Share This Page

Drug Price Trends for ASPIRIN EC

✉ Email this page to a colleague

Average Pharmacy Cost for ASPIRIN EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ASPIRIN EC 325 MG TABLET | 49483-0331-10 | 0.02259 | EACH | 2025-11-19 |

| ASPIRIN EC 325 MG TABLET | 70000-0014-01 | 0.02259 | EACH | 2025-11-19 |

| ASPIRIN EC 325 MG TABLET | 49483-0331-01 | 0.02259 | EACH | 2025-11-19 |

| ASPIRIN EC 325 MG TABLET | 70000-0035-01 | 0.02259 | EACH | 2025-11-19 |

| ASPIRIN EC 325 MG TABLET | 00536-1232-01 | 0.02259 | EACH | 2025-11-19 |

| ASPIRIN EC 81 MG TABLET | 63739-0212-02 | 0.01481 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Aspirin EC

Introduction

Aspirin EC (Enteric-Coated Aspirin) has been a cornerstone in pain relief, anti-inflammatory therapy, and cardiovascular protection for over a century. With its well-established efficacy and safety profile, Aspirin EC continues to command a significant segment of the pharmaceutical market. This report provides a comprehensive market analysis and price projection for Aspirin EC, evaluating current market dynamics, regulatory considerations, competitive landscape, and future pricing trajectories.

Market Overview

Historical Context and Usage Trends

Aspirin EC is designed to mitigate gastrointestinal irritation by delaying aspirin release until it reaches the intestines, enhancing patient tolerability. The global market for aspirin, primarily comprising low-dose formulations for cardiovascular prophylaxis and pain management, was valued at approximately USD 2.3 billion in 2022. Continuous aging populations, increased cardiovascular disease awareness, and longstanding over-the-counter (OTC) availability underpin sustained demand.

Current Market Landscape

The aspirins segment is dominated by generic manufacturers, with a handful of major pharmaceutical companies such as Bayer, Teva, and Mylan controlling significant market share through robust distribution networks and brand recognition. The global OTC aspirin market is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2028, driven by aging demographics and broader health consciousness.

Regulatory Environment

Aspirin EC formulations are well-established, with regulatory approvals primarily grounded in well-known safety and efficacy data. However, regional variations exist, particularly in European and North American markets, that influence pricing and market access strategies. Regulatory agencies, such as the FDA and EMA, continue to enforce standards that ensure product quality, but market access is facilitated for generic versions, fostering price competition.

Market Drivers and Challenges

Drivers

- Aging Population: Rising incidence of cardiovascular diseases necessitates chronic aspirin therapy, especially low-dose EC formulations.

- Physician Recommendations: Aspirin remains a first-line prophylactic agent in stroke and myocardial infarction, reinforcing demand.

- OTC Accessibility: OTC status in many regions promotes widespread consumer access and self-medication.

Challenges

- Patent Expiration and Generics: Patent expiry leads to increased generic competition, exerting downward pressure on prices.

- Regulatory Hurdles: Variability in regional approvals influences market entry and pricing strategies.

- Safety Concerns: Risk of bleeding and gastrointestinal side effects necessitate cautious prescribing, occasionally impacting demand.

Competitive Landscape

The competitive environment for Aspirin EC is characterized by high generic penetration. Bayer’s branded Aspirin brand remains prominent; however, generics account for the majority of sales. The presence of multiple manufacturers leads to price erosion and intense competition. Emerging markets, notably in Asia-Pacific, are witnessing increased manufacturing and consumption, further impacting global pricing structures.

Price Analysis

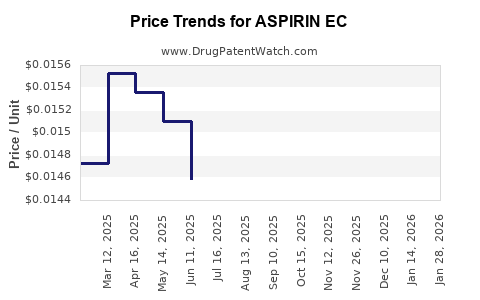

Historical Pricing Trends

Over the past decade, retail prices for Aspirin EC have declined steadily, with annual price erosion of approximately 3-5%, primarily driven by generic competition. A typical OTC pack (100 tablets, 81 mg) ranges from USD 2.50 to USD 4.00 in North America and Europe, depending on branding and formulation.

Current Pricing Landscape

- Branded Aspirin EC: USD 4.00 – USD 6.00 per pack (100 tablets).

