Share This Page

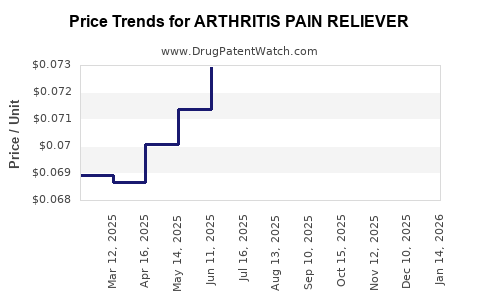

Drug Price Trends for ARTHRITIS PAIN RELIEVER

✉ Email this page to a colleague

Average Pharmacy Cost for ARTHRITIS PAIN RELIEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ARTHRITIS PAIN RELIEVER 1% GEL | 70000-0555-02 | 0.09532 | GM | 2025-12-17 |

| ARTHRITIS PAIN RELIEVER 1% GEL | 70000-0555-03 | 0.06916 | GM | 2025-12-17 |

| ARTHRITIS PAIN RELIEVER 1% GEL | 70000-0555-01 | 0.11877 | GM | 2025-12-17 |

| ARTHRITIS PAIN RELIEVER 1% GEL | 70000-0555-03 | 0.06954 | GM | 2025-11-19 |

| ARTHRITIS PAIN RELIEVER 1% GEL | 70000-0555-02 | 0.09424 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Arthritis Pain Reliever

Introduction

The global market for arthritis pain relief medications is poised for substantial growth driven by rising prevalence, aging populations, and advancements in targeted therapeutics. As a prevalent chronic condition, arthritis affects over 350 million individuals worldwide—an estimated 24% of adults globally—creating a sustained demand for effective analgesics. This analysis examines the current market landscape, competitive dynamics, regulatory environment, and projective pricing trends for arthritis pain relievers, aligning findings with investment and strategic decision-making.

Market Landscape and Current Dynamics

Prevalence and Demographics

Arthritis encompasses over 100 different joint disorders, with osteoarthritis (OA) and rheumatoid arthritis (RA) being the most common. The World Health Organization (WHO) reports an increasing global arthritis burden attributed to demographic shifts, especially in developed nations where aging populations surpass 60 years of age. This demographic shift correlates with increased demand for effective pain management options.

Therapeutic Options and Innovations

Current rheumatology treatment paradigms include NSAIDs, corticosteroids, disease-modifying antirheumatic drugs (DMARDs), biologics, and analgesics specifically designed for pain relief. The market is witnessing innovations such as:

- Targeted NSAIDs with improved safety profiles.

- Biologic agents that modulate immune pathways for inflammatory arthritis.

- Gene therapy and nanotechnology-based delivery systems enhancing drug efficacy and reducing side effects.

- Combination therapies offering synergistic benefits.

Market Segments and Leading Players

The arthritis pain relief market segments into prescription drugs, OTC products, and emerging therapies. The leading pharmaceutical players include Johnson & Johnson, Novartis, AbbVie, Pfizer, and Bayer, which dominate the market with a mixture of established NSAIDs and biologic agents.

Regulatory Environment and Market Challenges

Regulatory Approvals

Regulatory agencies such as the U.S. FDA and EMA strictly monitor safety profiles, especially concerning cardiovascular risks associated with NSAIDs and immunosuppression risks linked to biologics. Recent approvals of novel agents like biosimilars and targeted therapies have expanded options but also intensified competition.

Market Challenges

- Safety concerns surrounding long-term NSAID use.

- Cost constraints, particularly for biologics and biosimilars.

- Patient adherence influenced by side effects and administration methods.

- Pricing pressures driven by healthcare payers seeking cost-effective options.

Price Analysis and Projection

Current Pricing Landscape

The price of arthritis pain relievers varies considerably:

- NSAIDs (e.g., diclofenac, ibuprofen): OTC prices typically range from $10 to $50 per month.

- Prescription NSAIDs and corticosteroids: pricing varies from $50 to $200 per month.

- Biologics (e.g., etanercept, adalimumab): average annual costs range between $20,000 and $40,000, often covered through insurance or government programs.

Factors Influencing Price Movements

- Patent expirations: Entry of biosimilars diminishes prices.

- Regulatory approvals: Introduction of new formulations can command premium pricing.

- Manufacturing innovations: Cost reductions in biologics production could lower prices.

