Share This Page

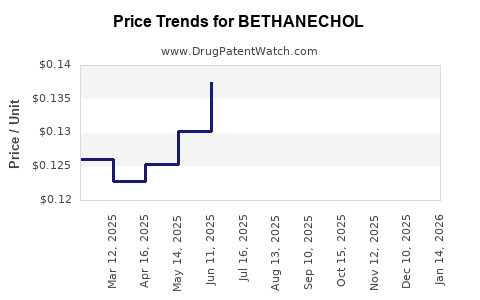

Drug Price Trends for BETHANECHOL

✉ Email this page to a colleague

Average Pharmacy Cost for BETHANECHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BETHANECHOL 10 MG TABLET | 00832-0511-01 | 0.17247 | EACH | 2025-12-17 |

| BETHANECHOL 10 MG TABLET | 23155-0935-01 | 0.17247 | EACH | 2025-12-17 |

| BETHANECHOL 10 MG TABLET | 53746-0572-01 | 0.17247 | EACH | 2025-12-17 |

| BETHANECHOL 10 MG TABLET | 00832-0511-89 | 0.17247 | EACH | 2025-12-17 |

| BETHANECHOL 50 MG TABLET | 65162-0574-10 | 0.32332 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Bethanechol

Introduction

Bethanechol, a cholinergic agonist primarily prescribed for postoperative and neurogenic urinary retention, has maintained a niche yet steady position within the pharmaceutical market. Its mechanism of action—stimulating bladder muscle contraction—addresses specific urological conditions with a well-established safety profile. Despite its longstanding presence, recent market dynamics, patent statuses, and emerging competition influence pricing strategies and market valuation. This analysis evaluates the current market landscape, analyzes key factors influencing bethanechol's pricing, and projects future price trends.

Market Overview

Therapeutic Application and Market Size

Bethanechol is indicated for the treatment of urinary retention, primarily functional or neurogenic, resulting from post-surgical or neurological causes. The global urology drug market, valued at approximately USD 29 billion in 2022, includes pharmaceuticals targeting urinary retention, overactive bladder, and other urological conditions [1]. Bethanechol's specific market share remains modest owing to its age and existing alternatives, but it serves a critical niche.

Regulatory Status and Patent Landscape

The patent exclusivity for bethanechol expired decades ago, resulting in multiple generic formulations across major markets like the U.S., EU, and Asia, intensifying price competition. Regulatory realities—such as approvals from the FDA and EMA—ensure consistent manufacturing standards, but no new proprietary formulations are currently under development, limiting innovation-driven price elevations.

Manufacturers and Supply Chain

Multiple generic manufacturers, including major pharmaceutical firms, produce bethanechol tablets, contributing to a highly competitive supply chain. Variability in manufacturing costs, particularly with generic producers in different regions, influences retail pricing. Distribution channels are well-established, with hospitals, pharmacies, and clinics as primary points of sale.

Current Pricing Landscape

Pricing by Region

-

United States: The average retail price for a 30-tablet course of bethanechol (50 mg) ranges from USD 15 to USD 40, depending on pharmacy negotiations and insurance coverage [2].

-

European Union: Prices tend to be lower, averaging around EUR 10-20 per course, reflecting regional healthcare pricing policies.

-

Emerging Markets: Prices are significantly lower, often below USD 10, driven by local manufacturing and market saturation.

Factors Influencing Price Stability

-

Generic Competition: Multiple suppliers keep prices low due to competition.

-

Demand Stability: Chronic use in specific patient populations sustains steady demand, preventing substantial price fluctuations.

-

Reimbursement Policies: Insurance reimbursement rates and coverage significantly influence out-of-pocket costs, indirectly impacting pricing strategies.

Future Price Projections

Analysis of Market Dynamics

Given the mature status of bethanechol, significant price increases are unlikely unless:

-

Patent or Exclusivity Resurrected: No current patent protections hinder price hikes; the only avenue could be formulation improvements or new delivery methods—neither currently underway.

-

Regulatory or Manufacturing Costs Rise: Environmental regulations or supply chain disruptions (e.g., geopolitical tensions affecting raw material imports) could increase costs.

-

Emergence of Superior Alternatives: The development of combination therapies or novel agents targeting similar pathways could erode bethanechol's market share, often exerting downward pressure on prices.

Projected Trends

-

Short Term (1-3 years): Prices will remain stable within current ranges, with minor variations due to inflation, manufacturing costs, or regional economic factors.

-

Medium to Long Term (3-10 years): Market saturation, widespread generic availability, and the absence of innovation will keep prices stagnant or declining slowly, adjusted for inflation and regional policy changes.

Potential Impact of Market Drivers

-

Introduction of Advanced Therapies: Biologics or targeted neuromodulation therapies could reduce demand over time, further depressing prices.

-

Health Policy Changes: Increased emphasis on cost containment and generic substitution policies, especially in emerging markets, may push prices downward.

-

Supply Chain Disruptions: Potential shortages due to manufacturing issues could temporarily elevate costs, but unlikely to establish long-term price increases.

Concluding Remarks

Bethanechol's market is characterized by low to moderate demand and intense generic competition, creating a highly competitive pricing environment. The absence of patent protections and ongoing availability of generics imply that prices are expected to remain flat or trend downward over the foreseeable future. Industry shifts towards novel urological therapies or formulation innovations could alter this landscape but, as of current trends, the outlook favors stability rather than significant price escalation.

Key Takeaways

-

Stable Market Dynamics: Bethanechol's mature status and generic competition underpin consistent, low-to-moderate pricing.

-

Pricing Outlook: Prices are projected to remain stable or decline slightly over the next decade, barring unexpected regulatory or supply chain disruptions.

-

Market Constraints: No current patent protections or innovative formulations threaten price increases; market evolution is predominantly downward or flat.

-

Regional Variations: Prices remain higher in the U.S. compared to Europe and Emerging Markets, primarily due to healthcare policy disparities.

-

Competitive Landscape: Increased competition ensures continued affordability, but potential entry of alternative therapies could further suppress pricing.

FAQs

1. Will the price of Bethanechol increase if a new formulation is developed?

Typically, new formulations or delivery systems can command higher prices initially. However, unless they offer significant advantages, market forces and generic competition will likely drive prices down over time.

2. Are there patent protections that could influence Bethanechol's market exclusivity?

Bethanechol's original patents have long expired, and no recent patent filings suggest exclusive rights will be granted in the foreseeable future.

3. How do regional healthcare policies affect Bethanechol pricing?

Regions with higher emphasis on generic substitution and cost containment, like Europe and certain Asian markets, tend to have lower drug prices compared to the U.S., where brand and formulary negotiations may influence costs.

4. Could shortages impact Bethanechol prices?

Supply disruptions could temporarily increase costs; however, such events rarely sustain long-term price escalation due to alternative sources and market competition.

5. What is the potential impact of emerging therapies on Bethanechol demand and pricing?

Innovative urological treatments, such as neurostimulation devices or novel pharmacologics, may reduce demand for Bethanechol, pressuring prices downward further.

References

- MarketWatch. "Global Urology Drugs Market Size, Trends & Forecasts." 2022.

- GoodRx. "Bethanechol prices and savings tips." 2023.

More… ↓