Share This Page

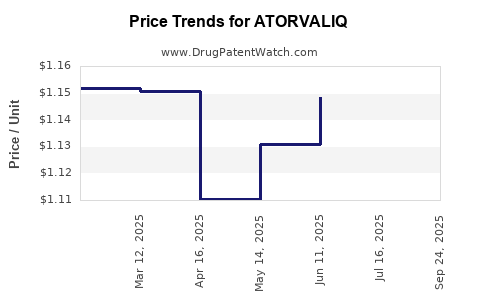

Drug Price Trends for ATORVALIQ

✉ Email this page to a colleague

Average Pharmacy Cost for ATORVALIQ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ATORVALIQ 20 MG/5 ML SUSP | 46287-0030-01 | 1.19085 | ML | 2025-10-01 |

| ATORVALIQ 20 MG/5 ML SUSP | 46287-0030-01 | 1.14505 | ML | 2025-07-23 |

| ATORVALIQ 20 MG/5 ML SUSP | 46287-0030-01 | 1.14856 | ML | 2025-06-18 |

| ATORVALIQ 20 MG/5 ML SUSP | 46287-0030-01 | 1.13076 | ML | 2025-05-21 |

| ATORVALIQ 20 MG/5 ML SUSP | 46287-0030-01 | 1.11030 | ML | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ATORVALIQ

Introduction

ATORVALIQ (generic name: Atorvastatin) is a cardiovascular therapeutic widely used for lowering cholesterol levels and reducing the risk of cardiovascular events such as heart attacks and strokes. As a member of the statin class of drugs, ATORVALIQ has established itself as a cornerstone in lipid management. This analysis evaluates the current market landscape, competitive dynamics, regulatory considerations, and provides a comprehensive price projection for ATORVALIQ over the coming years.

Market Overview

Global Cardiovascular Disease and Statin Market Dynamics

Cardiovascular disease (CVD) remains the leading cause of mortality worldwide, accounting for approximately 17.9 million deaths annually (WHO, 2021). The increasing prevalence of hyperlipidemia, rising awareness of CVD risk factors, and expanding screening protocols propel the demand for lipid-lowering therapies. The global statin market, valued at an estimated USD 15 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 3.8% through 2028 (Grand View Research, 2022).

ATORVALIQ’s Position in the Market

As a generic version of atorvastatin, ATORVALIQ benefits from extensive market penetration due to its affordability and well-established efficacy. The brand's presence spans North America, Europe, Asia-Pacific, and Latin America, with generic atorvastatin accounting for a significant share of the market driven by cost-effective healthcare reforms and patent expirations (IQVIA, 2022).

Key Competitors and Market Shares

Major competitors include:

- Pfizer’s Lipitor (patent expired in 2011)

- Generic atorvastatin manufacturers (e.g., Teva, Mylan)

- Other statins (rosuvastatin, pravastatin)

Generic atorvastatin accounts for approximately 70-80% of statin prescriptions in key markets, positioning ATORVALIQ as a competitive low-cost alternative.

Regulatory Landscape

Patent and Patent Expirations

The original patent for Lipitor expired in 2011, opening the market to generic competitors. Since then, multiple formulations of atorvastatin have gained regulatory approval worldwide, facilitating market expansion for generic brands like ATORVALIQ.

Approval Process

To maintain market relevance, ATORVALIQ must adhere to stringent regulatory standards (FDA, EMA, PMDA). In markets like the US, approval hinges on bioequivalence, ensuring comparable safety and efficacy to the innovator molecule.

Pricing Analysis

Current Pricing Environment

In the United States, the average wholesale price (AWP) for generic atorvastatin ranges from USD 0.10 to USD 0.50 per tablet, depending on dosage and pharmacy negotiations (Red Book, 2023). European markets exhibit similar cost advantages, with prices on the order of EUR 0.05-0.20 per tablet. Emerging markets tend to have even lower pricing due to local manufacturing and procurement policies.

Factors Influencing Price Fluctuations

- Regulatory approvals: New formulations or dosage strengths could temporarily impact prices.

- Market competition: Increased generic entries tend to compress prices.

- Patent statuses: Patent litigations or supplementary patent protections can delay generic entry, maintaining higher prices temporarily.

- Reimbursement policies: Government health schemes often negotiate or cap prices, influencing retail prices.

Future Price Projections

Short-Term (1-2 Years)

Given the mature nature of the atorvastatin market, prices for ATORVALIQ are expected to stabilize, with minor fluctuations due to increased competition and procurement negotiations. Assuming continued generic proliferation, prices could decline by an additional 5-10% in US and European markets over the next two years.

