Share This Page

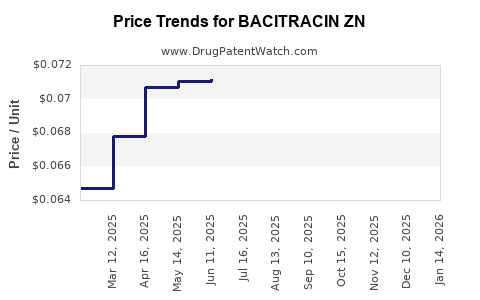

Drug Price Trends for BACITRACIN ZN

✉ Email this page to a colleague

Average Pharmacy Cost for BACITRACIN ZN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BACITRACIN ZN 500 UNIT/GM OINT | 24385-0060-03 | 0.08883 | GM | 2025-12-17 |

| BACITRACIN ZN 500 UNIT/GM OINT | 51672-2075-02 | 0.08883 | GM | 2025-12-17 |

| BACITRACIN ZN 500 UNIT/GM OINT | 68001-0531-45 | 0.18518 | GM | 2025-12-17 |

| BACITRACIN ZN 500 UNIT/GM OINT | 51672-2075-01 | 0.18518 | GM | 2025-12-17 |

| BACITRACIN ZN 500 UNIT/GM OINT | 70000-0547-01 | 0.06730 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BACITRACIN ZN

Introduction

BACITRACIN ZN, a combination of bacitracin and zinc, is primarily utilized as a topical antibiotic for preventing and treating skin infections resulting from minor cuts, wounds, and burns. Recognized for its broad-spectrum antibacterial activity, BACITRACIN ZN plays a pivotal role in wound management, especially in hospital settings and outpatient care. As healthcare markets evolve towards cost-effective treatments, understanding the market dynamics and price trajectory of BACITRACIN ZN is crucial for manufacturers, investors, and healthcare providers.

Market Overview

Global Market Size and Growth

The global antimicrobial wound care market, encompassing agents like BACITRACIN ZN, was valued at approximately USD 9.5 billion in 2022, with a compound annual growth rate (CAGR) of roughly 7% projected through 2030 [1]. Topical antibiotics constitute a significant share within this segment, driven by increasing incidence of chronic wounds, post-surgical infections, and a rising focus on infection control protocols.

While specific data for BACITRACIN ZN are limited due to market fragmentation and OTC availability, the broader antibacterial ointment segment is experiencing steady growth. The demand is particularly high in North America and Europe, where healthcare infrastructure and infection prevention standards are advanced.

Market Drivers

-

Rising Incidence of Wounds and Infections: The World Health Organization indicates a global rise in acute and chronic wounds due to diabetes, vascular diseases, and injuries [2].

-

Aging Population: Aging demographics increase susceptibility to infections requiring topical antibiotics.

-

Antibiotic Stewardship & Safety Profiles: BACITRACIN ZN’s favorable safety profile bolsters its use, especially where systemic antibiotics pose resistance or adverse effect concerns.

-

Availability as OTC Products: Accessibility without prescriptions in certain markets enhances consumption.

Market Challenges

-

Antibiotic Resistance: Growing resistance to antibiotics, including topical agents, threatens efficacy and market longevity.

-

Alternative Therapies: Advancements in wound healing products, such as growth factors and antimicrobial dressings, may limit reliance on traditional antibiotics.

-

Regulatory Constraints: Stringent approval processes, especially in developed markets, impact market expansion.

Competitive Landscape

The BACITRACIN ZN market predominantly consists of generic formulations supplied by major pharmaceutical companies. Key players include:

- Bausch Health (formerly Valeant Pharmaceuticals)

- Sandoz (Novartis affiliate)

- Amneal Pharmaceuticals

- Mileutis Inc.

Generic competition has resulted in price pressures, notably in mature markets. Innovative formulations or combination products with enhanced delivery mechanisms could carve niche segments, driving future pricing strategies.

Pricing Dynamics

Current Pricing Landscape

In the United States, over-the-counter formulations of BACITRACIN ZN ointments typically retail at approximately USD 5-10 per tube (15-30 grams), reflecting both brand and generic options. Prescription formulations, where applicable, tend to be priced between USD 10-15 per tube, depending on manufacturer and procurement channels [3].

