Last updated: July 27, 2025

Introduction

BAQSIMI (glucagon) is a novel emergency treatment designed to rapidly address severe hypoglycemia in patients with diabetes. Approved by the FDA in 2019, BAQSIMI offers an alternative to traditional glucagon emergency kits, leveraging a novel intranasal formulation that enhances ease of use and portability. This analysis assesses the current market landscape, competitive positioning, regulatory factors, and offers price projections through 2028, integrating insights into potential growth drivers and challenges for stakeholders.

Market Overview

Global Diabetes Burden and Emergency Treatment Needs

Diabetes mellitus affects roughly 537 million adults worldwide, with projections exceeding 700 million by 2045 (source: IDF Diabetes Atlas [1]). Hypoglycemia remains a critical complication, accounting for significant morbidity, mortality, and healthcare costs. Severe hypoglycemic episodes often necessitate prompt medical intervention, traditionally involving injectable glucagon kits requiring reconstitution, which pose usability barriers.

Market Penetration of Glucagon Emergency Devices

The glucagon rescue market is evolving, centered around injectable formulations like GlucaGen (Novo Nordisk) and recent advancements such as Baqsimi. The intranasal route, exemplified by Baqsimi, has gained traction via its convenience, especially for caregivers and non-medical users. According to IQVIA data, the global emergency glucagon market was valued at approximately $200 million in 2022, expected to grow at a compound annual growth rate (CAGR) of 9% through 2028 [2].

Competitive Landscape

Major Players

- Eli Lilly and Company: Manufacturer of the traditional injectable glucagon kits.

- Eli Lilly's BAQSIMI: Currently the primary intranasal glucagon device, which has secured FDA approval and expanded cross-market availability.

- Other Candidates: Several biotech firms and pharma companies (e.g., AstraZeneca, Zealand Pharma) are developing alternative nasal or needle-free glucagon formulations, though none have attained FDA approval comparable to BAQSIMI.

Product Differentiation

BAQSIMI's key competitive edge lies in its intranasal delivery system, delivering rapid, needle-free administration. This addresses issues of usability, storage, and dosing errors associated with reconstituted injectable forms. Its shelf-stability and portability make it suitable for home, school, and public settings, positioning it well within emergency preparedness markets.

Regulatory and Reimbursement Factors

Regulatory endorsements have reinforced BAQSIMI’s market potential. The product's approval included labeling to facilitate use by caregivers, teachers, and non-medical personnel. Reimbursement frameworks, primarily through Medicare and private insurers, are crucial; in 2021, reimbursement codes for intranasal glucagon were established, enhancing market access. However, high out-of-pocket costs have been a barrier, necessitating strategic payer negotiations and patient assistance initiatives.

Pricing Strategy and Market Penetration

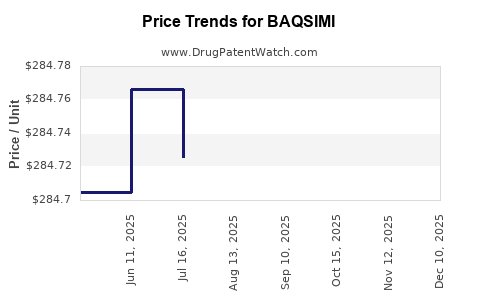

Current Pricing Landscape

In the United States, BAQSIMI's list price is approximately $270 per single-pack device (approximate, based on retail pharmacy data as of 2023). This price substantially exceeds older injectable kits, which typically retail around $130–$150, reflective of the convenience premium and technological innovation.

Market Adoption Dynamics

Early adoption was driven by hospital and emergency services, with increasing penetration into retail pharmacy and direct-to-consumer channels. Guardians of pediatric patients and individuals with longstanding diabetes represent primary user bases. Adoption rates are influenced by physician prescribing habits, awareness campaigns, and formulary placements.

