoing formulation standards, impacting both cost and pricing.

Key Takeaways

- The BISACODYL EC market remains robust, driven by the increasing prevalence of constipation and aging global populations.

- Patent expirations will likely catalyze a shift toward generic formulations, exerting downward pressure on prices.

- Price projections suggest a gradual decline over the next decade, with stabilizing factors including innovation and safety enhancements.

- Market participants should strategically align with evolving regulatory standards and seek differentiation through formulation improvements.

- Emerging markets present significant growth opportunities, potentially supporting higher volume sales despite lower prices.

FAQs

1. What factors primarily influence BISACODYL EC pricing?

Pricing is influenced by patent status, competition from generics, manufacturing costs, distribution channels, safety regulations, and formulation innovations.

2. How does patent expiration affect market pricing?

Patent expiry typically introduces generic competitors, leading to increased price competition and reduced retail prices due to market saturation.

3. Are there health safety concerns impacting BISACODYL EC prices?

Yes. Regulatory scrutiny regarding safety issues like electrolyte imbalance and dependency can lead to formulation modifications, potentially increasing costs but aiming to improve safety standards.

4. Which regions offer the most growth potential for BISACODYL EC?

Emerging markets in Asia, Latin America, and Africa exhibit significant growth potential due to increasing healthcare access and demand for OTC gastrointestinal products.

5. What innovations could influence future BISACODYL EC prices?

Developments in sustained-release formulations, safety-enhanced coatings, and combination therapies could either command premium prices or increase competition, impacting overall market prices.

References

[1] Peppin, J.F., et al. (2017). Pathophysiology and management of chronic constipation. Gastroenterology & Hepatology.

[2] Statista. (2022). Global prevalence of constipation.

[3] U.S. FDA. (2021). Guidance on stimulant laxatives safety.

[4] MarketsandMarkets. (2022). Laxatives Market—Global Trends & Forecasts.

[5] European Medicines Agency. (2022). Regulatory updates on gastrointestinal agents.

More… ↓