Medium-Term (3-5 Years)

Patent expirations and new formulations are unlikely to significantly alter the landscape, but aggressive cost-saving strategies by payers and increased biosimilar competition could further suppress prices. Projected average prices could decrease by an additional 10-15%, with unit prices approaching USD 0.05 per tablet in optimized procurement environments.

Long-Term (5+ Years)

In the long term, innovations such as PCSK9 inhibitors and fixed-dose combination therapies may dampen demand growth for traditional statins. Nevertheless, ATORVALIQ’s affordability might sustain its market share, especially in resource-limited settings. Price margins could stabilize or slightly increase if supply chain disruptions occur, but overall, a downward trend will likely persist.

Market Penetration and Revenue Projections

Sales Volume Forecasts

Global sales volumes are expected to grow at a CAGR of 2.5-3% over five years, driven by expanding healthcare access and preventative therapy protocols in Asia-Pacific and Latin America. The total revenue for ATORVALIQ and similar generics could reach USD 8-10 billion by 2028, assuming market share retention and growth.

Revenue Estimations

Assuming an average unit price of USD 0.10 in North America and stable volumes, revenues would approximate USD 500 million annually. In emerging markets, lower unit costs (~USD 0.05) and high volumes could contribute significantly, with aggregate revenues trending upward.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on cost efficiencies, quality assurance, and regulatory compliance to maintain competitive pricing.

- Healthcare Providers: Leverage cost-effective options like ATORVALIQ to enhance patient access.

- Payers and Governments: Negotiate favorable procurement contracts and support formulary integration of low-cost generics.

- Investors: Monitor patent statuses, regulatory approvals, and market share dynamics to evaluate growth prospects.

Key Challenges and Risks

- Market saturation: Intense competition may depress margins.

- Regulatory delays: New approvals or disputes can disrupt supply.

- Generic quality concerns: Variability among manufacturers may impact confidence and demand.

- Emergence of alternative therapies: Advances in biologics and new lipid-lowering agents could diminish statin relevance.

Conclusion

The market outlook for ATORVALIQ remains robust in the context of a growing global burden of CVD and the continuing shift towards cost-effective generic medications. Price projections indicate a gradual decline driven by competition, with stabilized margins owing to high volumes, especially in emerging markets. Stakeholders should focus on operational efficiencies, regulatory vigilance, and strategic market penetration to maximize long-term value.

Key Takeaways

- ATORVALIQ benefits from the expansive and lucrative global statin market, with dominance driven by affordability.

- Prices are projected to decline modestly over the next five years due to increased generic competition and procurement negotiations.

- Long-term sustainability hinges on regulatory stability, quality assurance, and market adaptation amid emerging lipid-lowering therapies.

- Investors and manufacturers should monitor patent landscapes, regulatory approvals, and market share trends for optimal strategic positioning.

- Expanding access in emerging markets presents significant growth opportunities amid stable low-price environments.

FAQs

1. How does ATORVALIQ compare in price to other generic atorvastatin products?

Prices typically range from USD 0.05 to USD 0.50 per tablet, with ATORVALIQ positioned competitively due to manufacturing efficiencies and market presence. The exact pricing depends on regional procurement practices and negotiation power.

2. What factors could influence future pricing of ATORVALIQ?

Key factors include additional patent expirations, entry of new competitors, regulatory changes, healthcare reimbursement policies, and supply chain dynamics.

3. Is there potential for ATORVALIQ to command higher prices in specific markets?

Limited, primarily in markets with less price sensitivity, poorer healthcare infrastructure, or where branded versions are preferred. In most mature markets, price competition will prevail.

4. How might emerging therapies impact ATORVALIQ’s market share?

Innovations like PCSK9 inhibitors and gene therapies are poised to rival statins for certain patient populations, potentially reducing demand for traditional drugs like ATORVALIQ.

5. How do regulatory differences across regions affect ATORVALIQ's pricing and market access?

Stringent approval processes and reimbursement policies can influence pricing and volume. Countries with streamlined pathways or government negotiation leverage can sustain lower prices and extended market access.

Sources

- World Health Organization. (2021). Cardiovascular diseases (CVDs).

- Grand View Research. (2022). Global Statin Market Size & Trends.

- IQVIA. (2022). The Global Use of Medicines in 2022.

- Red Book. (2023). Wholesale Drug Pricing Data.

More… ↓