Last updated: July 31, 2025

Introduction

AZASITE (azithromycin ophthalmic solution 1%) is an ophthalmic antibiotic indicated for bacterial conjunctivitis. As a topical formulation of azithromycin, it leverages the broad-spectrum activity and favorable dosing profile of the systemic drug, positioning itself within the ophthalmic antimicrobial market. The following analysis provides a comprehensive overview of AZASITE’s current market landscape, competitive positioning, regulatory environment, and future price projections.

Market Overview

Pharmacological Profile and Therapeutic Indications

AZASITE’s active ingredient, azithromycin, boasts a well-established systemic use, particularly in respiratory infections and sexually transmitted infections, with a favorable safety profile. Its adaptation to ophthalmic use aims to address bacterial conjunctivitis, a common condition with significant prevalence worldwide. The topical formulation’s once-daily dosing enhances patient compliance, offering a competitive advantage over traditional antibiotics requiring multiple daily doses.

Market Size and Epidemiology

Bacterial conjunctivitis affects approximately 3 to 6 million individuals annually in the United States alone. The global ophthalmic antibiotics market is projected to reach USD 4.1 billion by 2028, driven by increasing awareness, lifestyle factors, and growing antibiotic resistance concerns [1]. AZASITE’s niche within this context is its targeted use for bacterial conjunctivitis, representing an estimated segment of roughly USD 0.5 billion globally.

Competitive Landscape

Key Competitors

- Emergence of Alternative Ophthalmic Antibiotics: Drugs such as azithromycin (Zithromax, marketed as eye drops in some regions), erythromycin, and orbifloxacin compete directly with AZASITE.

- Market Entrants and Generics: The genericization of azithromycin for ophthalmic use is underway globally, increasing price competition.

- Non-prescription Options: Increased availability of over-the-counter antibacterial ointments limits prescription-driven sales.

Differentiators and Unique Selling Points

- Formulation Advantages: Once-daily dosing, minimal systemic absorption, and a favorable side-effect profile.

- Regulatory Status: FDA approval of AZASITE in 2014 established its credibility and regulatory backing, supporting its positioning.

Regulatory and Reimbursement Environment

FDA Approval and Post-Marketing Surveillance

AZASITE received approval from the U.S. Food and Drug Administration in 2014, endowing it with market exclusivity until 2031 [2]. This period allows for premium pricing and market penetration.

Reimbursement Dynamics

Coverage under Medicare and private insurance benefits is generally favorable, contingent upon formulary positioning by payers. The cost-effectiveness of AZASITE, driven by reduced dosing frequency, supports favorable reimbursement terms.

Market Dynamics and Growth Drivers

- Increasing Incidence of Bacterial Conjunctivitis: Rising urbanization and pollution contribute to higher cases, expanding the target population.

- Enhanced Patient Compliance: Once-daily dosing improves adherence, influencing prescriber preference.

- Brand Recognition and Physician Preference: Early market entry and FDA approval have established AZASITE as a reliable treatment.

Challenges include:

- Price Competition from Generics: As patent protections expire or are circumvented, price erosion is imminent.

- Antimicrobial Resistance: Growing resistance may limit efficacy, prompting the development of newer agents.

- Insurance Formularies: Payers may prefer generics or lower-cost options, pressuring AZASITE’s pricing.

Price Projection Analysis

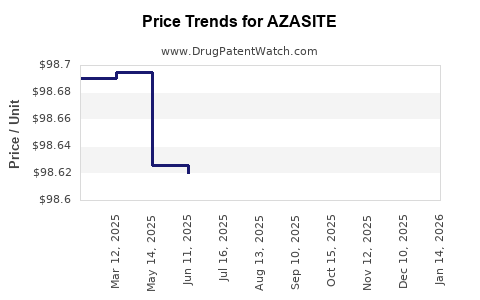

Historical Pricing Trends

Initially launched with a retail price of approximately USD 75–80 per bottle (1 mL), AZASITE’s pricing aligns with branded ophthalmic antibiotics. Over time, generic azithromycin formulations have entered the market, leading to price reductions of up to 40% in certain regions.

Forecasted Pricing Trajectory (Next 5 Years)

-

Short-term (1–2 years): Due to patent protection and brand positioning, prices are projected to stabilize around USD 70–80 per unit, with slight fluctuations based on regional tariffs and formulary negotiations.

-

Mid-term (3–5 years): As patent exclusivity lapses and generics gain market share, prices are expected to decline by approximately 20–30%, potentially reaching USD 50–60 per bottle in North American markets.

-

Long-term (beyond 5 years): Widespread generic availability and market saturation could drive prices down to USD 30–40, comparable to other low-cost ophthalmic antibiotics.

Influencing Factors

- Patent Expiry and Patent Challenges: Key to price erosion, as generic manufacturers introduce biosimilars or equivalent formulations.

- Market Penetration and Volume Growth: Higher sales volumes can offset lower unit prices, maintaining revenue streams.

- Pricing Strategies by the Manufacturer: Potential for tiered pricing, value-based pricing, or bundling with other ophthalmic drugs.

Market Opportunities and Risks

Opportunities

- Expansion into Emerging Markets: Rapidly growing healthcare sectors in Asia-Pacific and Latin America offer higher volume potential.

- Product Differentiation: Novel formulations or combination therapies could command premium pricing.

- Strategic Partnerships: Collaborations with healthcare providers and payers can secure favorable reimbursement and market access.

Risks

- Patent Litigation and Patent Expiry: Can precipitate price wars and reduce margins.

- Evolving Resistance Patterns: May necessitate reformulation or development of new antibiotics, impacting existing pricing.

- Regulatory Changes: Policy shifts, including price controls, could suppress revenue potential.

Key Takeaways

- AZASITE occupies a strategic niche in the ophthalmic antibiotics market, with advantages in dosing and safety profile.

- Market growth is driven by rising bacterial conjunctivitis incidence, improved compliance, and expanding global ophthalmic markets.

- Price projections suggest an initial stability period with gradual decreases as generics enter the market, potentially halving the price over five years.

- Competitive pressures, patent expiration, and resistance patterns are critical to monitoring for future pricing strategies.

- To maximize revenue, the manufacturer should focus on expanding regional access, educating prescribers, and exploring value-based pricing approaches.

FAQs

1. How does AZASITE’s pricing compare with other ophthalmic antibiotics?

AZASITE’s initial retail price (USD 75–80 per unit) aligns with branded ophthalmic antibiotics like besifloxacin. Generic azithromycin alternatives are significantly cheaper, often below USD 50, with prices potentially dropping further as generics proliferate.

2. When is the patent for AZASITE expected to expire?

The drug’s patent protection is anticipated to last until 2031, after which generic manufacturers may introduce lower-cost equivalents, exerting pricing pressure.

3. What factors influence AZASITE’s pricing in different markets?

Pricing varies based on regional patent laws, reimbursement policies, healthcare infrastructure, and competitive landscape. Developed markets typically maintain higher prices due to brand recognition and insurance coverage.

4. How vulnerable is AZASITE to the threat of antimicrobial resistance?

While azithromycin retains efficacy against many bacterial strains, rising resistance could diminish its utility, prompting pricing adjustments and formulation reforms.

5. What strategies can manufacturer adopt to sustain profitability amidst declining prices?

Strategies include expanding into emerging markets, developing combination therapies, enhancing formulary access, and investing in patient adherence programs to drive higher volumes.

References

[1] Market Research Future. (2022). Ophthalmic Antibiotics Market Report.

[2] U.S. Food and Drug Administration. (2014). AZASITE approval letter.