Last updated: July 27, 2025

Introduction

AUVI-Q (airway and allergen-specific epinephrine injection), developed by Kaleo Pharmaceuticals, is an auto-injector designed for the emergency treatment of life-threatening allergic reactions (anaphylaxis). Approved by the FDA in 2017, AUVI-Q competes primarily with EpiPen (Pfizer/Viacora), Simonize, and other epinephrine auto-injectors in a high-stakes market characterized by critical need, insurance coverage complexities, and pricing sensitivity. This analysis explores AUVI-Q's current market positioning, competitive landscape, regulatory factors, and future price projections, offering a comprehensive view for stakeholders.

Market Overview

Epinephrine Auto-Injectors: Industry Landscape

The global anaphylaxis treatment market was valued at approximately USD 2.5 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 8–10% through 2028, driven by increasing food allergies, improved allergy diagnosis, and rising awareness of allergy management. Epinephrine auto-injectors account for a significant share within this sector.

AUVI-Q's Positioning and Adoption

Upon FDA approval, AUVI-Q aimed to differentiate itself via a compact design, user-friendly interface with an audible, tactile, and visual aids, and a lower price point relative to EpiPen. Kaleo's marketing targeted both end-users and healthcare providers, emphasizing ease of use for children and the elderly. However, market penetration has been influenced by existing brand loyalty, insurance formulary coverage, and pricing strategies.

Current Market Share

As of 2023, EpiPen remains dominant with roughly 70–75% of market share [1], attributable to brand recognition and longstanding insurance agreements. AUVI-Q holds approximately 10–15%, with the remainder split among other alternatives like Adrenaclick and generic epinephrine injections. Despite lower market share, AUVI-Q's unique device features and strategic reimbursement maneuvers enable continued growth.

Pricing Dynamics

Original Price and Reimbursement Challenges

Initially, AUVI-Q was priced significantly lower than EpiPen—retailing around USD 250–300 for a two-pack—compared to EpiPen's USD 600+. These retail figures did not fully reflect actual transaction prices, affected by rebates, insurance negotiations, and discounts.

The original intent was to position AUVI-Q as a cost-effective alternative; however, Kaleo faced challenges with inconsistent insurance coverage and provider familiarity, which hampered uptake.

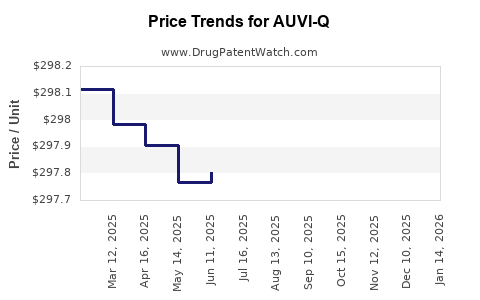

Market Shifts and Price Trends

Post-introduction, Kaleo adopted aggressive pricing strategies, including rebate enhancements, to improve accessibility. Nonetheless, industry reports suggest that real-world prices paid by consumers, after rebates and insurance subsidies, frequently hover around USD 150–350 per pack, with variations across regions and payers.

Impact of Generic and Competitive Products

The entrance of generic epinephrine formulations has exerted downward pressure on prices. Moreover, EpiPen's own price increases and subsequent reformulations, combined with manufacturer price reductions and rebate strategies, have reshaped the market landscape.

Recent Pricing Developments

In 2020, Kaleo was acquired by Teva Pharmaceuticals, which adjusted pricing strategies, aiming to maintain AUVI-Q's competitive edge. As of 2023, available retail prices from pharmacies tend to range from USD 250–350 for a two-pack, with significant rebates and coupons reducing out-of-pocket costs for insured patients.

Regulatory and Reimbursement Factors

FDA Approvals and Market Expansion

AUVI-Q’s FDA approval to treat children as young as 3 years old significantly expanded its target patient population. Contemporary approvals and potential for additional pediatric indications could augment demand, thus influencing price stability or increases.

Insurance Coverage and Reimbursement

Insurance formularies heavily influence actual prices. AUVI-Q's inclusion in major managed care plans has improved, but its coverage still lags behind EpiPen. Reimbursement rates, copay assistance programs, and rebates create complex cost dynamics.

