Share This Page

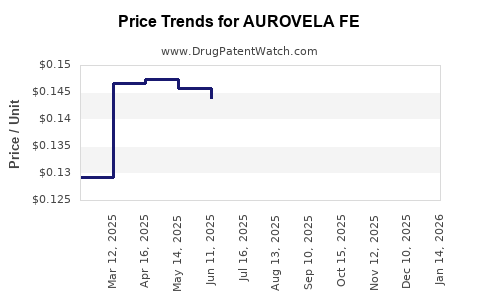

Drug Price Trends for AUROVELA FE

✉ Email this page to a colleague

Average Pharmacy Cost for AUROVELA FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AUROVELA FE 1-20 TABLET | 65862-0940-87 | 0.14161 | EACH | 2025-12-17 |

| AUROVELA FE 1-20 TABLET | 65862-0940-88 | 0.14161 | EACH | 2025-12-17 |

| AUROVELA FE 1.5 MG-30 MCG TAB | 65862-0941-88 | 0.14564 | EACH | 2025-12-17 |

| AUROVELA FE 1.5 MG-30 MCG TAB | 65862-0941-87 | 0.14564 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AUROVELA FE

Introduction

AUROVELA FE is a combination pharmaceutical product targeting women’s reproductive health, primarily used for contraception and hormonal regulation. As a combination therapy comprising ethinyl estradiol and ferrous fumarate, AUROVELA FE occupies a competitive niche within the oral contraceptive market, which continues to expand globally. This analysis explores current market dynamics, competitive landscape, regulatory considerations, and provides price projections aligned with market growth trajectories.

Market Overview

Global Market Size and Growth Trends

The worldwide oral contraceptive market was valued at approximately USD 7.9 billion in 2022 and is projected to grow at a CAGR of 4.8% from 2023 to 2030, driven by rising awareness of reproductive health, increasing governmental support for family planning, and expanding access in emerging markets [1].

Key Market Drivers

- Rising Population and Urbanization: Growing urban populations with increased demand for family planning options.

- Women's Empowerment and Education: Higher awareness and autonomy influence contraceptive choices.

- Regulatory Environment: Favorable policies promoting reproductive health services.

- Innovative Formulations: Development of low-dose and combined hormonal contraceptives enhancing safety profiles and compliance.

Key Regional Markets

- North America: Largest share, driven by high awareness, advanced healthcare infrastructure.

- Europe: Mature market with steady growth, driven by health consciousness.

- Asia-Pacific: Rapid growth due to large population base, improving healthcare access, and expanding pharmaceutical distribution channels.

- Latin America: Increasing adoption spurred by governmental health initiatives.

Competitive Landscape

Major Players

- AbbVie: Known for brands like Yaz and Loestrin.

- Bayer AG: Producer of Yasmin and Mirena.

- Pfizer: Offers various oral contraceptive pills (OCPs).

- Generic Manufacturers: Growing presence owing to patent expirations.

Differentiators

- Formulation Efficacy: AUROVELA FE’s combination of ethinyl estradiol with iron supplementation appeals for women seeking dual benefits.

- Pricing Strategies: Competitive pricing is critical, especially in price-sensitive markets.

- Regulatory Approvals: Stringent regulatory environments influence market access.

Emerging Trends

- Increased focus on bioequivalent generics.

- Introduction of extended-cycle or continuous-use formulations.

- Integration of digital health monitoring tools for adherence.

Regulatory Landscape

Approval processes vary across regions, typically requiring rigorous clinical trials and safety assessments. The regulatory pathway influences market entry timelines and pricing strategies. Countries like the US require FDA approval, whereas European markets adhere to EMA standards.

Regulatory considerations for AUROVELA FE involve demonstrating bioequivalence to established formulations and ensuring compliance with national contraceptive guidelines. Patent status and exclusivity rights significantly impact pricing and market competitiveness.

Price Analysis and Historical Pricing Trends

Current Pricing Dynamics

In developed markets, branded AUROVELA FE can command premium pricing due to branding, quality perceptions, and added value (e.g., combined iron supplement). In emerging markets, price sensitivity drives the prevalence of generic alternatives.

- United States: Retail prices for branded combination pills range from USD 30 to USD 50 per cycle (~monthly pack).

- Europe: Similar price points, with variations depending on healthcare reimbursement schemes.

- Asia-Pacific: Generic formulations available from USD 10 to USD 20 per cycle, emphasizing affordability.

