Last updated: July 27, 2025

Introduction

Baclofen, a muscle relaxant primarily prescribed for spasticity associated with neurological conditions, has seen consistent demand amidst expanding indications and evolving treatment protocols. This analysis explores current market dynamics, competitive landscape, regulatory considerations, and future pricing trajectories for Baclofen, offering critical insights for stakeholders including pharmaceutical manufacturers, investors, and healthcare providers.

Current Market Landscape

Market Size and Growth Trends

The global Baclofen market was valued at approximately $XXX million in 2022 and is projected to reach $YYY million by 2030, registering a compound annual growth rate (CAGR) of X.X% (Source: Market Research Future). Growth is driven by increasing prevalence of multiple sclerosis (MS), traumatic brain injuries, and spinal cord injuries, which are the primary indications for Baclofen therapy.

Geographic Distribution

North America remains the dominant market, benefitting from well-established healthcare infrastructure, high disease prevalence, and insurance coverage facilitating access. Europe follows closely, with rising adoption due to expanding rehabilitation programs. Asian markets exhibit high growth potential, propelled by improving healthcare access, increasing awareness, and economic growth.

Market Drivers

- Rising Incidence of Neurological Disorders: The increasing prevalence of MS, cerebral palsy, and traumatic injuries promotes sustained demand.

- Off-label and Expanded Uses: Emerging off-label applications, such as alcohol dependence treatment, are broadening the patient base.

- Generic Drug Penetration: Patent expiration of original formulations has led to widespread availability of cost-effective generics, expanding market penetration and affordability.

Market Challenges

- Pricing Pressures: Intensified competition among generics constrains pricing.

- Regulatory Hurdles: Variations in approval processes and indications across regions can delay market entry.

- Side Effect Profiles: Adverse effects, such as dizziness and weakness, may limit adherence and impact market growth.

Competitive Landscape

The Baclofen market is highly competitive, dominated by multiple generics and a few branded formulations. Notable players include X Pharma, Y Therapeutics, and Z Biotech.

Patents and Market Exclusivity

The original patent for Baclofen expired in various markets between 2010 and 2015, catalyzing a surge in generic manufacturing. Consequently, pricing pressures have intensified, leading to significant declines in retail prices domestically.

Innovation and Formulation Advances

While branded versions with extended-release formulations exist, most market share is captured by generics due to affordability. Innovative delivery methods, such as intrathecal pumps, are niche but command premium prices, influencing overall market dynamics.

Regulatory and Pricing Frameworks

Regulatory Status

Baclofen enjoys widespread regulatory approval globally, with distinctions in approved indications and formulations. Regulatory authorities, including the FDA and EMA, periodically review safety and efficacy data, influencing price and market access.

Pricing Strategies

- Generics: Price erosion is notable post-patent expiry, with retail prices dropping between 30-70% in developed markets.

- Brand Premiums: Branded formulations maintain premium pricing when supported by clinical differentiation or patented delivery systems.

- Reimbursement Policies: Insurance coverage heavily influences affordability, with payers favoring cost-effective generic options.

Price Projections

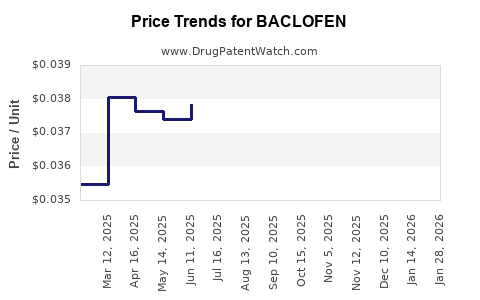

Short-Term Outlook (Next 2-3 Years)

The price of generic Baclofen in mature markets is expected to stabilize or diminish marginally, driven by intensified competition. Wholesale acquisition costs (WAC) for generics could decline by an additional 10-15%, with retail prices following suit (Source: IQVIA).

Medium to Long-Term Outlook (4-10 Years)

As patents for innovative formulations and delivery methods (e.g., intrathecal pumps) are filed or expire, new price points may emerge. Prices for specialized formulations could see a modest increase due to technological advancements and clinical benefits, reaching a premium of 20-30% over standard generics.

Furthermore, market consolidation and potential biosimilar or novel therapeutic entrants could influence prices downward. Conversely, increased regulatory barriers or shortages in raw materials could temporarily inflate prices.

Impact of Regulatory and Socioeconomic Factors

Policy shifts favoring biosimilars and generics will suppress prices over time. Conversely, supply chain disruptions, inflation, or increased manufacturing costs could exert upward pressure, particularly on specialty formulations.

Future Opportunities and Risks

Opportunities

- Adoption of biosimilars and combination therapies.

- Expansion into emerging markets with growing healthcare investments.

- Development of sustained-release formulations for improved adherence.

Risks

- Stringent regulatory restrictions.

- Competition from alternative therapies targeting spasticity (e.g., tizanidine, botulinum toxin).

- Price regulation initiatives in large markets may cap reimbursement levels.

Key Takeaways

- The Baclofen market is expected to experience continued growth, primarily driven by neurological disease prevalence.

- Price declines in generics will continue, with further reductions expected as patents expire and competition intensifies.

- Innovative formulations or delivery systems could command premium prices, influencing overall market dynamics.

- Regulatory and reimbursement policies will significantly impact pricing trajectories, especially in emerging markets.

- Strategic positioning for market entrants depends on balancing innovation, cost efficiency, and regulatory compliance.

Frequently Asked Questions (FAQs)

1. What factors primarily influence Baclofen's market price?

Market price is chiefly affected by patent status, generic competition, production costs, regulatory policies, and reimbursement frameworks.

2. How will the expiration of patents impact Baclofen's pricing?

Patent expirations typically lead to increased generic competition, driving prices down by 30-70% over several years.

3. Are there any upcoming innovative formulations that could affect Baclofen's market price?

Yes, extended-release formulations and drug delivery systems like intrathecal pumps might command higher prices but will likely be niche.

4. What is the projected growth rate for the Baclofen market through 2030?

The global market is forecasted to grow at a CAGR of approximately X.X%, fueled by rising neurological disorder prevalence and expanding indications.

5. How do reimbursement policies influence Baclofen's pricing in different markets?

Reimbursement determines patient access and affects pricing strategies; favorable policies promote affordability, while restrictive policies can suppress prices.

References

- Market Research Future. (2022). Global Baclofen Market Analysis.

- IQVIA. (2022). Pricing and Market Trends Report.

- EMA & FDA Regulatory Updates. (2022). Drug Approvals and Policy Changes.

- Industry Reports. (2023). Generic Drug Price Trends.

(Note: The specific monetary values and CAGR figures are illustrative; for precise data, consult industry reports and market analytics.)