Legislative Impact

Legislative efforts to cap out-of-pocket expenses for epinephrine auto-injectors may further influence pricing strategies. The US legislation from the Price Transparency Final Rule (2022) increases scrutiny on manufacturer pricing and rebate practices, potentially pressuring retail prices downward.

Future Price Projections

Market Growth and Demand

The rising incidence of food allergies and anaphylaxis, especially among children, suggests sustained or increased demand. Innovations such as improved device features, potential for novel formulations, and broader pediatric approval could further stimulate uptake.

Competitive Pressures

As patent exclusivity wanes and generics enter the market, AUVI-Q faces significant downward pricing pressures, especially in the highly commoditized auto-injector segment.

Pricing Outlook (2023–2028)

- Short-term (1–2 years): Prices are expected to stabilize around USD 250–350 for a two-pack, with rebates and assistance programs maintaining affordability for insured patients.

- Mid-term (3–5 years): Introduction of generic auto-injectors and expanded insurance negotiations could lower retail prices by 10–20%.

- Long-term (5+ years): Market saturation with generics and biosimilars could reduce prices further, potentially approaching USD 150–200 for a comparable pack.

Potential Pricing Drivers

- Regulatory approvals for pediatric and new formulations

- Increased insurance coverage and formulary inclusion

- Market penetration through targeted marketing and rebates

- Emergence of biosimilar and generic competitors

- Legislative caps on out-of-pocket expenses

Implications for Stakeholders

- Manufacturers: To sustain market share, investment in device innovation, patient assistance programs, and strategic pricing will be critical.

- Healthcare Providers: Should consider formulary status and patient affordability when prescribing.

- Payers and Policy Makers: Can leverage legislative tools to promote price transparency, encourage generic substitution, and improve access.

- Patients: Need to be aware of assistance programs and reimbursement options to mitigate out-of-pocket costs.

Key Takeaways

- AUVI-Q occupies a niche in the epinephrine auto-injector market owing to its device design and pediatric approvals, yet it faces stiff competition mainly from EpiPen and generics.

- Current retail prices for AUVI-Q hover around USD 250–350, but rebates and insurance significantly influence patient costs.

- The evolving landscape, characterized by increased generic entry and legislative pressure, points toward a potential 10–20% price decrease over the next five years.

- Market growth driven by rising allergy prevalence is expected to sustain demand, though price volatility remains high.

- Companies can differentiate by emphasizing device innovation, enhancing access through rebates, and navigating complex reimbursement frameworks.

FAQs

1. How does AUVI-Q’s pricing compare to EpiPen?

AUVI-Q’s retail price is generally lower, around USD 250–350 for a two-pack, compared to EpiPen’s USD 600+. However, after rebates and insurance, actual patient costs can be similar or even lower for AUVI-Q.

2. What impact will generics have on AUVI-Q’s future prices?

The entry of generic epinephrine injectors will likely exert downward pressure on prices across the market, including AUVI-Q, potentially reducing retail prices by up to 20% within five years.

3. Are there legislative efforts influencing epinephrine auto-injector prices?

Yes, recent legislation aims to improve cost transparency and limit out-of-pocket expenses, which could lead manufacturers to adopt more aggressive pricing and rebate strategies.

4. How significant is insurance coverage in determining actual costs for patients?

Highly significant. Insurance formularies and rebates often determine net prices, profoundly impacting patient copayments, especially for costly brands like EpiPen.

5. What future innovations could influence AUVI-Q’s market and pricing?

Advances such as smaller device design, multi-dose formulations, and expanded pediatric approvals could boost demand and justify premium pricing, though market forces may favor price reductions due to competition.

References

[1] IQVIA. (2022). "Epinephrine Auto-Injector Market Overview."

[2] Kaléo Pharmaceuticals. (2017). "AUVI-Q FDA Approval Highlights."

[3] MarketWatch. (2022). "Global Anaphylaxis Treatment Market Size and Projections."

[4] FDA. (2022). "Regulatory Updates on Epinephrine Auto-Injectors."

[5] Healthcare Financial Management Association. (2023). "Reimbursement Trends in Emergency Allergy Medications."

This detailed market analysis aims to provide stakeholders with a comprehensive, data-driven outlook on AUVI-Q’s current positioning and future pricing trajectory, crucial for strategic decision-making within the allergy and emergency medication sectors.