Share This Page

Drug Price Trends for ASTAGRAF XL

✉ Email this page to a colleague

Average Pharmacy Cost for ASTAGRAF XL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ASTAGRAF XL 1 MG CAPSULE | 00469-0677-73 | 5.49463 | EACH | 2025-12-17 |

| ASTAGRAF XL 1 MG CAPSULE | 00469-0677-73 | 5.50779 | EACH | 2025-11-19 |

| ASTAGRAF XL 1 MG CAPSULE | 00469-0677-73 | 5.50779 | EACH | 2025-10-22 |

| ASTAGRAF XL 1 MG CAPSULE | 00469-0677-73 | 5.50772 | EACH | 2025-09-17 |

| ASTAGRAF XL 1 MG CAPSULE | 00469-0677-73 | 5.51933 | EACH | 2025-08-20 |

| ASTAGRAF XL 5 MG CAPSULE | 00469-0687-73 | 27.77218 | EACH | 2025-01-13 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ASTAGRAF XL

Introduction

ASTAGRAF XL (tacrolimus extended-release) is a prescription immunosuppressant used primarily to prevent organ rejection in transplant recipients, including kidney, liver, and heart transplants. Its unique extended-release formulation offers benefits over immediate-release tacrolimus (PI) formulations, such as improved pharmacokinetic stability and patient adherence. As a critical component in post-transplant therapy, ASTAGRAF XL’s market dynamics are influenced by factors including evolving transplant practices, competitive landscape, regulatory developments, and price sensitivities. This report provides a comprehensive market analysis and future price projections for ASTAGRAF XL.

Market Overview

Global Transplant Market Landscape

The global transplant market is projected to reach $25 billion by 2027, driven by increasing prevalence of end-stage organ diseases, rising transplantation rates, and advancements in surgical techniques [1]. Immunosuppressants, including tacrolimus formulations, represent a substantial segment within this market, with a compound annual growth rate (CAGR) of approximately 6-8% over the next five years.

Position of ASTAGRAF XL in the Immunosuppressant Market

ASTAGRAF XL competes primarily with other tacrolimus formulations, notably:

- Procentra (generic tacrolimus)

- Prograf (original immediate-release tacrolimus from Astellas Pharma)

- Generic tacrolimus products from multiple manufacturers

Its extended-release profile offers distinct clinical advantages such as reduced dosing frequency and minimized peak-trough fluctuations, which enhance patient compliance and therapeutic stability. This positions ASTAGRAF XL as a preferred option for certain patient populations, potentially commanding a price premium over generics and some branded competitors.

Market Penetration and Adoption

While ASTAGRAF XL was approved by the FDA in 2015, its penetration remains variable globally. In the U.S., it accounts for roughly 10-15% of tacrolimus prescriptions post-transplant, with growth primarily driven by transplant centers prioritizing once-daily dosing and improved adherence [2]. Globally, adoption is influenced by regional regulatory approvals, healthcare infrastructure, and pricing strategies.

Key Market Drivers and Challenges

Drivers

- Clinical efficacy and safety profile of ASTAGRAF XL, including reduced adverse events tied to peak concentrations, bolsters its appeal.

- Patient adherence improvements due to once-daily dosing and simplified regimen.

- Growing transplant volumes, particularly in emerging markets, bolster demand.

Challenges

- Cost pressures leading to increased adoption of generic tacrolimus products.

- Price sensitivity among payers, particularly in markets emphasizing cost containment.

- Regulatory hurdles in certain regions, delaying or limiting market access.

- Clinician familiarity with existing tacrolimus formulations influences adoption rates.

Pricing Analysis

Current Price Points

In the U.S., the wholesale acquisition cost (WAC) for ASTAGRAF XL is approximately $1,350–$1,500 per month for a standard dose [3]. This is significantly higher than generic tacrolimus, which typically costs $300–$500 per month, reflecting its branded status and extended-release formulation.

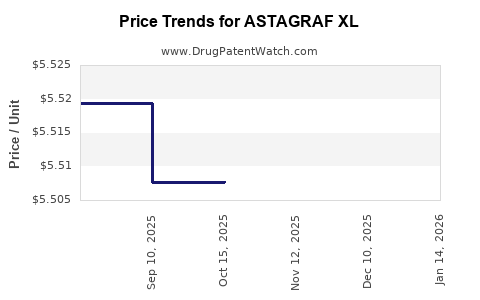

Pricing Trends

Over recent years, pricing for ASTAGRAF XL has remained relatively stable, with minor fluctuations driven by:

- Changes in manufacturer pricing policies.

