Share This Page

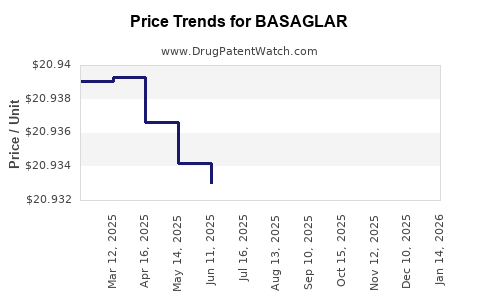

Drug Price Trends for BASAGLAR

✉ Email this page to a colleague

Average Pharmacy Cost for BASAGLAR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BASAGLAR 100 UNIT/ML KWIKPEN | 00002-7715-59 | 20.93104 | ML | 2025-12-17 |

| BASAGLAR 100 UNIT/ML KWIKPEN | 00002-7715-59 | 20.92995 | ML | 2025-11-19 |

| BASAGLAR TEMPO PEN 100 UNIT/ML | 00002-8214-05 | 20.95489 | ML | 2025-11-19 |

| BASAGLAR TEMPO PEN 100 UNIT/ML | 00002-8214-05 | 20.95920 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BASAGLAR (Insulin Glargine)

Introduction

BASAGLAR (insulin glargine injection) is a long-acting recombinant human insulin analog approved for glycemic control in adults and pediatric patients with diabetes mellitus. Since its FDA approval in 2016, it has positioned itself as a biosimilar alternative to Lantus (insulin glargine) with competitive pricing and marketed advantages. This analysis evaluates BASAGLAR’s current market landscape, competition, pricing dynamics, and forecasts future price trends over the upcoming years.

Market Landscape of BASAGLAR

Market Position and Adoption

The global diabetes epidemic continues to fuel demand for long-acting insulins, with an increasing shift toward biosimilar options driven by cost sensitivity and healthcare policy reforms. BASAGLAR, developed by Eli Lilly in collaboration with Boehringer Ingelheim, entered a mature insulin market characterized by intense competition from branded products such as Sanofi's Lantus, its biosimilar Semglee, and other alternatives like Tresiba (insulin degludec).

Initial adoption of BASAGLAR was modest, gaining ground through competitive pricing and formulary inclusion. Its biosimilar profile has attracted payers aiming to reduce healthcare expenditure while maintaining clinical efficacy. The expansion of biosimilar insulin use aligns with broader global policies favoring biosimilar substitution, especially in North America and Europe.

Competitive Landscape

The insulin market is dominated by a few manufacturers, with biosimilars gaining weight. Key competitors to BASAGLAR include:

- Lantus (Sanofi) — the original insulin glargine product, with a significant market share but facing biosimilar competition.

- Semglee (MediGene/Viacom) — a biosimilar insulin glargine, approved in multiple markets and often priced lower.

- Toujeo (Sanofi) — a concentrated insulin glargine, targeting specific patient populations.

- Tresiba (Novo Nordisk) — a long-acting insulin with different pharmacokinetics but competing in the same segment.

The competitive landscape is further complicated by differing formulations, dosing flexibility, and regulatory approvals across regions.

Pricing Dynamics of BASAGLAR

Historical Pricing Trends

Upon launch, BASAGLAR was priced approximately 20-30% below branded Lantus, creating a compelling value proposition for formulary inclusion. According to IQVIA data, the list price of BASAGLAR in the U.S. in 2017 averaged around $300 per pen, compared to Lantus's roughly $400–$500.

Rebates, negotiations, and patient assistance programs further influence actual out-of-pocket costs. The entry of additional biosimilars has intensified price competition, leading to reductions in list prices and negotiated discounts.

Impact of Biosimilar Competition

As biosimilar insulins like Semglee gained wider approval, BASAGLAR experienced downward pricing pressure. Market studies indicate that first-generation biosimilars reduced U.S. list prices by approximately 10–20% upon entry, with ongoing discounts in subsequent years. The trend toward value-based agreements and stepwise pricing adjustments continues to shape the market.

Pricing in Different Markets

- United States: Pricing remains variable, heavily dependent on insurance formularies, rebates, and patient assistance. The overall trend has been a decline in net prices.

