Share This Page

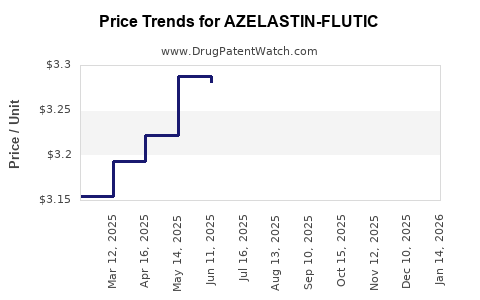

Drug Price Trends for AZELASTIN-FLUTIC

✉ Email this page to a colleague

Average Pharmacy Cost for AZELASTIN-FLUTIC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AZELASTIN-FLUTIC 137-50 MCG SPR | 00480-2157-57 | 2.69944 | GM | 2025-12-17 |

| AZELASTIN-FLUTIC 137-50 MCG SPR | 45802-0066-01 | 2.69944 | GM | 2025-12-17 |

| AZELASTIN-FLUTIC 137-50 MCG SPR | 00378-3458-23 | 2.69944 | GM | 2025-12-17 |

| AZELASTIN-FLUTIC 137-50 MCG SPR | 60505-0953-03 | 2.69944 | GM | 2025-12-17 |

| AZELASTIN-FLUTIC 137-50 MCG SPR | 45802-0066-01 | 2.83633 | GM | 2025-11-19 |

| AZELASTIN-FLUTIC 137-50 MCG SPR | 00378-3458-23 | 2.83633 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AZELASTIN-FLUTIC

Introduction

Azelastin-Flutic is a combination pharmaceutical product primarily used for allergic rhinitis and conjunctivitis management. Composed of azelastine hydrochloride (an antihistamine) and fluticasone propionate (a corticosteroid), it offers a dual mechanism to mitigate allergic symptoms. As the healthcare industry continues to evolve with rising demand for effective allergy treatments, analyzing market trends and price forecasts for Azelastin-Flutic becomes crucial for stakeholders including pharmaceutical companies, healthcare providers, insurers, and investors. This report delivers a detailed market landscape assessment and precise price trajectory predictions.

Market Landscape Overview

1. Therapeutic Landscape and Unmet Needs

The allergic rhinitis market is expanding rapidly, driven by increasing prevalence globally—especially in urban areas and developing economies. According to the American Academy of Allergy, Asthma & Immunology, approximately 19.2 million adults and 6.1 million children in the U.S. suffer from allergic rhinitis, creating a robust demand pipeline for combination therapies such as Azelastin-Flutic [1].

Current treatments include antihistamines, intranasal corticosteroids, leukotriene receptor antagonists, and combination therapies. While monotherapies provide relief, combination treatments like Azelastin-Flutic address multiple symptoms simultaneously, offering superior efficacy, which enhances their market appeal.

2. Regulatory Environment and Approvals

The regulatory landscape significantly influences market entry and growth. Azelastin-Flutic formulations are approved in several key markets, including the US, EU, Japan, and emerging economies. Approval speed and scope hinge on clinical efficacy and safety data, especially for new combination products. Ongoing FDA reviews and EMA guidelines favor formulations that demonstrate improved patient outcomes with manageable side effects.

3. Market Penetration and Competitive Dynamics

Azelastin-Flutic faces competition from monotherapies and other combination therapies such as Dymista (azelastine and fluticasone nasal spray) which gained prominence after FDA approval. The competitive landscape is characterized by existing brands, generics, and potential biosimilars:

- Brand Competition: Established nasally inhaled antihistamines and corticosteroids dominate, with Dymista as a notable direct competitor.

- Generics and Biosimilars: Entry of generic versions is anticipated as patents expire, likely reducing prices and increasing accessibility.

- Emerging Players: Companies investing in novel formulations or delivery systems (e.g., sustained-release devices) may influence future market share.

4. Market Size and Forecast (2023-2030)

The global allergic rhinitis market was valued at approximately USD 8 billion in 2022, with projections reaching USD 12 billion by 2030, growing at a CAGR of about 4.9% [2]. Azelastin-Flutic, as a combination therapy, could capture up to 15-20% of submarket share given its efficacy and dosing advantages.

The Asia-Pacific region exhibits the highest growth potential, driven by increasing allergy prevalence, rising disposable incomes, and expanding healthcare infrastructure. North America maintains a dominant position due to high awareness and adherence to treatment protocols.