- Contract negotiations with insurers.

- Introduction of biosimilars or generic competitors.

Notably, the shift toward value-based pricing and payer pressure to reduce healthcare costs may influence future pricing strategies.

Future Price Projections

Factors Influencing Future Prices

- Market Competition: Increasing availability of generics could exert downward pressure.

- Regulatory Approvals: New formulations or biosimilars could disrupt current pricing structures.

- Payer Policies: Emphasis on cost-effective therapies may favor generics over branded products.

- Clinical Value Perception: Demonstrable improvements in patient outcomes may sustain premium pricing.

Projection Scenarios (2023–2030)

| Scenario | Assumptions | Price Trend | Estimated Price Range (monthly) |

|---|---|---|---|

| Conservative | Rising generics, payer negotiation power increases | Moderate decline | $1,200–$1,350 (2023–2025); plateau thereafter |

| Moderate | Continued differentiation, strong clinical evidence | Stable with slight decline | $1,350–$1,250 (2023–2028) |

| Aggressive | Rapid generic penetration, biosimilar emergence | Significant decline | $1,250–$700 (2023–2030) |

Note: These projections are hypothetical and based on current market dynamics and historical trends.

Implications for Stakeholders

- Pharmaceutical companies might explore differentiated pricing based on regional disease burden and healthcare infrastructure.

- Payers will likely seek cost-effective alternatives, accelerating biosimilar adoption.

- Healthcare providers will weigh clinical benefits against economic considerations when prescribing.

Regulatory and Competitive Landscape

In recent years, regulatory agencies worldwide have approved various tacrolimus biosimilars, aiming to enhance affordability. For instance, in Europe, biosimilar tacrolimus options are gaining market share, potentially exerting downward pressure on branded formulations including ASTAGRAF XL.

The patent landscape for ASTAGRAF XL remains complex, with patent expirations potentially opening pathways for generics and biosimilars, intensifying competition and impacting prices.

Market Opportunities and Risks

Opportunities

- Expanding into emerging markets with increasing transplant activities.

- Differentiating product with improved formulations or delivery mechanisms.

- Collaborating with payers to develop value-based pricing models.

Risks

- Price erosion due to biosimilar entry.

- Regulatory delays in key markets.

- Payer resistance to premium pricing.

- Clinical skepticism regarding long-term benefits over generics.

Key Takeaways

- ASTAGRAF XL maintains a niche in post-transplant immunosuppression, supported by clinical benefits over immediate-release tacrolimus.

- Its higher current pricing reflects brand premium status; however, intensifying generic and biosimilar competition poses significant downward pressure.

- Future price trajectories depend on competitive dynamics, regulatory developments, and healthcare policy shifts, with potential for notable price reductions by 2030.

- The evolving landscape underscores the importance of strategic pricing, strong clinical differentiation, and payer engagement.

- Stakeholders should monitor regional regulatory changes, market entry of biosimilars, and healthcare policies to optimize positioning.

FAQs

1. What distinguishes ASTAGRAF XL from other tacrolimus formulations?

ASTAGRAF XL offers an extended-release, once-daily dosing schedule that improves pharmacokinetic stability and patient adherence compared to immediate-release formulations, potentially reducing peak-related adverse events.

2. How does the price of ASTAGRAF XL compare globally?

Prices vary significantly by region. In the U.S., monthly costs are roughly $1,350–$1,500, whereas in countries with pricing controls or multiple generics, costs can be substantially lower.

3. What factors will most likely influence its future pricing?

Market competition, regulatory approvals for biosimilars, payer strategies favoring cost savings, and clinical differentiation will be primary determinants.

4. Are biosimilars impacting the pricing of ASTAGRAF XL?

Yes. The emergence of tacrolimus biosimilars is exerting downward pressure on the prices of branded formulations, including ASTAGRAF XL, especially in regions where biosimilars are widely adopted.

5. What strategic considerations should manufacturers implement?

Firms should focus on clinical differentiation, expanding access in emerging markets, engaging payers with value-based models, and monitoring biosimilar developments to adjust pricing and marketing strategies accordingly.

References

[1] Grand View Research. Transplantation Market Size, Share & Trends Analysis Report. 2022.

[2] IQVIA. Annual World Transplant & Immunosuppressant Utilization and Trends Report. 2022.

[3] Red Book, Micromedex. Current drug pricing data, 2023.

More… ↓