- Europe: Governments have enforced price caps and tender processes, leading to lower prices consistently below US levels.

- Emerging Markets: Pricing varies substantially, often being more affordable due to local manufacturing and government subsidies.

Forecasting Future Price Trends

Short-term (Next 1–2 Years)

In the immediate future, BASAGLAR's list prices are expected to stabilize or slightly decrease, driven by:

- Increased biosimilar competition incentivizing Eli Lilly to maintain their market share through aggressive pricing strategies.

- Payer negotiations favoring low-cost alternatives to reduce overall healthcare spend on insulin therapies.

- Potential introduction of formulary preferred status for biosimilars such as Semglee and TikTok, impacting BASAGLAR’s market share and price.

Based on recent market data, a conservative estimate suggests an additional 5–10% reduction in net prices.

Medium to Long-term (3–5 Years)

Predicted price trajectory indicates:

- Continued downward pressure with biosimilar proliferation, possibly leading to list prices declining by up to 25-30% over five years.

- The emergence of more affordable biosimilar options in global markets, especially in Europe and Asia, where price sensitivity is higher.

- Economic pressures from healthcare reforms and the shift toward value-based contracts further incentivizing price reductions.

The total decrease in list prices could reach approximately 30–35% by 2028, contingent upon biosimilar market penetration and regulatory landscape evolution.

Drivers of Price Decline

- Increased biosimilar approvals: The FDA has accelerated biosimilar approvals, including insulin glargine products.

- Pricing policies: Governments pushing for cost savings through competitive tendering.

- Market saturation: Broad acceptance of biosimilars leading to commoditization of long-acting insulins.

- Technological innovations: Novel delivery methods and formulations may impact demand and pricing strategies.

Implications for Stakeholders

Pharmaceutical companies: Need to innovate in formulation, delivery systems, and pricing strategies to retain market share amidst biosimilar competition.

Payers and providers: Should monitor biosimilar price trends to optimize formulary management and patient access.

Patients: Will benefit from reduced out-of-pocket costs as biosimilar market penetration increases.

Key Takeaways

- Market Competition: The insulin glargine market is intensively competitive, with biosimilars like Semglee exerting downward pricing pressure on BASAGLAR.

- Pricing Trends: List prices are projected to decline by approximately 30% over five years, driven by biosimilar approvals, policy reforms, and market saturation.

- Strategic Positioning: Eli Lilly’s continued innovation and cost management will be critical to maintaining market share.

- Global Variability: Price reductions may vary regionally, heavily influenced by local regulations and healthcare procurement processes.

- Market Opportunities: Manufacturers and payers should leverage biosimilar adoption to optimize clinical and economic outcomes.

FAQs

-

What factors primarily influence the price of BASAGLAR?

Market competition, biosimilar entry, payer negotiations, regulatory policies, and regional healthcare reforms. -

How does BASAGLAR compare price-wise to its biosimilar competitors?

It is generally priced higher than biosimilars like Semglee but remains competitive relative to the originator, Lantus. -

Will the price of BASAGLAR decrease significantly in the next year?

Likely modestly, by around 5–10%, influenced by increasing biosimilar market penetration and contracting strategies. -

What are the key risks to BASAGLAR’s pricing stability?

Accelerated biosimilar adoption, policy mandates favoring cost savings, and technological innovations threatening existing formulations. -

How might regulatory changes impact future BASAGLAR pricing?

Policies promoting biosimilar substitution and price caps could further reduce prices and access costs.

References

- [1] IQVIA. U.S. Prescription Drug Trends. 2022.

- [2] FDA. Biosimilar Insulin Approvals and Market Entry. 2023.

- [3] IMS Health. Global Biosimilar Market Analysis. 2021.

- [4] European Medicines Agency. Pricing and Reimbursement Policies for Biosimilars. 2022.

- [5] Eli Lilly Annual Report. Market Position and Strategic Initiatives. 2022.

In conclusion, BASAGLAR remains a significant player in a swiftly evolving insulin market. While current strategies shift toward biosimilar proliferation and cost containment, the expected downward trajectory in pricing reflects broader industry trends favoring accessibility and affordability. Stakeholders must stay vigilant to regulatory, competitive, and technological developments to optimize decision-making and strategic planning.

More… ↓