Share This Page

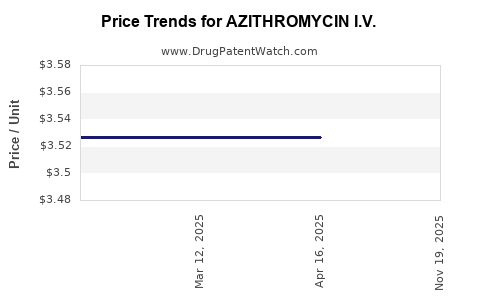

Drug Price Trends for AZITHROMYCIN I.V.

✉ Email this page to a colleague

Average Pharmacy Cost for AZITHROMYCIN I.V.

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AZITHROMYCIN I.V. 500 MG VIAL | 70095-0025-02 | 3.52700 | EACH | 2025-05-28 |

| AZITHROMYCIN I.V. 500 MG VIAL | 63323-0398-14 | 3.52700 | EACH | 2025-04-23 |

| AZITHROMYCIN I.V. 500 MG VIAL | 70860-0100-10 | 3.52700 | EACH | 2025-04-23 |

| AZITHROMYCIN I.V. 500 MG VIAL | 55150-0174-10 | 3.52700 | EACH | 2025-04-23 |

| AZITHROMYCIN I.V. 500 MG VIAL | 62756-0512-44 | 3.52700 | EACH | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AZITHROMYCIN I.V.

Introduction

Azithromycin IV (intravenous) is a critical antibiotic used primarily for severe respiratory infections, particularly when oral administration is not feasible. As a broad-spectrum macrolide, azithromycin IV presents significant clinical value, especially amid rising antibiotic resistance and the need for potent hospital therapies. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory environment, and provides price projections over the next five years.

Market Overview

The global azithromycin market, valued at approximately USD 720 million in 2022, features both oral and parenteral formulations. Aventis (now part of Sanofi) pioneered azithromycin's development, and the drug's versatile administration routes cater to diverse healthcare settings. The IV formulation accounts for roughly 15-20% of the total azithromycin market, reflecting its specialized use in inpatient care.

The increase in respiratory infections—including hospital-acquired pneumonia (HAP), community-acquired pneumonia (CAP), and complicated bronchitis—drives demand for IV antibiotics like azithromycin. The rising prevalence of multi-drug resistant pathogens underscores the need for potent antibiotics, positioning azithromycin IV as a key therapeutic agent.

Key Market Drivers

-

Clinical Efficacy and Safety: Azithromycin's proven efficacy against a broad pathogen spectrum and favorable dosing profile bolster its utilization. Its once-daily dosing enhances compliance in inpatient and outpatient settings.

-

Rising Incidence of Respiratory Infections: Data from the CDC indicates that pneumonia and bronchitis are among top causes of morbidity worldwide, escalating the demand for effective IV antibiotics.

-

Hospital Infections and Antibiotic Resistance: The growing prevalence of resistant strains necessitates potent antibiotics with proven activity, promoting the ongoing use of azithromycin IV in severe cases.

-

Expansion in Emerging Markets: Increasing healthcare infrastructure and awareness in Asia-Pacific and Latin America expand the IV antibiotic market segment.

-

Regulatory Approvals and New Indications: Ongoing clinical trials for azithromycin in novel indications, including COVID-19 related therapies, could widen its administrative scope.

Competitive Landscape

Major pharmaceutical players, including Pfizer, Sanofi, and Mylan, manufacture azithromycin IV formulations. Generic manufacturers have gained significant market share post-patent expiry in various regions, intensifying price competition. For instance:

- Brand-name products: Zithromax IV (Sanofi)

- Generics: Numerous suppliers in India, China, and other emerging markets offering cost-effective alternatives.

The commodification of azithromycin IV leads to downward pressure on pricing, especially in markets with high generic penetration.

Regulatory Environment

The U.S. FDA approved azithromycin for IV use in the early 2000s, with subsequent approvals in Europe and Asia. Regulatory frameworks influence pricing strategies through reimbursement policies and market access restrictions. Additionally, off-label use, especially in emerging indications, impacts demand and pricing dynamics.

