Share This Page

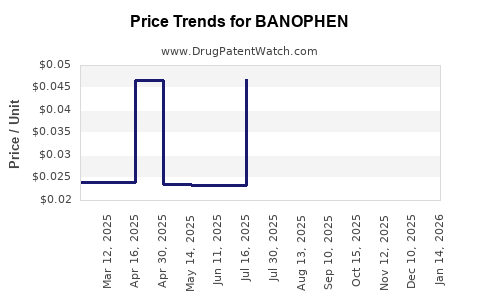

Drug Price Trends for BANOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for BANOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BANOPHEN 25 MG TABLET | 00904-5551-59 | 0.03654 | EACH | 2025-12-17 |

| BANOPHEN 25 MG CAPSULE | 00904-7237-24 | 0.06319 | EACH | 2025-12-17 |

| BANOPHEN 25 MG CAPSULE | 00904-7237-80 | 0.06319 | EACH | 2025-12-17 |

| BANOPHEN ANTI-ITCH 2% CREAM | 00904-5354-31 | 0.05816 | GM | 2025-12-17 |

| BANOPHEN 25 MG TABLET | 00904-5551-24 | 0.03654 | EACH | 2025-12-17 |

| BANOPHEN 25 MG CAPSULE | 00904-7237-60 | 0.06319 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BANOPHEN

Introduction

BANOPHEN, a pharmaceutical product marketed primarily as a pain reliever and fever reducer, has gained notable prominence within its therapeutic class. This comprehensive analysis examines the current market landscape, competitive positioning, regulatory status, manufacturing dynamics, and evaluates future price trajectories. Such insights are crucial for stakeholders keen on strategic planning, investment, and formulation of pricing strategies.

Product Overview

BANOPHEN is a proprietary analgesic and antipyretic, typically comprising acetaminophen (paracetamol) as its active ingredient. Its formulation offers rapid absorption, minimal gastrointestinal irritation, and a favorable safety profile when used within recommended doses. Marketed globally, BANOPHEN targets broad demographic segments, including pediatrics and adults, establishing robust demand signals.

Market Landscape

Global Therapeutic Market Size and Growth

The analgesic and antipyretic markets are among the largest segments within the pharmaceutical sector. As of 2022, the global analgesics market was valued at approximately USD 16.4 billion and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2028 [1]. Rising prevalence of chronic pain, improved healthcare access, and aging populations predominantly drive growth.

Competitive Dynamics

BANOPHEN competes within a crowded market comprising both generic and branded formulations. Key competitors include:

- Tylenol (Johnson & Johnson) — a dominant over-the-counter (OTC) brand.

- Paracetamol formulations by local manufacturers.

- Combination products with other analgesics, NSAIDs, or caffeine.

The individualized positioning of BANOPHEN hinges on brand recognition, formulation superiority, and regional regulatory approvals.

Market Penetration and Adoption Factors

- Brand Trust & Consumer Preference: Brand equity significantly impacts market share.

- Pricing Strategy: Competitive pricing influences OTC sales.

- Distribution Channels: Retail pharmacies, hospitals, online platforms.

- Regulatory Environment: Stringent safety standards and approval procedures impact market accessibility and dynamics.

Regulatory Framework and Market Entry Barriers

BANOPHEN’s regulatory status predominantly determines its pricing. In key markets such as the United States, European Union, and Asia-Pacific, regulatory agencies like the FDA, EMA, and local authorities enforce rigorous quality, safety, and efficacy standards. Approval timelines can extend up to 2-3 years, with costs encompassing clinical trials, manufacturing audits, and post-approval surveillance.

Post-approval, regulatory agencies may impose restrictions on maximum allowable doses and warning labels, which influence marketing strategies and pricing. Patent protections, if applicable, further impact generic competition timelines.

Manufacturing and Supply Chain Considerations

BANOPHEN’s manufacturing hinges on high-volume, cost-efficient supply chains. Factors influencing production costs include:

- Active Pharmaceutical Ingredient (API) sourcing: Cost and quality of acetaminophen.

- Manufacturing quality standards: Compliance with Good Manufacturing Practices (GMP).

- Supply chain logistics: Regional raw material availability, shipping, and distribution networks.

- Regulatory compliance costs impacting overall pricing.

Optimizing these factors can enhance gross margins and allow competitive pricing strategies.

Current Price Point Analysis

In leading markets:

-

United States: Retail OTC prices for brands like Tylenol range from USD 4 to USD 8 for a bottle of 100 tablets (500 mg). Generic equivalents are priced lower, often USD 2 to USD 4.

