Last updated: July 27, 2025

Introduction

Benazepril hydrochloride (HCl) is an orally administered angiotensin-converting enzyme (ACE) inhibitor primarily prescribed to manage hypertension and heart failure. Since its approval in the late 1990s, Benazepril HCl has established a significant presence within the cardiovascular therapeutic landscape. This analysis explores the current market landscape, competitive positioning, regulatory environment, and future price trajectories of Benazepril HCl, underpinning strategic decision-making for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Current Market Landscape

Market Presence and Usage Patterns

Benazepril HCl is marketed globally, with notable market penetration in North America, Europe, and parts of Asia. It is often prescribed as a first-line therapy for hypertension due to its efficacy, tolerability, and well-established safety profile. According to IQVIA data, the global sales volume of Benazepril-based medications reached approximately $1.2 billion in 2022, with a compound annual growth rate (CAGR) of roughly 3% over the past five years [1].

The drug is available as branded formulations—such as Lotensin (by Sanofi)—and generic equivalents introduced after patent expiration in many jurisdictions. The generic segment now dominates sales due to its lower cost, accounting for over 80% of total Benazepril HCl prescriptions in mature markets.

Market Share and Competition

The antihypertensive class includes other ACE inhibitors (e.g., Lisinopril, Enalapril) and alternative drug classes such as angiotensin receptor blockers (ARBs) like Losartan and Olmesartan. While Benazepril competes effectively within the ACE inhibitor segment due to its proven efficacy, market share is increasingly influenced by cost, clinician preferences, and drug equivalence perceptions. Generic availability and price sensitivity significantly reduce the price premium of branded formulations, impacting overall revenue streams.

Pricing Dynamics

The average retail price of branded Benazepril HCl (Lotensin 20 mg) hovers around $0.30 per tablet, whereas generic equivalents are priced roughly 50–70% lower. The steep decline in prices post-patent expiry underscores the commodity-like nature of the medication, with sustained affordability as a defining feature.

Regulatory and Patent Environment

Patent Status and Intellectual Property

Sanofi’s original patent protections for Lotensin expired in key markets by 2010, facilitating the entry of generics. Current patent protections for Benazepril HCl are generally limited to formulations, packaging, or specific delivery methods, which do not significantly impede generics' market entry.

Regulatory Approvals

The regulatory landscape is stable, with the drug approved by agencies such as the FDA and EMA. Ongoing regulatory reviews primarily focus on bioequivalence, manufacturing quality, and extending indications. No significant recent regulatory hurdles restrict market access or pricing flexibility.

Future Price Projections

Influencing Factors

-

Generic Competition: Continued proliferation of generic Benazepril HCl will exert downward pressure on prices. As prices for generics stabilize at low levels, branded products will struggle to command premiums.

-

Market Saturation and Prescribing Trends: Hypertension management guidelines increasingly favor ARBs or combination therapies, potentially diminishing Benazepril’s growth momentum. However, in low- and middle-income countries, where cost remains a primary driver, demand is resilient.

-

Pricing Regulations: Governments and payers are implementing cost-containment measures, including price caps and formulary restrictions, especially in OECD countries, which could suppress prices further.

-

Innovation and New Formulations: Currently, no novel formulations or delivery methods for Benazepril are in advanced development stages, limiting upward pricing potential based on innovation.

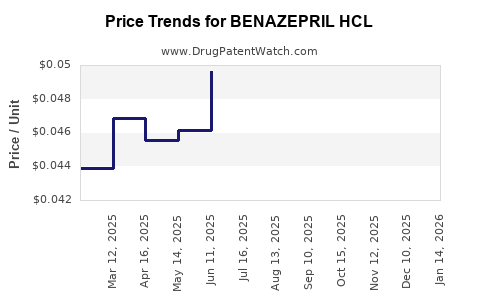

Projected Price Trajectory (2023–2030)

- Short-term (1–3 years): Retail prices for branded Benazepril HCl are expected to decline marginally—approximately 5–10%—due to aggressive generic competition and healthcare cost containment policies.

- Medium-term (4–7 years): Prices may stabilize or decline more slowly, with branded formulations trading at a 70–80% discount from initial post-patent prices.

- Long-term (8+ years): Market saturation and generics dominance could drive prices towards the $0.05–$0.10 per tablet range in mature markets, similar to other small-molecule antihypertensives.

Emerging Markets and Price Variability

In emerging markets, prices remain higher relative to local income levels but benefit from less aggressive price regulation. Local manufacturing and patent protections influence pricing, often limiting market entry of affordable generics. Consequently, some regions may sustain higher prices or limited competition, creating pockets for profit.

Strategic Implications

- For Pharmaceutical Companies: To maximize revenue, focus on niche formulations, combination therapies, or value-added delivery systems, as generic price erosion continues.

- For Investors: The drug’s valuation should account for patent expiries, generic competition, and regional pricing differences, emphasizing exposure to markets with less price regulation.

- For Healthcare Payers: Cost-containment initiatives will continue to pressure prices downward, favoring generics and biosimilars.

Key Takeaways

- Competitiveness: Benazepril HCl faces intense generic competition, which is expected to depress prices further over the next decade.

- Pricing Trends: In mature markets, prices for branded formulations could decline by up to 80%, approaching the $0.05–$0.10 per tablet range.

- Market Opportunities: Emerging markets may offer higher prices due to less regulation, albeit with increased market entry challenges.

- Regulatory Environment: Stable approvals aid in market continuity, but no current innovation pipeline signals limited upside unless new formulations emerge.

- Strategic Focus: Differentiation through new delivery methods or combination therapies may mitigate price erosion pressures.

FAQs

1. Will the price of Benazepril HCl increase in the near future?

No. Due to widespread generic competition and regulatory price controls in many markets, prices are more likely to decline or stabilize at low levels.

2. What factors most influence the future pricing of Benazepril HCl?

The primary factors include patent expiries, generic market penetration, healthcare policy reforms, and regional price regulation practices.

3. How does market share influence pricing strategies?

Higher market share for branded versions may justify premium pricing, but in the context of generic competition, maintaining market share becomes challenging, leading to price reductions.

4. Are there technological advancements that could elevate Benazepril’s price?

Currently, no. Lack of innovation limits price escalation potential unless new formulations or combination therapies gain regulatory approval.

5. How do emerging markets impact the overall pricing outlook?

Emerging markets often sustain higher prices due to less aggressive regulation, but growth is constrained by affordability and infrastructure challenges.

References

[1] IQVIA. (2022). Global Prescription Drug Market Data.