Market Challenges and Opportunities

- Challenges: Increasing generic competition reduces margins; supply chain disruptions can hinder availability; concerns over antimicrobial stewardship may impose prescribing restrictions.

- Opportunities: Adoption in new clinical protocols, particularly during pandemics; development of combination therapies; expansion into targeted pediatrics and immunocompromised populations.

Price Trends and Projections (2023-2028)

Current pricing for azithromycin IV varies based on region, formulation, and manufacturer scale:

- United States: Institutional pricing ranges from USD 15–30 per vial (100 mg/4 mL or 500 mg/250 mL infusion).

- Europe: Slightly lower, averaging EUR 10–25 per vial.

- Emerging Markets: Significantly lower, often USD 5–15 per vial, owing to local manufacturing and competitive generic markets.

Short-term (2023-2024)

Initial stability in pricing persists due to supply chain adjustments post-pandemic. Vaccine and antibiotic stewardship programs exert slight downward pressure, especially in developed countries. The increased need during COVID-19 for antibiotic stewardship and pandemic preparedness temporarily bolstered demand; however, that is expected to normalize.

Mid-term (2025-2026)

Given the intensification of generic competition, overall IV azithromycin prices are projected to decline by approximately 10-15% annually in developed markets. The expansion into newly approved indications or combination therapies could temporarily stabilize prices for specific clinical use cases.

Long-term (2027-2028)

As patents are fully or partially expired in many regions by 2027, price erosion accelerates. In highly penetrated markets, prices could fall by an additional 20-30%. Conversely, shortages due to manufacturing disruptions or supply chain issues could temporarily stabilize or increase prices.

Influencing Factors on Price Projections

- Patent Status: Patent expiries in key markets promote generics, exerting downward pressure.

- Supply Chain Stability: Disruptions (e.g., geopolitical or COVID-19 related) may influence availability and pricing.

- Regulatory Changes: Stricter prescribing guidelines aimed at antimicrobial stewardship could reduce volume, impacting price and margins.

- Market Penetration of New Formulations: Liposomal or novel delivery variants could command premium pricing.

Conclusion

The azithromycin IV market is poised for gradual price reductions aligned with generic proliferation, especially in mature markets. However, demand for potent IV antibiotics persists due to clinical needs, driving cautious pricing strategies. Stakeholders should monitor regulatory shifts, supply chain dynamics, and emerging clinical indications to optimize procurement and market positioning.

Key Takeaways

- The global azithromycin IV market segment is growing moderately, driven by inpatient respiratory infections and resistance challenges.

- Increasing generic penetration in developed regions is expected to depress prices by approximately 20-30% over five years.

- Supply chain stability and regulatory policies will substantially influence pricing trends.

- Expansion into new therapeutic areas and formulations could temporarily stabilize or increase prices.

- Procurement strategies should account for regional differences, patent status, and supply reliability.

FAQs

1. How does patent expiry influence azithromycin IV prices?

Patent expiry allows generic manufacturers to enter the market, significantly increasing supply and driving down prices due to enhanced competition.

2. What are the key factors impacting the price of azithromycin IV in emerging markets?

Local manufacturing capacity, regulatory policies, demand volume, and affordability influence prices. Generally, emerging markets offer lower prices due to cheaper generics and lower healthcare costs.

3. Are there notable clinical developments affecting azithromycin IV’s market?

Yes. Ongoing trials exploring azithromycin’s role in COVID-19 and other antiviral therapies could expand its use cases, potentially stabilizing prices temporarily.

4. How does supply chain disruption affect azithromycin IV pricing?

Disruptions can reduce availability, create shortages, and temporarily increase prices despite downward pressure from competition.

5. What strategies should healthcare providers consider for azithromycin IV procurement?

They should assess supply reliability, consider generic options for cost savings, and stay updated on formulary policies that influence prescribing restrictions.

References

- Market Research Future, "Global Azithromycin Market Outlook," 2022.

- U.S. Food and Drug Administration, "Approval Documents for Azithromycin IV," 2000.

- CDC, "Respiratory Infection Statistics," 2022.

- IQVIA, "Healthcare Market Data," 2022.

- European Medicines Agency (EMA), "Azithromycin Approvals," 2021.

More… ↓