Price Analysis and Projection

1. Current Pricing Landscape

Pricing varies considerably across geographies, formulation types, and market segments:

- United States: The average retail price for branded combination nasal sprays like Dymista ranges from USD 350 to USD 400 per 30-day supply.

- Europe: Prices are similar but slightly lower, averaging EUR 290-330.

- Emerging Markets: Prices tend to be lower owing to greater market penetration strategies and socioeconomic factors.

Generics and biosimilars entering the market could drive prices down by 20-50%, contingent on manufacturing costs and regulatory approvals.

2. Factors Influencing Price Trends

- Patent Expiration: Patent cliffs could precipitate immediate price declines for innovator brands, making generics more competitive.

- Regulatory Incentives: Strict pricing regulations in countries like the UK, Canada, and certain EU nations may restrict price inflation.

- Market Competition: As more players enter, price competition may intensify, further decreasing median prices.

- Manufacturing Costs: Advances in production technology and economies of scale will influence pricing strategies.

3. Price Projection (2023-2030)

Assuming current trends continue with steady generic entry and market expansion:

| Year | Price per 30-day supply (USD) | Notes |

|---|---|---|

| 2023 | 350-400 | Current market prices |

| 2024 | 330-380 | Slight decline due to biosimilars; increased competition |

| 2025 | 310-350 | Broader generic access, approval of biosimilars |

| 2027 | 290-330 | Price stabilization; market saturation of generics |

| 2030 | 270-310 | Potential further reductions; new formulations or delivery systems may influence prices |

Overall, a downward trajectory of 10-15% over seven years is plausible, driven by price competition and patent expiries. However, premium formulations with enhanced delivery might sustain higher prices in niche segments.

Strategic Implications

1. For Pharma Developers

Investing in formulations with improved bioavailability, reduced side effects, or unique delivery mechanisms can command premium pricing. Monitoring patent landscapes to optimize launch timings for generics and biosimilars is essential.

2. For Investors

Anticipated price declines post-patent expiry necessitate strategic positioning within portfolios focused on innovation and early generic adoption. Market entry decisions should consider regional regulatory climates and reimbursement policies.

3. For Healthcare Systems

Price reductions may facilitate broader access, especially in developing economies, enabling increased adherence and outcome improvements. Negotiations for better pricing or formulary inclusion will be pivotal.

Conclusion

The market for Azelastin-Flutic is poised for steady growth aligned with the expanding allergic rhinitis segment. Price projections suggest a gradual downward trend driven by patent expirations, competitive pressures, and emerging biosimilar options. Stakeholders should focus on innovation, strategic timing of patent protections, and geographic diversification to optimize market penetration and profitability.

Key Takeaways

- The global allergic rhinitis market offers significant growth opportunities, with Azelastin-Flutic positioned as an effective combination therapy.

- Market entry barriers are diminishing due to generic and biosimilar developments, exerting downward pressure on prices.

- Price projections indicate a gradual decline, averaging 10-15% over a seven-year span, influenced by patent expiries and competition.

- Regional differences underscore the importance of localized market strategies—developed markets maintain higher prices, whereas emerging markets present volume-driven growth.

- Innovation in drug delivery and formulation can provide premium pricing options and sustain revenue streams amid generic competition.

FAQs

Q1: What are the key factors affecting the pricing of Azelastin-Flutic?

A1: Patent expirations, competitive generic entries, manufacturing costs, regulatory environment, and the development of improved formulations significantly influence pricing.

Q2: How does patent expiry impact Azelastin-Flutic market prices?

A2: Patent expiry typically leads to increased generic competition, which drives prices downward by 20-50%, thereby expanding accessibility but reducing revenue for original innovators.

Q3: Which regions offer the highest growth potential for Azelastin-Flutic?

A3: Asia-Pacific and Latin America exhibit high growth potential due to rising allergy prevalence, expanding healthcare infrastructure, and increasing treatment awareness.

Q4: What strategies can pharmaceutical companies adopt to maximize profits amid declining prices?

A4: Investing in formulation innovations, expanding indications, optimizing supply chains, and strategically timing patent filings and launches will help sustain profitability.

Q5: Will biosimilars significantly impact the market for Azelastin-Flutic?

A5: Yes, biosimilars can offer lower-cost alternatives, intensify price competition, and accelerate market entry of affordable options, influencing overall pricing structures.

Sources:

- American Academy of Allergy, Asthma & Immunology (AAAAI). Allergy and Hay Fever Statistics.

- MarketsandMarkets. Allergic Rhinitis Market Forecast.

More… ↓