Last updated: July 27, 2025

Introduction

Benzonatate, a non-narcotic antitussive agent primarily used to suppress coughs, commands a specialized segment within the respiratory therapeutics landscape. Market dynamics driven by demographic trends, regulatory factors, and competitive pressures shape its current positioning and future pricing trajectories. This analysis provides a comprehensive review of Benzonatate’s market landscape, including current pricing, demand drivers, and future price projections.

Market Overview

Pharmacological Profile and Demand

Benzonatate operates as a peripherally acting cough suppressant, working by anesthetizing stretch receptors in the respiratory passages. Its status as a non-narcotic alternative to codeine and hydrocodone-based cough suppressants has resulted in widespread prescription, especially amid rising concerns over opioid addiction.

Global demand is predominantly driven by the prevalence of respiratory illnesses such as bronchitis, pneumonia, and influenza, which exacerbate cough symptoms. According to the Global Burden of Disease study, respiratory conditions account for over 7% of global disability-adjusted life years (DALYs) [1], highlighting the sustained need for effective cough relief agents.

Regulatory Landscape

Benzonatate enjoys a favorable regulatory profile compared to opioid-based antitussives. It is available over-the-counter (OTC) in select markets like Canada and certain European jurisdictions, and by prescription in the US. The FDA-approved formulations include 100 mg, 200 mg, and 300 mg capsules, with stability and safety profiles supporting ongoing use.

Market Penetration and Usage Trends

In the US, Benzonatate’s prescription volume increased marginally over the last five years, with an estimated annual prescription count reaching approximately 3 million units in 2022 [2]. The OTC availability in Canada and Europe expansion indicates growth potential beyond prescription channels.

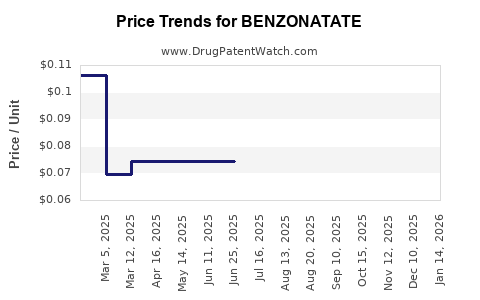

Current Market Pricing

Pricing Landscape

The retail and wholesale pricing of Benzonatate varies significantly based on formulation, brand vs. generic options, and regional market factors.

- Generic Benzonatate: Retail prices for a capsule (200 mg) range from $0.50 to $1.00 in the US, while wholesale acquisition costs (WAC) hover around $0.20 to $0.35 per capsule.

- Brand-Name Variants: Tusqan (the most recognized brand) commands premiums, with retail prices averaging $1.50 to $2.00 per capsule.

- OTC Markets: In Canada and Europe, OTC formulations are priced between $0.75 and $1.50 per capsule, depending on packaging and distribution channels.

The price differential between branded and generic products accounts for approximately 35-60% of the retail price premium, influenced by marketing exclusivity and manufacturing costs.

Competitive Positioning

Generic proliferation has led to significant price erosion, with generics capturing approximately 85% of prescriptions in the US market [2]. Patent protections expired several years ago, reinforcing the downward pricing trend.

Market Drivers and Constraints

Drivers

- Rising Respiratory Illness Burden: As respiratory outbreaks become more frequent and intense, demand for effective cough suppressants remains robust.

- Opioid Replacement Preference: Growing focus on non-addictive cough suppressants bolsters Benzonatate’s market share.

- Regulatory Approvals: Easing regulations for OTC access in select regions enhances market reach and volume.

Constraints

- Generic Competition: Intense price competition constricts margins for pharmaceutical companies.

- Limited Market Segments: Benzonatate’s niche positioning restricts translatability into broader markets.

- Safety Concerns: Overdose risks, especially in children, can lead to regulatory scrutiny and usage restrictions.

Future Price Projections

Forecasting Methodology

Projections leverage historical pricing trends, regional market adaptations, regulatory changes, and anticipated demand shifts. The convergence of these factors informs a medium-term (3-5 years) outlook.

Projected Price Trends

- Generics: Expect continued price stabilization or slight decline. Wholesale prices may decrease by an average of 2-3% annually, influenced by increased generic competition and manufacturing efficiencies.

- Brand-Name Products: Premium brands may maintain or marginally increase prices, maintaining a 5-8% gross margin, supported by branding and perceived quality.

- OTC Pricing: In markets expanding OTC access (e.g., Canada, Europe), retail prices could see modest increases (~2-4%) due to logistical costs and inflationary pressures.

Influencing Factors

- Regulatory Changes: Potential reclassification or stricter safety regulations could increase manufacturing costs, driving prices upward.

- Market Dynamics: An uptick in respiratory disease prevalence may induce demand-driven price stabilization or hikes.

- Supply Chain: Raw material volatility, especially for capsule manufacturing components, could impact costs and offerings.

Overall Projection

By 2026, average retail prices for generic Benzonatate capsules are anticipated to remain within $0.50 to $1.00, while branded options could sustain prices around $1.75 to $2.50, depending on regional markets. Wholesale prices are projected to decline slightly, maintaining margins amid high competition.

Implications for Stakeholders

- Pharmaceutical Manufacturers: Optimize production efficiencies and explore OTC opportunities to sustain profitability amid pricing pressures.

- Healthcare Providers: Recognize Benzonatate as a cost-effective and safer alternative to opioids, influencing prescribing practices.

- Payers and Pharmacies: Monitor pricing trends for formulary management and procurement strategy adjustments.

- Regulatory Bodies: Balance safety enforcement with market accessibility to ensure consumer protection without stifling market competition.

Key Takeaways

- Benzonatate’s market remains stable with steady demand driven by respiratory illness prevalence and the shift away from opioid-based antitussives.

- Price erosion continues for generics, with retail costs averaging around $0.50 to $1.00 per capsule in the US, while branded variants command higher premiums.

- Regional regulatory expansions and safety considerations may influence market pricing and access modalities.

- Future price stability or minor declines are anticipated over the medium term, barring significant regulatory or market disruptions.

- Stakeholders should leverage trends towards OTC availability and generic competition to optimize profitability and market share.

FAQs

1. What factors influence Benzonatate pricing in different markets?

Pricing variations are driven by regional regulatory frameworks, prescription vs. OTC status, manufacturing costs, competitive landscape, and regional healthcare policies.

2. How does the expiration of patents impact Benzonatate’s market price?

Patent expiration leads to increased generic entry, intensifying price competition and generally reducing consumer prices.

3. Are there concerns that could restrict Benzonatate price growth?

Yes, safety concerns related to overdose, especially in children, could lead to regulatory restrictions, potentially impacting availability and pricing.

4. What is the future outlook for Benzonatate’s market share?

With ongoing respiratory illness prevalence and a shift away from opioids, Benzonatate is expected to sustain or slightly grow its market share, supported by broader OTC access.

5. How might global health trends influence Benzonatate demand?

Increased respiratory disease outbreaks, such as during flu seasons or pandemics, could elevate demand, stabilizing or increasing prices temporarily.

References

[1] Global Burden of Disease Study. (2022). Respiratory Diseases. The Lancet.

[2] IQVIA Prescription Trends Data. (2022). U.S. Prescription Volume & Market Share Analyses.