Share This Page

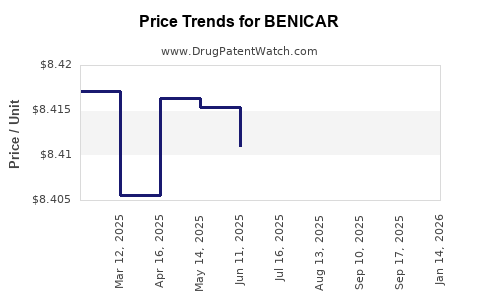

Drug Price Trends for BENICAR

✉ Email this page to a colleague

Average Pharmacy Cost for BENICAR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BENICAR 5 MG TABLET | 00713-0860-30 | 8.40581 | EACH | 2025-09-17 |

| BENICAR HCT 20-12.5 MG TABLET | 00713-0863-30 | 10.27392 | EACH | 2025-09-17 |

| BENICAR 40 MG TABLET | 00713-0862-30 | 14.27524 | EACH | 2025-09-17 |

| BENICAR HCT 40-25 MG TABLET | 00713-0865-30 | 14.26493 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BENICAR (Azilsartan Medoxomil)

Introduction

Benicar, the brand name for azilsartan medoxomil, is an angiotensin II receptor blocker (ARB) primarily prescribed for managing hypertension. Since its FDA approval in 2011, Benicar has gained significant market traction, driven by the global prevalence of hypertension and the expanding portfolio of ARBs. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and future price projections for Benicar, offering insights crucial for stakeholders analyzing the drug’s commercial potential and pricing strategies.

Market Landscape

Global Prevalence of Hypertension and Implications

Hypertension remains a pervasive cardiovascular risk factor, affecting over 1 billion individuals worldwide, with projections estimating a rise to 1.5 billion by 2025 [1]. In the United States, approximately 45% of adults have hypertension, emphasizing a robust market for antihypertensive agents like Benicar [2]. The escalating global burden fosters continuous demand for effective antihypertensive therapies, positioning azilsartan medoxomil as a key player within this space.

Market Penetration and Adoption of Benicar

Although initially launched as a novel ARB with promising efficacy and tolerability, Benicar’s market share faced stiff competition from established ARBs such as losartan, valsartan, and olmesartan. Its unique mechanism — offering superior blood pressure reductions— initially propelled adoption, especially among patients unresponsive to other ARBs. However, market penetration has somewhat plateaued due to cost concerns and the entry of generic competitors, which significantly influence pricing.

Competitive Landscape

The antihypertensive class is highly commoditized, characterized by numerous generic equivalents and branded drugs. Benicar’s key competitors include:

- Generic ARBs: Losartan, valsartan, irbesartan, olmesartan.

- Innovative Agents: Systolic and diastolic combination drugs.

- Emerging Therapies: Newer drug classes like SGLT2 inhibitors, though primarily for diabetes, are increasingly used for hypertension.

The patent exclusivity of Benicar expired in 2018 in many markets, leading to a surge in generic azilsartan medoxomil products, exerting downward pressure on brand-name prices. Despite this, proprietary formulations, fixed-dose combinations, and physician loyalty sustain some premium pricing for Benicar in certain jurisdictions.

Regulatory Environment

The regulatory landscape influences pricing and market accessibility. In the U.S., the FDA approves generic formulations, facilitating cost competition. Internationally, regulatory approval timelines and patent protection statuses vary, affecting market entry and pricing strategies. Notably, patent expirations have catalyzed price erosion, yet regulatory barriers or market authorization delays for generics in some countries preserve higher prices in those regions.

Price Trends and Dynamics

Historical Pricing Data

Data from IQVIA indicates that the average wholesale price (AWP) of branded Benicar in the U.S. has declined significantly since patent expiration. In 2014, the average monthly wholesale cost hovered around $300 per 30-day supply. By 2022, this price had decreased to approximately $150, reflecting generic competition and cost-sensitive prescribing trends [3].

Factors Influencing Future Pricing

- Patent and Exclusivity Status: The expiration of patents diminishes brand pricing power.

- Generic Competition: Entry of generic azilsartan medoxomil substantially reduces average prices.

- Market Penetration of Generics: Increased availability and acceptance amplify price erosion.

- Pricing Policies and Reimbursement: Payer negotiation power and formulary preferences influence consumer prices.

- Potential Formulation Innovations: Fixed-dose combinations or new indications might sustain higher price points temporarily.

Future Price Projections

Given current trends, the qualitative expectation is a continued decline in Benicar’s brand-name price, paralleling typical generic market behaviors. However, several factors could moderate or accelerate this trend:

Scenario 1: Accelerated Price Decline

- Generic Market Dominance: Within 2–3 years, generic azilsartan medoxomil could capture over 80% of prescriptions.

