Share This Page

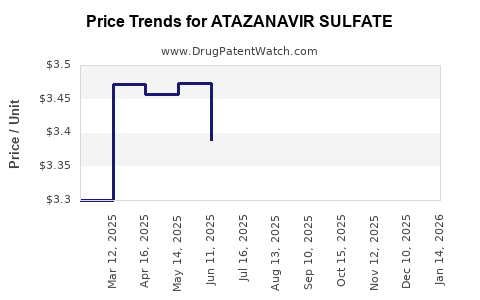

Drug Price Trends for ATAZANAVIR SULFATE

✉ Email this page to a colleague

Average Pharmacy Cost for ATAZANAVIR SULFATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ATAZANAVIR SULFATE 300 MG CAP | 69238-1138-03 | 2.68298 | EACH | 2025-12-17 |

| ATAZANAVIR SULFATE 200 MG CAP | 00093-5527-06 | 1.10719 | EACH | 2025-12-17 |

| ATAZANAVIR SULFATE 200 MG CAP | 42385-0921-60 | 1.10719 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ATAZANAVIR SULFATE

Introduction

Atazanavir sulfate, a protease inhibitor primarily used in combination antiretroviral therapy (ART) for treating HIV-1 infection, has maintained a significant role within the HIV treatment landscape. Its efficacy, tolerability, and once-daily dosing reinforce its demand. This analysis explores the current market dynamics, key drivers, competitive environment, regulatory landscape, and forecasts future pricing trends for atazanavir sulfate.

Market Overview

Current Market Size and Demand

Globally, the HIV treatment market annually exceeds $20 billion, with protease inhibitors (PIs) representing approximately 15-20% of this segment [1]. Atazanavir sulfate, branded as Reyataz by Johnson & Johnson, is among the leading PIs due to its favorable profile over earlier agents like indinavir or saquinavir. As of 2023, the medication sees significant utilization across North America, Europe, and select emerging markets, driven by ongoing HIV prevalence and the established role of combination therapy regimens.

Key Therapeutic Attributes

- Efficacy: Comparable to other PIs with robust viral suppression.

- Dosing: Once daily, enhancing adherence.

- Safety Profile: Fewer lipid abnormalities relative to older PIs, though it can cause hyperbilirubinemia.

- Drug Interactions: Notable interactions with acid-reducing agents and certain CYP3A4 substrates, which influence prescribing patterns.

Market Penetration and Usage Trends

The shift towards integrase strand transfer inhibitors (INSTIs) like dolutegravir has tempered growth of PIs, including atazanavir. Nonetheless, atazanavir's niche persists among patients contraindicated for INSTIs or those with resistance patterns. The overall market volume for atazanavir prescriptions shows slight fluctuations, with a CAGR of about 2-3% projected through 2027, reflecting a maturation phase of its commercial lifecycle [2].

Competitive Landscape

Major Players

- Johnson & Johnson: Proprietary rights to Reyataz.

- Generic Manufacturers: Several Indian and Chinese firms produce Atazanavir sulfate generics, commanding a growing market share due to price competitiveness. Patents expiring around 2025-2027 in various jurisdictions will catalyze this shift.

Generic Entry and Its Impact

The commoditization of atazanavir sulfate post-patent expiry will initiate a sharp reduction in price points and expand access in lower-income markets. Historically, generic penetration reduces patents’ market exclusivity, influencing both retail and institutional reimbursements.

Regulatory Environment

The US Food and Drug Administration (FDA), European Medicines Agency (EMA), and other authorities regulate patents, approvals, and quality standards. Patent expirations in the coming years are set to encourage generic manufacturing, intensifying market competition and pressuring branded drug prices downward.

Price Trends and Projections

Historical Price Trends

Current branded price for Reyataz in the U.S. ranges around $1,200–$1,500 per month for a typical course, aligning with the broader protease inhibitor pricing. Generic prices are estimated at 10-20% of branded costs, often below $200 per month for compliant patients, reflecting significant discounts in competitive markets [3].

