Last updated: July 27, 2025

Introduction

Azelastine Hydrochloride (HCL) is a potent topical antihistamine primarily used for allergy relief, including allergic rhinitis and conjunctivitis. Since its introduction, Azelastine HCL has garnered a significant market share owing to its efficacy and favorable safety profile. This analysis examines the current market landscape, key drivers influencing growth, competitive dynamics, regulatory considerations, and provides price projections over the next five years.

Market Overview

Global Market Size and Growth Trajectory

The global antihistamine market was valued at approximately $4.8 billion in 2022, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% through 2028 [1]. Azelastine HCL contributes a substantial proportion, estimated at $800-900 million in 2022, driven predominantly by its nasal spray formulation.

The increasing prevalence of allergic rhinitis, affecting up to 30% of adults worldwide [2], fuels steady demand. The expanding aging population and rising environmental allergens exacerbate allergy-related conditions, expanding the market.

Key Regions and Distribution

- North America: Largest market, driven by high awareness, diagnosis rates, and availability of advanced formulations.

- Europe: Similar dynamics as North America, with steady growth.

- Asia-Pacific: Fastest-growing segment, owing to rising urbanization, pollution exposure, and expanding healthcare infrastructure.

Market Drivers

-

Growing Prevalence of Allergic Conditions

Rising global allergy incidence directly correlates with increased Azelastine HCL prescriptions.

-

Product Approvals and New Formulations

Recent approvals for innovative delivery mechanisms, such as combination therapies and improved nasal sprays, enhance patient compliance and expand market penetration.

-

Patient Preference for Topical Antihistamines

Favorable safety profile, minimal systemic absorption, and ease of use favor Azelastine HCL over systemic antihistamines.

-

Healthcare Infrastructure and Awareness

Improved access and diagnostic capabilities in emerging markets bolster drug utilization.

Competitive Landscape

Major pharmaceutical players include:

- Boehringer Ingelheim: Original manufacturer with multiple formulations.

- Mayne Pharma and Teva Pharmaceuticals: Marketed generics, offering competitive pricing.

- Others: Emerging generic manufacturers, especially in Asia.

Patent protections for specific formulations have historically limited generic entry, but upcoming patent expirations forecast increased generic competition.

Regulatory Environment

Regulatory bodies like the FDA and EMA have approved Azelastine HCL nasal sprays, with ongoing applications for combination therapies and new indications. Regulatory pathways favor rapid approval of generics post-patent expiry, which will influence market prices.

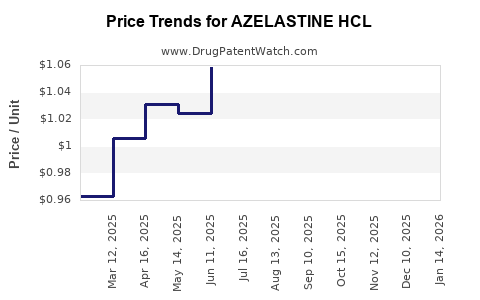

Pricing Dynamics and Future Trends

**Current Pricing

The retail price of branded Azelastine HCL nasal spray typically ranges from $25 to $45 per 10 mL spray (approximately 120 doses), depending on region and manufacturer. Generic versions are priced significantly lower, around $10 to $20 per bottle** [3].

Factors Affecting Future Pricing

- Patent Expirations: Expected in the next 2-3 years for certain formulations, leading to price reductions.

- Market Penetration of Generics: Increased generic competition will pressure prices downward.

- Reimbursement Policies: Insurance coverage and pharmacy benefit management influence consumer costs.

- Novel Formulations: Innovations such as alternative delivery devices or combination therapies may command premium pricing.

Price Projections (2023-2028)

Based on market trends, patent expiration forecasts, and competitive pressures:

| Year |

Branded Azelastine HCL Price Range |

Generic Azelastine HCL Price Range |

Key Factors Influencing Price |

| 2023 |

$25 - $45 |

$10 - $20 |

Patent protections maintaining higher prices; growing generics penetration. |

| 2024 |

$23 - $40 |

$8 - $16 |

Patent expiries nearing; increase in generic supply. |

| 2025 |

$20 - $35 |

$6 - $14 |

Major patent losses; intensified generic competition. |

| 2026 |

$18 - $30 |

$5 - $12 |

Market saturation; price stabilization. |

| 2027 |

$16 - $28 |

$4 - $10 |

Widespread generic adoption; volume-driven price reductions. |

| 2028 |

$15 - $25 |

$3 - $8 |

Market maturity; potential for biosimilar-like entries. |

Note: These projections assume no significant disruptions (e.g., new formulations, regulatory changes) and are subject to regional variations.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies:

Prepare for patent expiries by developing new formulations, delivery systems, or combination therapies to sustain margins.

-

Investors:

Monitor patent expiration timelines and regional regulatory developments that could impact pricing dynamics.

-

Healthcare Providers:

Consider cost-effective generic options as they become available, balancing efficacy and patient compliance.

-

Policy Makers:

Encourage policies that foster competition, improve access, and facilitate generic adoption.

Conclusion

Azelastine HCL remains a vital molecule within the antihistamine market, underpinned by robust demand driven by allergy prevalence and patient preference for topical agents. The imminent patent expiries, coupled with expanding generic manufacturing capacity—particularly in Asia—will exert downward pressure on prices over the coming years. Market players should strategically innovate and optimize supply chains to leverage upcoming opportunities and mitigate pricing pressures.

Key Takeaways

- The global Azelastine HCL market is poised for steady growth, supported by rising allergy cases.

- Patent expirations (expected within 2-3 years) will accelerate generic competition, leading to significant price declines.

- Current branded prices range from $25-$45; generics are typically 50-75% cheaper.

- Price projections indicate a gradual decrease to around $15-$25 for branded and $3-$8 for generic alternatives by 2028.

- Strategic innovation, regional market entry, and regulatory navigation are critical for sustained profitability.

FAQs

1. What factors most influence Azelastine HCL pricing?

Patent status, generic competition, formulation innovations, regulatory approvals, and regional reimbursement policies primarily dictate pricing.

2. How soon will generic Azelastine HCL significantly impact prices?

Major patent expirations are anticipated within the next 2-3 years, with generics expected to dominate the market thereafter.

3. Are there any factors that could disrupt the current price trend?

Yes. Introduction of bioequivalent biosimilars, new delivery formulations, or regulatory changes could alter pricing dynamics.

4. How does regional variation affect Azelastine HCL pricing?

Pricing tends to be higher in North America and Europe due to regulatory costs and market dynamics, while Asian markets typically offer lower prices owing to increased generic manufacturing.

5. What opportunities exist for pharmaceutical companies in this market?

Developing innovative delivery systems, combination therapies, and expanding into emerging markets will be valuable strategies to sustain revenue streams amidst declining prices.

References

[1] Transparency Market Research. "Antihistamines Market Size, Share & Trends Analysis," 2022.

[2] Bousquet et al., "Allergic Rhinitis and its Impact on Asthma," Journal of Allergy and Clinical Immunology, 2020.

[3] GoodRx. "Azelastine Nasal Spray Prices," 2023.