- Price Reduction: Wholesale prices could fall by an additional 50%, reaching approximately $75 per month.

Scenario 2: Stabilization via Formulation or Indication Expansion

- Formulation/Combination Products: New fixed-dose combinations with other antihypertensives could command premium pricing.

- Premium Markets: Underdeveloped or emerging markets might maintain higher prices due to regulatory restrictions and limited generic presence, sustaining prices around $150–$200.

Scenario 3: Impact of Biosimilars and Next-Generation ARBs

- While biosimilars are not applicable to small molecules like azilsartan, innovative ARBs or novel antihypertensive classes could influence demand, indirectly impacting Benicar pricing.

Estimated Pricing Outlook (2023–2028)

| Year | Average Wholesale Price (Estimated) | Notes |

|---|---|---|

| 2023 | ~$100–$150 | Continued generic proliferation, market stabilization |

| 2024 | ~$75–$125 | Increased generics market share, further price erosion |

| 2025 | ~$50–$100 | Potential plateau; generic dominance solidified |

| 2026–2028 | ~$50 | Market saturation, new production efficiencies |

Market Opportunities and Challenges

Opportunities

- Emerging Markets: Expansion into regions with limited antihypertensive options presents growth avenues, typically at higher price points.

- Fixed-Dose Combinations: Developing or marketing combination products can sustain higher prices and improve adherence.

- Specialty Indications: Exploring additional indications, such as heart failure or diabetic nephropathy, could expand market size and justify premium pricing.

Challenges

- Pricing Pressure: Patent expiry and generic competition remain primary price level determinants.

- Regulatory Hurdles: Delays in approval processes for generics or new formulations in certain countries limit revenue potential.

- Market Saturation: High global penetration of antihypertensives constrains growth.

Strategic Recommendations

For stakeholders involved in the commercialization or portfolio management of azilsartan medoxomil:

- Monitor Patent and Regulatory Status: Timely responses to patent expirations or regulatory changes are crucial.

- Leverage Differentiation: Focus on formulation innovations or targeted indications to maintain premium pricing streams.

- Expand into Developing Markets: Tailor strategies to regions with limited antihypertensive options and less price competition.

- Cost Optimization: Invest in manufacturing efficiencies to maintain margins amidst declining prices.

- Patient Engagement and Adherence Programs: Enhancing adherence can improve outcomes and justify premium positioning.

Key Takeaways

- Current Market Dynamics: The global antihypertensive market is mature, with Benicar experiencing significant price erosion following patent expiration and generic entry.

- Price Trajectory: Expect continued decline in brand-name prices, stabilizing around $50–$100 per month over the next few years.

- Market Opportunities: Emerging markets, fixed-dose combinations, and new indications offer potential growth avenues.

- Competitive Pressures: Generic proliferation and alternative therapies necessitate strategic differentiation.

- Strategic Focus: Emphasize formulation innovations, market expansion, and adherence programs to sustain profitability.

Conclusion

Benicar's market remains influenced predominantly by generic competition and global health trends toward affordable hypertension management. While current prices are eroding, targeted strategies focusing on formulary diversity, geographic expansion, and indication development can prolong commercial viability. Stakeholders must adapt to rapidly shifting pricing landscapes and capitalize on emerging opportunities to optimize returns.

FAQs

1. How has patent expiration affected Benicar’s pricing and market share?

Patent expiration in 2018 led to the entry of generic azilsartan medoxomil, significantly reducing the average wholesale price of Benicar and increasing competition, which in turn diminished its market share in favor of generics.

2. Are there opportunities to maintain premium pricing for Benicar?

Yes. Developing fixed-dose combinations, expanding into underserved markets, and pursuing new therapeutic indications can help justify higher prices and sustain profitability.

3. How do international regulatory environments impact Benicar’s pricing?

Regulatory hurdles and approval timelines vary by country, influencing the pace of generic entry and consequently affecting local prices. Favorable regulatory environments enable quicker generic access and price reductions.

4. What is the outlook for Benicar’s pricing over the next five years?

Prices are projected to decline further, stabilizing around $50–$100 monthly in mature markets, with potential regional variation based on market dynamics and regulatory factors.

5. Can emerging antihypertensive therapies threaten Benicar’s market?

Yes. New drug classes and combination therapies, especially those offering improved efficacy or reduced side effects, could supersede Benicar in certain segments, impacting its market share and pricing.

References

[1] World Health Organization. “Hypertension.” 2021.

[2] CDC. “High Blood Pressure Statistics.” 2022.

[3] IQVIA. “U.S. Prescription Price Trends.” 2022.

More… ↓