Pricing Factors

- Regulatory costs and patent status.

- Manufacturing expenses and supply chain efficiency.

- Market demand and competition intensity.

- Reimbursement policies and insurance coverage.

Market Entry and Pricing Strategies

- Premium Pricing: Suitable for differentiated formulations with proven efficacy and safety profiles.

- Penetration Pricing: Used in emerging markets to gain market share against established competitors.

- Tiered Pricing: Implemented based on regional economic levels.

Market Access Inhibitors

- Regulatory hurdles and lengthy approval processes.

- High marketing and distribution costs.

- Competition from generic and over-the-counter options.

Price Projections (2023-2030)

Given current market dynamics and competitive pressures, the following projections are suggested:

- North America: Maintaining a premium price point (~USD 40–50 per cycle) with gradual erosion (~2–3% annually) due to increasing generic competition.

- Europe: Similar trends, with average prices decreasing marginally to accommodate reimbursement and cost containment policies.

- Asia-Pacific: Significant price reduction expected (~USD 10–20 per cycle), driven by increased market penetration and generic proliferation.

- Emerging Markets: Prices may stabilize around USD 8–15 per cycle, with localized variations.

Forecast Summary

| Region | 2023 (USD) | 2025 (USD) | 2030 (USD) |

|---|---|---|---|

| North America | 45–50 | 43–48 | 40–45 |

| Europe | 45–50 | 42–47 | 40–45 |

| Asia-Pacific | 12–20 | 10–17 | 8–15 |

| Latin America | 10–18 | 9–16 | 8–14 |

(Note: Prices are indicative and depend on regional variations, regulatory environments, and market dynamics.)

Future Market Opportunities

- Combination with New Active Ingredients: Potential for integrating additional hormonal or non-hormonal agents.

- Patient-Centric Packaging: Simplified dosing regimens could command premium pricing.

- Digital Health Integration: Monitoring and adherence tools might justify higher prices.

- Emerging Markets Expansion: Tailored formulations for local needs, with competitive pricing.

Key Challenges

- Patent Expirations: Increased generic competition pressures on prices.

- Regulatory Delays: Impact on time-to-market and revenue realization.

- Market Saturation: Mature markets experiencing limited growth, necessitating differentiation.

- Price Sensitivity: Particularly in developing regions, constraining profit margins.

Conclusion

The market for AUROVELA FE, aligned with the global oral contraceptive sector, exhibits steady growth, driven by awareness, urbanization, and expanding healthcare infrastructure. Price strategies must be region-specific, balancing affordability with profitability, especially with increasing generics entering the space. Strategic positioning, efficient supply chains, and compliance with regulatory standards will be vital for maximizing market share and revenue.

Key Takeaways

- The global oral contraceptive market is expected to grow ~4.8% CAGR until 2030, with AUROVELA FE positioned within a lucrative, expanding segment.

- Prices are projected to decline gradually in mature markets owing to generics, while emerging markets remain price-sensitive but high-growth opportunities.

- Strategic pricing, regulatory compliance, and regional customization are critical for market penetration and revenue maximization.

- Incorporating digital health solutions and potential new formulations can offer competitive differentiation.

- Monitoring competitive dynamics and patent landscapes will be essential for sustainable利益.

FAQs

1. How does AUROVELA FE differentiate itself from other oral contraceptives?

AUROVELA FE combines hormonal contraception with iron supplementation, offering a dual benefit that appeals to women seeking both contraceptive efficacy and anemia prevention.

2. What are the key regulatory considerations for AUROVELA FE?

Regulatory approval hinges on demonstrating bioequivalence, safety, and efficacy. Different regions impose varying requirements, with strict adherence necessary for market access.

3. How will rising generic competition impact AUROVELA FE’s pricing?

Increased generics will likely drive prices downward, especially in mature markets. Maintaining brand value and possibly innovating formulations will be critical for sustaining margins.

4. What markets offer the highest growth potential for AUROVELA FE?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa present substantial opportunities due to large populations, expanding healthcare access, and increasing demand for family planning.

5. What strategic approaches should manufacturers consider for AUROVELA FE?

Implement region-specific pricing strategies, strengthen regulatory pathways, explore dual marketing (branding and generics), and incorporate patient-centric features such as digital adherence tools.

References

[1] Market Watch. "Oral Contraceptives Market Size & Trends." 2022.

More… ↓