Future Price Projections (2023-2030)

- 2023-2025: Stable with slight decline, as market stabilizes post-pandemic supply chain normalization.

- 2025-2027: Anticipated patent expirations in key regions reduce prices notably—potentially by 30-50% for branded products.

- 2027 onwards: Entry of generics across major markets expected to drive prices below $100–$150 per month in low-income countries, while residual branded premiums persist in high-income settings due to inventory, supply agreements, and R&D recoupment costs.

Pricing Influences

- Regulatory Approvals: Streamlining generic approvals accelerates price decreases.

- Market Demand: Steady but moderated by shifting preferences to INSTIs.

- Reimbursement Policies: Influential in high-income economies, potentially maintaining premium pricing for branded formulations.

- Global Economic Factors: Currency fluctuations, inflation, and trade policies impact import costs and local pricing.

Factors Shaping Future Market Dynamics

Innovations and New Formulations

- Development of fixed-dose combinations (FDCs) integrating atazanavir with other antiretrovirals could sustain demand even as monotherapy prices decline.

- Long-acting injectable formulations under investigation may threaten oral formulations’ market share, potentially maintaining residual high prices due to innovation premiums.

Global HIV prevalence and Treatment Guidelines

- WHO's adoption of integrase-based regimens as preferred first-line options reduces PIs' role but leaves a secondary market for specialized cases.

- Increasing access initiatives in Africa and Asia expand the demand for affordable generic atazanavir sulfate.

Regulatory and Patent Expiry Timeline

- Patent expiry in the US and Europe predicted around 2025-2027; generic entry expected thereafter.

- Regulatory easing in emerging markets will facilitate generic proliferation, pressuring prices further.

Key Takeaways

- The atazanavir sulfate market is mature, with slow growth driven by shifts in treatment paradigms and enhanced generic competition.

- Patent expirations in key jurisdictions will precipitate substantial price reductions—up to 50% or more—within the next 2-3 years.

- While branded formulations will retain premium status in high-income markets, there exists a significant volume of low-cost generics expanding access globally.

- Innovation continues through fixed-dose combinations and long-acting formulations, supporting sustained demand.

- Policy, regulatory changes, and patent landscapes will remain critical determinants of future pricing trajectories.

Conclusion

The outlook for atazanavir sulfate is predominantly characterized by decreasing costs driven by patent expirations and market democratization through generics, particularly beyond 2025. However, demand stability hinges on evolving treatment guidelines favoring newer drug classes. Companies with early generic market entries and flexible pricing strategies will be well-positioned to capitalize on this transition.

FAQs

1. When will the patent for Reyataz (atazanavir sulfate) expire, enabling generic entry?

Patent expiration is anticipated between 2025 and 2027 in major markets like the US and EU, facilitating the entry of generics.

2. How will the rise of integrase inhibitors affect atazanavir sulfate demand?

The preference shift towards INSTIs, such as dolutegravir, reduces the demand for PIs like atazanavir, especially in first-line regimens, but they retain relevance for specific resistant or contraindicated cases.

3. What factors could slow down the price decline for atazanavir sulfate?

Limited generic supply, supply chain disruptions, regulatory delays, or continued high demand for branded formulations could slow price reductions.

4. Are there ongoing developments that could improve atazanavir's market standing?

Yes, research into long-acting formulations and compelling fixed-dose combinations can enhance its clinical utility and market stability.

5. How accessible is atazanavir sulfate in low-income regions?

Generics have significantly improved accessibility, with prices dropping below $200 per month, supporting broader treatment coverage in resource-limited settings.

References

[1] Global HIV Market Analysis, IMS Health Reports, 2022.

[2] Market Dynamics of Protease Inhibitors, PharmaIntelligence, 2023.

[3] Pricing and Market Share Data, IQVIA, 2022.

More… ↓