- Generic Aspirin EC: USD 1.50 – USD 3.00 per pack (100 tablets).

Prices vary regionally, influenced by supply chain costs, regulatory factors, and market saturation.

Price Projections (2023-2028)

Forecast Overview

Given the high level of generic penetration and mature market status, prices are expected to continue declining modestly through 2028, with an estimated CAGR of -1% to -2%.

Factors Influencing Future Prices

- Market Saturation: Increased generic manufacturing capacity may further drive competition.

- Procurement Policies: Institutional and governmental bulk procurement could stabilize or suppress prices in certain markets.

- Innovations: Introduction of value-added formulations (e.g., combination products or improved enteric coatings) could temporarily bolster prices.

Projected Price Range

| Year | Average Price (USD) per 100 tablets (81 mg) |

|---|---|

| 2023 | USD 2.50 – USD 4.00 |

| 2024 | USD 2.45 – USD 3.95 |

| 2025 | USD 2.40 – USD 3.90 |

| 2026 | USD 2.35 – USD 3.85 |

| 2027 | USD 2.30 – USD 3.80 |

| 2028 | USD 2.25 – USD 3.75 |

The slight price decrease aligns with current industry patterns, with a potential stabilization if new formulations or regional regulatory changes occur.

Future Market Opportunities

Despite the mature status, niche markets offer growth avenues:

- Oncology and Long-term Preventive Use: Expanding indications for aspirin in cancer prevention may sustain demand in specific cohorts.

- Developing Markets: Rising healthcare expenditure and increased access could expand usage, albeit at lower price points.

- Value-Added Formulations: Innovations such as dual-release or combination therapies might command premium pricing.

Key Regulatory and Economic Factors Impacting Prices

- Regulatory Stringency: Stringent generic approval processes could elevate manufacturing costs, slightly impacting prices.

- Trade Policies: Tariffs and import/export restrictions may influence regional price variances.

- Supply Chain Dynamics: Raw material availability (e.g., salicylic acid, acetylsalicylic acid) affects manufacturing costs and, consequently, pricing.

Conclusion

Aspirin EC remains a highly competitive, mature market with predictable downward pricing trends due to generic competition. While the overall market sustains consistent demand primarily through OTC channels, incremental innovations and expanding indication uses could provide some pricing premiums. Companies should focus on efficient procurement strategies and regional market adaptation to optimize profitability.

Key Takeaways

- Aspirin EC’s global market value exceeds USD 2 billion, with consistent growth driven by aging populations and cardiovascular health awareness.

- The market is predominantly driven by generic manufacturers, exerting downward pressure on prices, which are projected to decline modestly over the next five years.

- Prices are expected to hover within USD 2.25 to USD 4.00 per 100-tablet pack (81 mg) range, with slight annual decreases.

- Opportunities exist in niche markets and innovation-driven formulations, potentially offsetting price declines.

- Understanding regional regulatory landscapes and supply chain factors is critical for pricing strategy optimization.

Frequently Asked Questions

1. What are the main factors influencing Aspirin EC pricing?

Pricing is primarily affected by generic market competition, regulatory approval processes, manufacturing costs, regional market dynamics, and demand from both OTC consumers and prescribed use.

2. How does patent law affect Aspirin EC market prices?

Since Aspirin EC formulations are off-patent, generic manufacturers incur minimal patent costs, leading to intense price competition and downward pressure on retail prices.

3. Is there potential for branded Aspirin EC to command higher prices?

Branding and perceived quality may sustain premium pricing temporarily, but long-term, generic competition limits the ability to significantly increase prices unless new formulations or indications emerge.

4. What regions are most likely to see price changes in Aspirin EC?

Developed markets (North America, Europe) tend to experience stable or declining prices due to high generic penetration, while emerging markets may see variable prices influenced by local regulations and economic factors.

5. What future innovations could influence Aspirin EC market prices?

Developments such as combination drugs, slow-release formulations, or new therapeutic indications could create niche premiums and alter competitive dynamics temporarily.

References

[1] MarketandMarkets. "Aspirin Market by Application, Route of Administration, and Region," 2022.

[2] Grand View Research. "Analgesics Market Size & Share," 2023.

[3] U.S. Food and Drug Administration. "OTC Pain Relievers," 2023.

[4] European Medicines Agency. "Regulatory Status of Aspirin," 2023.

[5] GlobalData. "Pharmaceutical Pricing Trends," 2023.

More… ↓