- Market competition: Increased market entrants intensify price competition.

- Pricing regulations: Governments and payers impose price controls, influencing retail prices.

Future Price Projections (2023–2030)

Based on current trends and historical precedents, the following projections are made:

- OTC NSAIDs: Prices are expected to remain relatively stable, with minor annual increases of 1–2%, primarily due to inflation and supply chain factors.

- Prescription NSAIDs: Slight price escalations of 2–3% annually, constrained by generic competition.

- Biologics and Specialty Drugs: Prices are projected to decline by approximately 10–15% by 2030 owing to biosimilar market penetration, manufacturing efficiencies, and regulatory pressures.

Innovative and Personalized Therapies

Emerging therapies such as targeted biologics, gene therapies, and nanomedical delivery systems are anticipated to command premium prices initially, ranging from $30,000 to $50,000 annually, but these are forecasted to decrease as patents expire and biosimilars enter the market.

Market Drivers and Growth Opportunities

- Rising prevalence of arthritis in aging populations.

- Development of safer, more effective therapeutics with better side effect profiles.

- Increasing adoption of personalized medicine approaches.

- Expansion in healthcare coverage and reimbursement policies.

- Growing awareness and patient demand for minimally invasive and oral treatment options.

The compound annual growth rate (CAGR) for the arthritis pain relief market is estimated at 4–6% through 2030, with the biologics segment outpacing traditional NSAIDs due to innovation and premium pricing strategies.

Risk Factors and Market Constraints

- Regulatory hurdles and safety concerns could delay new drug approvals or lead to reformulations.

- Market saturation in developed regions may limit growth; expansion into emerging markets becomes critical.

- Pricing caps and reimbursement restrictions could compress profit margins.

- Patent cliffs will accelerate biosimilar proliferation, exerting downward pressure on prices.

Conclusion and Strategic Implications

The arthritis pain relief market presents substantial growth prospects amid technological innovations and rising disease burden. Price trajectories indicate stability in OTC and generic prescription segments, while biologic and innovative therapies will likely see temporary premium positioning before eventual price decreases due to biosimilar competition. Stakeholders must navigate regulatory challenges, safety concerns, and pricing pressures while leveraging emerging personalized and targeted therapeutics to optimize market share.

Key Takeaways

- The global arthritis pain relief market is expected to grow at 4–6% CAGR, driven by demographic trends and innovation.

- Conventional OTC NSAIDs will maintain stable, low-to-moderate prices; biologics will initially command high prices, with significant reductions anticipated as biosimilars dominate.

- Patent expirations and biosimilar competition will be primary drivers of downward price pressure by 2030.

- Innovations like targeted biologics, gene therapy, and nanotechnology will present premium pricing opportunities but face regulatory and reimbursement hurdles.

- Market entry and expansion strategies should focus on emerging markets, personalized therapies, and cost-effective formulations.

FAQs

1. How will biosimilars impact the pricing of biologic arthritis treatments?

Biosimilars are expected to reduce biologic drug prices by 30–50% upon market entry, encouraging more widespread adoption and improving affordability [1]. This will lead to a downward trajectory in prices over the next decade as biosimilar competition intensifies.

2. What is the outlook for OTC arthritis pain relievers?

OTC NSAIDs like ibuprofen are likely to experience minimal price increases of 1–2% annually, primarily due to inflation. Market saturation and generic availability will restrict significant price escalations, maintaining their affordability for consumers.

3. Are there upcoming therapies that could disrupt the current market?

Yes, emerging therapies like gene editing, targeted biologics, and nanomedicine-based drug delivery promise enhanced efficacy and safety, potentially commanding premium prices initially. Their market penetration could significantly alter the landscape within 5–10 years.

4. How do regulatory policies influence pricing strategies?

Regulatory agencies impose safety and efficacy standards, delaying or limiting new product approvals. Pricing regulations and payer negotiations often lead to price caps or reimbursement restrictions, shaping market dynamics and profitability.

5. What are the regions with the highest growth potential?

Emerging markets such as China, India, and Latin America exhibit expanding demand for affordable arthritis treatments. Demographic shifts and increasing healthcare infrastructure investment make these regions attractive for market entry and growth.

Citations

[1] IMS Health Reports, 2022. Impact of Biosimilar Adoption on Market Dynamics.

More… ↓