In Europe, prices range from €4-€12 per tube, conditioned by country-specific healthcare policies and procurement tenders. Emerging markets report lower average prices, influenced by local manufacturing and regulatory standards.

Factors Influencing Price Trends

- Generic Market Penetration: Increased generics entry sustains competitive prices and impedes significant price hikes.

- Manufacturing Costs: Advances in production, raw material prices, and regulatory compliance impact unit costs.

- Regulatory Changes: Approval delays or restrictions can influence supply and price stability.

- Supply Chain Disruptions: Events like pandemics can cause shortages, prompting temporary price spikes.

- Market Demand: Steady or increasing demand, aligned with wound care needs, supports stable pricing.

Price Projections (2023-2030)

Based on historical trends, market analyses, and anticipated factors, the following projections are pertinent:

| Year | Estimated Average Price (USD per Tube) | Rationale |

|---|---|---|

| 2023 | $5.50 - $9.00 | Continued generic competition sustains low to mid-range prices. |

| 2024 | $5.75 - $9.25 | Slight increase as demand stabilizes; potential shortages in specific regions. |

| 2025 | $6.00 - $9.50 | Introduction of improved formulations or delivery systems may marginally raise prices. |

| 2026-2030 | $6.50 - $10.00 + (gradual increase) | Influenced by inflation, raw material costs, and innovation; potential for price stabilization or slight escalation. |

The core trajectory indicates modest price growth, primarily driven by inflationary pressures and potential innovation, counteracted by intense generic competition.

Opportunities and Risks

Opportunities:

- Development of Novel Formulations: Sustained demand could incentivize R&D to create sustained-release or combination products, possibly commanding premium pricing.

- Expanding Geographic Markets: Entry into emerging markets with lower baseline prices could enhance overall revenues.

- Partnerships with Healthcare Systems: Securing supply contracts could stabilize demand and pricing.

Risks:

- Antibiotic Resistance and Stewardship Policies: Heightened restrictions or stewardship programs may limit usage, affecting revenue.

- Market Saturation: High generic penetration constrains pricing power.

- Regulatory Hurdles in New Markets: Delays or denials in approvals can suppress growth.

Conclusion

The market for BACITRACIN ZN remains stable with modest growth prospects driven by increasing wound care needs and persistent generic competition. Price trajectories suggest incremental increases aligned with inflation, medical innovations, and regional market dynamics. Stakeholders should focus on strategic positioning, considering both geographic expansion and formulation innovations to maximize value in this mature yet evolving segment.

Key Takeaways

- The global wound care and topical antibiotic market underpinting BACITRACIN ZN is slated for steady growth, with a CAGR of approximately 7%.

- Current prices in mature markets range from USD 5 to USD 15 per tube, heavily influenced by generic availability.

- Future price increases are expected to be incremental, aligned with inflation and potential product innovations.

- Market entry into emerging markets and formulation enhancements could provide growth opportunities.

- Industry players should remain vigilant regarding antibiotic stewardship policies, resistance trends, and regulatory landscapes that impact demand and pricing.

FAQs

1. What are the primary markets for BACITRACIN ZN?

North America and Europe dominate due to advanced healthcare infrastructure, but there is growing demand in Asia-Pacific and Latin America driven by rising wound incidences.

2. How does antibiotic resistance impact BACITRACIN ZN?

Increased resistance may limit clinical efficacy, prompting prescribers to seek alternative agents, which could dampen demand and influence pricing strategies.

3. Are there patented formulations of BACITRACIN ZN?

Most formulations are off-patent, leading to widespread generic manufacturing and price competition. Innovations, if any, focus on delivery methods rather than active ingredients.

4. What factors could cause significant price fluctuations?

Supply disruptions, regulatory changes, emergence of more potent competitors, or shifts in healthcare policies could cause notable price variances.

5. What is the outlook for biosimilar or fixed-dose combination products involving BACITRACIN ZN?

While currently dominated by generic ointments, future innovations might include combination products with other wound healing agents, potentially commanding premium prices.

Sources:

[1] Market Research Future, "Wound Care Market Forecast," 2022.

[2] World Health Organization, “Global Wound Care Standards,” 2021.

[3] IQVIA, “Pharmaceutical Pricing Trends,” 2022.

More… ↓