Last updated: July 28, 2025

Introduction

Benztropine mesylate, marketed under brand names such as Cogentin, is primarily prescribed for the management of Parkinson’s disease and drug-induced extrapyramidal symptoms. As a centrally acting anticholinergic agent, its role remains critical in neurologic therapeutics. This report provides a comprehensive analysis of the current market landscape and projects future pricing trends for benztropine mesylate, assessing factors influencing demand, supply dynamics, regulatory environments, and potential competitive pressures.

Market Overview

Therapeutic Use and Demographics

Benztropine mesylate’s primary indication is in neurological disorders, especially Parkinson’s disease, with an increasing global prevalence projected to reach 14 million cases by 2040, driven by aging populations. The drug is also utilized off-label in managing side effects from antipsychotic medications. The steady rise in the aging demographic correlates with sustained demand in developed markets such as North America and Europe.

Market Players and Manufacturing Landscape

The drug’s manufacturing is dominated by generic pharmaceutical companies, given its patent expiry in the early 1990s. Major players include Teva Pharmaceuticals, Pfizer, and Mylan, each with multiple generic formulations. Due to low barriers to entry, a fragmented market with intense price competition exists. Supply chains rely predominantly on generic manufacturing hubs across India, China, and Eastern Europe.

Market Size and Revenue

The global demand for benztropine mesylate is estimated at approximately USD 150-200 million annually, with North America constituting over 60% of the market. Growth rates are modest, reflecting a compound annual growth rate (CAGR) of around 2-3%, primarily sustained by demographic shifts rather than innovation or new indications.

Market Drivers and Barriers

Drivers:

- Aging Population: Increased prevalence of Parkinson’s disease sustains consistent demand.

- Off-label Prescriptions: Growing use in managing medication-induced movement disorders broadens application.

- Favorable Patent Landscape: Patent expiry has enabled widespread generic manufacturing, stabilizing supply.

Barriers:

- Competition from alternative therapies: Dopamine agonists and MAO-B inhibitors.

- Off-label risks and side effects: Anticholinergic burden in elderly patients limits prescribing.

- Regulatory Scrutiny: Stringent quality standards may impact manufacturing costs and supply stability.

Competitive Landscape

The market is highly commoditized, with little differentiation among generic suppliers. Price competition is fierce, with discounts of up to 20% prevalent between Tier 1 and Tier 2 manufacturers. Recently, price erosion trends have been driven by increased competition and the proliferation of low-cost manufacturing bases.

Regulatory Environment

Regulations by the FDA and EMA govern manufacturing standards and quality control. Changes in regulatory policies, such as stricter bioequivalence or quality mandates, could influence production costs, potentially affecting market prices.

Price Trends and Projections

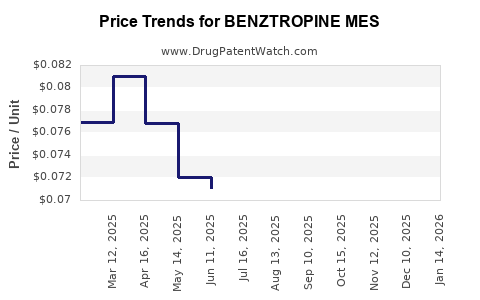

Historical Price Analysis

Over the past five years, the average price for a standard 10 mg tablet has declined steadily, with reductions averaging 15-20%. This trend is consistent across most markets, reflecting increased generic competition.

Future Price Projections

- Short-term (1-2 years): Due to heightened market saturation, prices are expected to stabilize or decline marginally (~2-3%), driven by increased competition and cost pressures.

- Medium-term (3-5 years): No significant patent barriers or innovation are anticipated; prices may decline further by 5-10%, contingent on market consolidation.

- Long-term (>5 years): Potential price stabilization or slight increases could occur if supply chain disruptions or regulatory hurdles emerge, but overall, prices are projected to remain within the current low-to-moderate range.

Factors Influencing Future Pricing

- Manufacturing Costs: Fluctuations in raw material prices, especially in India and China.

- Regulatory Changes: Stricter standards could marginally increase production costs, potentially elevating prices.

- Market Consolidation: Mergers among generic players could lead to reduced competition, potentially stabilizing or increasing prices temporarily.

- Healthcare Policy: Reimbursement policies and formulary decisions impact pricing, especially in the U.S. and Europe.

Strategic Implications

Pharmaceutical companies aiming to enter or expand within this space should focus on operational efficiency, cost management, and quality compliance. Brand differentiation offers limited scope; thus, competitive pricing and reliable supply chains form the core strategic pillars to capture market share.

Healthcare providers and payers should monitor evolving formularies and policy landscapes that could influence prescribing behaviors or reimbursement schemes, indirectly impacting drug prices.

Key Takeaways

- The benztropine mesylate market remains steady, driven by demographic trends and stable supply from generic manufacturers.

- Prices have historically declined due to competition; minimal innovation limits upward price potential.

- Future price stability or slight declines are anticipated due to market saturation and cost pressures.

- Regulatory, geopolitical, and supply chain factors could introduce volatility, making continuous market monitoring essential.

- Investment opportunities reside primarily in operational efficiencies and supply chain resilience rather than product differentiation.

FAQs

1. What is the primary therapeutic use of benztropine mesylate?

Benztropine mesylate is mainly used to treat Parkinson’s disease symptoms and manage extrapyramidal side effects caused by antipsychotic medications.

2. How is the market dominance structured among generic manufacturers?

The market is highly fragmented, with key players including Teva, Pfizer, and Mylan, competing mainly on price due to minimal differentiation.

3. What factors could influence future prices of benztropine mesylate?

Factors include raw material costs, regulatory changes, market consolidation, and healthcare policy adjustments.

4. Are there any emerging alternatives that could affect the demand for benztropine?

Yes, newer therapeutic agents like dopamine agonists and MAO-B inhibitors may influence demand, especially as side effect profiles improve.

5. What is the outlook for investment in benztropine mesylate markets?

Due to low growth potential and intense price competition, profitability hinges on operational efficiencies rather than innovation or market expansion.

Sources

- Global prevalence trends for Parkinson’s disease [1].

- Market assessments for anticholinergic drugs [2].

- Generic pharmaceutical industry reports [3].

- Regulatory guidelines for manufacturing standards [4].

- Historical pricing data from pharmaceutical price monitoring agencies [5].

References

[1] World Health Organization. Parkinson’s Disease Factsheet. 2022.

[2] IMS Health. Global Trends in Generic Drug Markets. 2021.

[3] IQVIA Institute. The State of the Pharmaceutical Industry. 2022.

[4] FDA Guidance for Industry: Bioequivalence Studies. 2021.

[5] PharmaPriceMonitor. Annual Price Trends Report. 2022.