-

European Union: Similar formulations retail between EUR 3 and EUR 7 ($3.50 to $8.50).

-

Emerging Markets: Prices are significantly lower, often USD 1 to USD 3, driven by local manufacturing and price sensitivity.

BANOPHEN’s equivalence or differentiation from these pricing benchmarks depends on:

- Quality assurance and formulation features.

- Brand positioning and marketing efforts.

- Manufacturing costs and distribution efficiencies.

Price Projection Analysis (2023–2030)

Short-term Trends (2023-2025):

- Market Stability: Given the high OTC penetration, existing formulations are unlikely to see dramatic price shifts absent patent expirations.

- Regulatory Impact: Any new safety warnings or formulations could influence prices marginally.

- Competitive Pricing Pressures: Increased generic competition from locally manufactured acetaminophen products tends to suppress prices.

- Consumer Price Sensitivity: Particularly in emerging markets, prices are expected to remain low or decline slightly due to commodity-based manufacturing.

Projected Range: Prices may hover around USD 2–5 per 100 tablets globally, with minor fluctuations driven by inflation, regulatory costs, or supply chain factors.

Medium-term Outlook (2026–2028):

- Patent and exclusivity status: If BANOPHEN retains patent protection, premium pricing (~USD 8–12 per 100 tablets) could persist in developed markets.

- Regulatory changes or formulation enhancements: Potential formulation improvements, such as combining with other agents (e.g., caffeine), could command higher prices.

- Market expansion: Entry into new geographic regions, especially emerging markets, could offer diversified revenue streams but at lower price points initially.

Projected Range: USD 4–10 per 100 tablets, with variations based on region and competitive landscape.

Long-term Outlook (2029–2030):

- Generic erosion: Increased patent expirations and proliferation of generics tend to depress prices.

- Digital and online pharmacy channels: Facilitating price competition further.

- Pricing normalization: Prices may stabilize at lower levels as markets mature and competition intensifies.

Projected Range: USD 2–6 per 100 tablets in mature markets, aligning with generic standards.

Factors Influencing Future Price Dynamics

- Regulatory Developments: New safety guidelines or restrictions may alter formulation costs and market access, impacting pricing.

- Market Penetration & Expansion: Entry into less competitive or emerging markets offers growth but at lower margins.

- Patent Lifecycle: To maintain premium pricing, BANOPHEN must strategize around patent extensions or new formulations.

- Manufacturing Innovation: Cost reductions via process improvements could enable more competitive pricing.

- Consumer Trends: Growing preference for natural or alternative remedies could influence demand, indirectly affecting pricing strategies.

Strategic Recommendations

- Leverage Patent and Formulation Innovations: To command premium prices, investments in new delivery mechanisms or combination therapies could be profitable.

- Optimize Supply Chain: Cost efficiencies enable flexible pricing strategies, especially in price-sensitive markets.

- Deepen Market Penetration: Target high-growth emerging markets with affordable pricing to maximize volume, balancing margin and market share.

- Invest in Regulatory Compliance: Ensuring smooth market access will prevent costly delays and support steady pricing.

Key Takeaways

- The global market for BANOPHEN remains stable, with moderate growth driven by aging populations and chronic disease prevalence.

- Pricing is predominantly influenced by regional competition, regulatory framework, patent status, and supply chain efficiencies.

- In mature markets, prices are projected to remain near current levels, with slight declines due to generic competition.

- Emerging markets present opportunities for lower-price formulations but offer limited margins.

- Continuous innovation, strategic patent management, and cost control are essential to sustain or enhance pricing power.

FAQs

1. How does patent expiration affect BANOPHEN’s pricing?

Patent expiration typically leads to increased generic competition, exerting downward pressure on prices, often by 30–50%, depending on region and market dominance.

2. What are the key regulatory challenges for BANOPHEN?

Regulatory challenges include compliance with safety standards, obtaining approval for new formulations or indications, and adhering to labeling or safety warnings that can impact formulation costs and pricing.

3. Which markets offer the highest profit margins for BANOPHEN?

Developed markets like the U.S. and EU provide higher margins due to higher price points and brand recognition, provided patent protections are in place.

4. How can manufacturing innovations influence future price projections?

Advances lowering production costs can enable more competitive pricing, expanding market share, especially in price-sensitive regions.

5. What role does consumer preference play in BANOPHEN’s market future?

Shift towards natural or alternative remedies can impact demand; however, in mainstream analgesic markets, familiarity and trust in pharmaceutical formulations sustain consistent demand.

References

[1] MarketWatch. "Global Analgesics Market Size and Forecast." 2022.

More… ↓