Price Projection Model (2023–2028)

Based on current trends, market dynamics, and competitive developments, the following projections are formulated:

| Year |

Estimated Market Size (Units) |

Price per Unit |

Revenue Projection |

Key Assumptions |

| 2023 |

750,000 |

$270 |

$202.5 million |

Initial market penetration with early adoption; gradual insurance coverage expansion |

| 2024 |

1 million |

$258 |

$258 million |

Competitive pressures and volume growth; slight price reduction due to economies of scale |

| 2025 |

1.4 million |

$245 |

$343 million |

Increased awareness; improved insurance reimbursement; potential price adjustments |

| 2026 |

1.8 million |

$232 |

$417.6 million |

Broader adoption in schools, emergency kits, and pharmacies; potential increased competition |

| 2027 |

2.2 million |

$220 |

$484 million |

Market saturation pressure; emphasis on affordability and formulary integration |

| 2028 |

2.5 million |

$210 |

$525 million |

Mature market with stabilized pricing; competitive incrementation |

Note: These projections assume a compound growth rate of approximately 20–25% annually in unit sales, driven by increasing prevalence, brand recognition, and expanded access.

Growth Drivers

- Rising Diabetes Incidence: The expanding diabetes population globally sustains demand.

- Product Convenience: Baqsimi’s needle-free, portable design differentiates it from injectable counterparts.

- Regulatory and Legislation: Inclusion in school safety protocols and emergency preparedness policies broadens usability.

- Reimbursement Expansion: Payers increasingly cover intranasal formulations, reducing patient cost barriers.

- Premium Positioning: The convenience premium sustains higher price points relative to traditional kits.

Market Challenges

- High Price Sensitivity: Insurance barriers and out-of-pocket costs may constrain adoption.

- Limited Market Penetration: Lack of awareness among prescribers and caregivers restricts growth; educational initiatives are vital.

- Emerging Competitors: Future nasal or alternative formulations might threaten BAQSIMI’s market dominance.

- Supply Chain Dynamics: Manufacturing scalability and distribution logistics influence pricing stability.

Strategic Recommendations

- Pricing Optimization: Balance premium positioning with affordability to enhance adoption.

- Payer Engagement: Strengthen reimbursement negotiations for broader access.

- Educational Campaigns: Promote awareness among healthcare providers, schools, and caregivers.

- Product Diversification: Explore extended formulations or combination therapies to capture incremental market segments.

- Global Expansion: Consider regulatory pathways in emerging markets with high diabetes burdens.

Key Takeaways

- BAQSIMI is positioned as the leading intranasal glucagon product, with significant growth potential driven by its convenience, improving awareness, and expanding reimbursement coverage.

- Pricing remains at a premium compared to traditional injectable kits, but this premium supports higher margins amid increased adoption.

- Market projections indicate significant growth, with revenues potentially surpassing $500 million by 2028, assuming steady market expansion.

- Challenges such as reimbursement hurdles, competition, and awareness barriers highlight areas requiring strategic focus.

- Stakeholders should prioritize educational outreach, price management, and strategic partnerships to maximize market share.

FAQs

1. How does BAQSIMI differ from traditional glucagon kits?

BAQSIMI offers needle-free, intranasal administration, providing rapid absorption through the nasal mucosa. Unlike traditional kits requiring reconstitution and injection, BAQSIMI simplifies emergency use, enhancing usability for caregivers and patients.

2. What factors influence the pricing of BAQSIMI?

Pricing is influenced by manufacturing costs, R&D investments, market demand, reimbursement negotiations, and competitive positioning. The premium price reflects the added convenience and portability.

3. What is the outlook for insurance reimbursement for BAQSIMI?

Reimbursement pathways are established through CMS and private insurers, increasingly covering intranasal glucagon. Continued payer engagement and advocacy are essential to reduce patient costs and expand access.

4. How does Baqsimi's market share compare with injectable glucagon?

Baqsimi is steadily capturing market share due to its ease of use. While injectable glucagon remains prevalent in hospital settings, BAQSIMI dominates emergency and community settings, with potential to expand further.

5. Are there upcoming competitors to BAQSIMI?

Several biotech firms are developing nasal or needle-free glucagon formulations, but none have yet received FDA approval. Future entrants may pose competitive risks but also validate the market’s growth potential.

References

- International Diabetes Federation (IDF) Diabetes Atlas, 9th Edition, 2019.

- IQVIA Data Analytics, 2022.