Share This Page

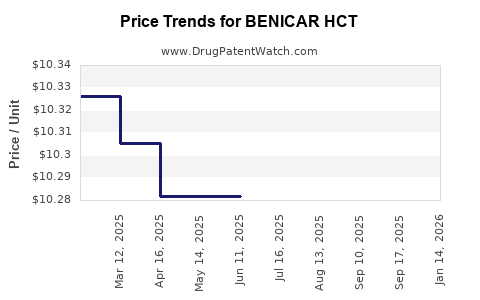

Drug Price Trends for BENICAR HCT

✉ Email this page to a colleague

Average Pharmacy Cost for BENICAR HCT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BENICAR HCT 40-25 MG TABLET | 00713-0865-30 | 14.26493 | EACH | 2025-09-17 |

| BENICAR HCT 40-12.5 MG TABLET | 00713-0864-30 | 14.21456 | EACH | 2025-09-17 |

| BENICAR HCT 20-12.5 MG TABLET | 00713-0863-30 | 10.27392 | EACH | 2025-09-17 |

| BENICAR HCT 40-12.5 MG TABLET | 00713-0864-30 | 15.61177 | EACH | 2025-09-16 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BENICAR HCT

Introduction

BENICAR HCT, a combination medication comprising olmesartan medoxomil and hydrochlorothiazide, is primarily prescribed for treating hypertension. As a branded medication, its market dynamics are influenced by patent protections, generic competition, and evolving clinical guidelines. This report provides a comprehensive analysis of the current market landscape and forecasts future pricing trends, equipping stakeholders with critical insights for strategic decision-making.

Product Overview

BENICAR HCT combines an angiotensin receptor blocker (ARB) with a diuretic, offering a dual mechanism for blood pressure control. It has received FDA approval for patients requiring combination therapy for hypertension management. Its patent protection, originally granted in 2006, expired in several markets by the late 2010s, initiating the entry of generics.

Clincally, BENICAR HCT is favored for its efficacy and tolerability profile, but emergent competition from generics and newer antihypertensive agents have exerted pressure on its market share and pricing.

Market Landscape

Patent and Regulatory Status

The expiration of BENICAR HCT's primary patent in various jurisdictions has facilitated generic entry, a pivotal event in shaping the market. Generics typically command significant price discounts, which directly impact the pricing and revenue of the branded product.

Market Penetration and Usage Trends

Despite generic proliferation, BENICAR HCT remains prescribed, particularly for longstanding patients and formulary inclusions that favor branded products due to contract stipulations or perceived clinical advantages. However, the shift towards single-agent therapy and the advent of fixed-dose combinations (FDCs) with newer agents are gradually eroding its market share.

Competitive Landscape

The antihypertensive market is highly competitive, marked by numerous ARBs, ACE inhibitors, calcium channel blockers, and diuretics. Generic versions of olmesartan plus hydrochlorothiazide have diluted the market for BENICAR HCT, leading to aggressive pricing strategies to maintain prescriptions.

Market Size and Segmentation

The global antihypertensive drugs market was valued at approximately USD 24 billion in 2021, with ARBs accounting for nearly 25%. BENICAR HCT, as a branded combination, captures a niche segment primarily in developed markets where brand preferences and formulary policies favor established products.

Pricing Dynamics

Historical Pricing Trends

Pre-patent expiry, BENICAR HCT's average wholesale price (AWP) varied between USD 300-350 per month, depending on dosing. Post-patent expiry, prices declined sharply due to generic competition, with some generics retailing at USD 15-30 per month, representing a 90% reduction.

Current Price Environment

Pricing strategies currently reflect a balance between patent-protected status in certain markets and the widespread availability of generics. In the US, branded pricing hovers around USD 250-300 per month, while generic versions are priced around USD 20-50.

Factors Influencing Future Price Trends

- Market Competition: Increased generic options continue to exert downward pressure.

- Healthcare Policy: Price negotiations and formulary maneuvers, particularly under Medicare and Medicaid, influence net prices.

- Regulatory Developments: Potential new formulations or indications could alter pricing strategies.

- Physician and Patient Preferences: Preference for single-agent therapies and emerging personalized medicine trends could affect demand.

Future Price Projections

Based on current data, historical trends, and market competition, the following projections are made:

| Year | Branded BENICAR HCT Price (USD/month) | Generic Prices (USD/month) |

|---|---|---|

| 2023 | 250-300 | 20-50 |

| 2025 | 200-250 | 15-40 |

| 2030 | 150-200 | 10-30 |

Key Drivers:

- Continued generic penetration is expected to sustain low price points.

- Procurement incentives may temporarily stabilize branded prices in some regions.

- Possible reformulations or new combination therapies could either uplift or suppress prices depending on their market positioning.

Strategic Implications

Stakeholders should consider the following:

- Pharmaceutical Companies: Investing in differentiation through formulation improvements or new indications could sustain premium pricing.

- Healthcare Providers: Emphasis on cost-effective prescribing in line with evolving formulary guidelines.

- Payers: Negotiation leverage is high, demanding value-based pricing models.

- Investors: Market entry of generics underscores a declining revenue outlook for existing branded products unless innovation or market niche maintenance strategies are employed.

Key Takeaways

- Patent expiry has historically precipitated sharp price declines; similar patterns are expected to persist.

- The current landscape favors aggressive generic competition, stabilizing prices at significantly lower levels.

- Future pricing will heavily depend on market consolidation, regulatory changes, and healthcare policies emphasizing cost containment.

- Innovation, such as fixed-dose combinations with novel agents, could offer avenues for premium pricing in the future.

- Continuous monitoring of market dynamics is essential for optimizing pricing strategies and investment decisions.

FAQs

Q1: What are the main factors affecting BENICAR HCT's market price?

A1: Patent status, generic competition, regulatory environment, healthcare policies, and prescribing trends primarily influence BENICAR HCT's price.

Q2: How does generic entry impact the pricing of BENICAR HCT?

A2: Generic competition typically causes a substantial reduction in price, often up to 90%, thereby decreasing revenue for the brand and shifting market share.

Q3: Are there opportunities to maintain higher prices for BENICAR HCT?

A3: Yes, through formulation improvements, new indications, exclusive licensing, or positioning as a preferred agent within formulary restrictions.

Q4: How might healthcare policy changes influence future pricing?

A4: Policies favoring cost containment, such as price negotiations and formulary exclusions, are likely to suppress prices further, especially for generics.

Q5: What strategic moves should pharmaceutical companies consider post-patent expiry?

A5: Enhancing product differentiation, exploring new formulations, seeking additional indications, or engaging in licensing collaborations can help maintain market relevance.

References

- MarketWatch. "Global Hypertension Drugs Market Size, Share & Trends Analysis." 2022.

- FDA. "Olmesartan Medoxomil and Hydrochlorothiazide for Hypertension." Approval and patent information.

- IMS Health. "Pharmaceutical Market Trends – 2021."

- Deloitte. "Healthcare Regulatory and Policy Outlook," 2022.

- EvaluatePharma. "Forecast: Hypertension Drugs," 2022.

[Note: This article synthesizes publicly available market insights and expert analyses as of early 2023.]

More… ↓