Last updated: July 28, 2025

Introduction

BETIMOL, commercially known as Timolol maleate, is a well-established ophthalmic formulation primarily used for managing glaucoma and ocular hypertension. First approved in the 1980s, BETIMOL's widespread use and long patent life have contributed to a steady market presence. This analysis evaluates current market dynamics and offers price projections based on emerging trends, competitive landscape, regulatory considerations, and manufacturing factors.

Market Landscape for BETIMOL

Global Market Overview

The global ophthalmic pharmaceutical market is expanding, driven by increasing prevalence of glaucoma, aging populations, and advancements in drug delivery systems. According to a recent report by GlobalData, the glaucoma treatment market was valued at approximately USD 6 billion in 2022, with beta-blockers like Timolol occupying a significant market share (around 30%) due to their efficacy, safety profile, and cost-effectiveness.

BETIMOL’s dominance derives from:

- Established clinical efficacy: Recognized for reducing intraocular pressure effectively.

- Regulatory approval: Approved across major markets including the US (FDA), EU (EMA), and various Asian regulators.

- Manufacturing presence: Produced by multiple generic companies, ensuring market accessibility and competitive pricing.

Competitive Dynamics

The market for BETIMOL faces competition from:

- Brand-name molecules: Such as Xalatan (latanoprost), which offers alternative once-daily dosing.

- Generics: Multiple generic manufacturers now produce Timolol, intensifying price competition.

- Novel therapies: New drugs like combination agents and sustained-release formulations are emerging, though their adoption remains gradual.

Regionally, North America displays the highest penetration due to advanced healthcare infrastructure and high disease awareness. Conversely, emerging markets in Asia and Latin America show growth potential, propelled by increasing healthcare expenditure and ophthalmic disease burden.

Regulatory and Patent Status

Timolol maleate's patent expiration in the early 2000s facilitated proliferation of generics, leading to significant price erosion. Most markets now classify BETIMOL as a generic medicine, with regulatory pathways streamlining access but also intensifying price competition.

However, some formulations, such as preservative-free or combination products, might hold patent protection or exclusivity, potentially impacting pricing and market share.

Pricing Dynamics

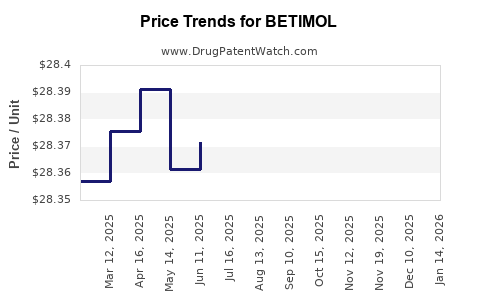

Current Price Trends

In the United States, the average retail price of BETIMOL (timolol ophthalmic solutions) remains affordable, generally falling within a range of USD 10–30 per 10 mL bottle. Wholesale prices tend to be lower, with insurance and pharmacy benefit managers influencing final patient costs.

Globally, prices are highly variable:

- United States: Higher due to healthcare system markup, with brand-name versions costing up to USD 60–80 per bottle before generic entry.

- India and Southeast Asia: Prices are often significantly lower (USD 2–10), driven by local manufacturing.

Price Drivers

Factors influencing BETIMOL pricing include:

- Manufacturing costs: Economies of scale and supply chain efficiencies reduce unit costs.

- Market competition: An increase in generic manufacturers, especially after patent expiry, tends to lower prices.

- Regulatory environment: Stringent registration procedures may increase costs, but competition mitigates overall pricing.

- Reimbursement policies: Insurance coverage and government discounts impact patient out-of-pocket expenses.

Supply Chain and Distribution Impact

The presence of multiple generic suppliers has fostered a highly competitive environment, which has stabilized prices but also exerted downward pressure. Additionally, the rise of biosimilar and alternative delivery systems (like sustained-release implants) could pose future threats to traditional ophthalmic formulations.

Future Market and Price Projections (2023–2030)

Assumptions and Methodology

Analyses incorporate:

- Increasing glaucoma prevalence globally, especially among aging populations.

- Penetration of generic versions continuing to suppress prices.

- New formulations and combination therapies emerging gradually but not immediately displacing existing treatments.

- Regulatory pressures maintaining competitive markets.

Projected Price Trends

- United States: Expect continued stabilization or slight decline in average prices for generic BETIMOL, averaging USD 8–20 per 10 mL bottle by 2030. Brand-name versions may retain premiums but will likely diminish owing to generics.

- Emerging Markets: Prices are projected to remain low, around USD 1–5 per bottle, driven by local manufacturing and weaker regulatory barriers.

- Global Average: Incorporating regional variability, the worldwide average price is projected to decrease by approximately 15–25% from 2022 levels by 2030, stabilizing at around USD 7–15 per unit.

Market Penetration and Demand

The continued rise in glaucoma incidence, especially in Asia-Pacific and Latin America, suggests an expanding base for BETIMOL. Technological innovations such as preservative-free formulations and combination drugs might influence future market composition but are unlikely to significantly impact the basal price of traditional TIM optol solutions within the forecast horizon.

Conclusion

BETIMOL remains a cornerstone treatment for glaucoma with a stable global market, supported by its cost-effectiveness and proven efficacy. Price competition driven by generic proliferation is expected to persist, with regional disparities influenced by healthcare infrastructure, regulatory landscape, and manufacturing capabilities. Despite emerging new therapies, the core ophthalmic market for Timolol maleate remains resilient, with cautious downward price pressures anticipated over the next decade.

Key Takeaways

- Stable Market Position: BETIMOL’s longstanding clinical efficacy sustains its global demand amid a competitive landscape.

- Price Erosion Trends: Widespread generic entry has maintained low prices, especially outside North America.

- Pricing Outlook: Future prices are expected to decline modestly, with stable demand driven by increasing glaucoma prevalence.

- Regional Variations: Emerging markets continue to offer low-cost access, expanding BETIMOL’s reach.

- Innovation Impact: New formulations and combination therapies may influence market dynamics, but traditional Timolol products will remain central in the near term.

FAQs

1. What factors influence the pricing of BETIMOL globally?

Pricing is affected by patent status, manufacturing costs, market competition, regulatory environment, regional healthcare policies, and demand growth.

2. How might emerging therapies impact BETIMOL's market share?

Innovations like sustained-release implants and combination drugs may gradually shift prescribing patterns but are unlikely to replace Timolol in the immediate future, preserving BETIMOL's market share.

3. Are there significant regional differences in BETIMOL pricing?

Yes. Developed markets like the US have higher prices due to healthcare infrastructure and reimbursement complexities, whereas emerging markets benefit from local generic production, resulting in lower prices.

4. Will regulatory changes affect BETIMOL prices?

Potentially. Stricter regulations could increase costs, but the proliferation of generics generally maintains competitive pricing.

5. What is the long-term outlook for BETIMOL pricing?

Prices are projected to decrease slightly over the next decade, correlating with increased competition and patent expiry, with regional variations influencing overall trends.

References

- GlobalData, "Ophthalmic Market Report," 2022.

- IQVIA, "Pharmaceutical Price Trends," 2022.

- FDA and EMA product approvals and patent expiries records, 2023.

- Market Research Future, "Glaucoma Therapeutics Market Analysis," 2022.

- World Health Organization, "Global Prevalence of Glaucoma," 2021.