Share This Page

Drug Price Trends for ARIMIDEX

✉ Email this page to a colleague

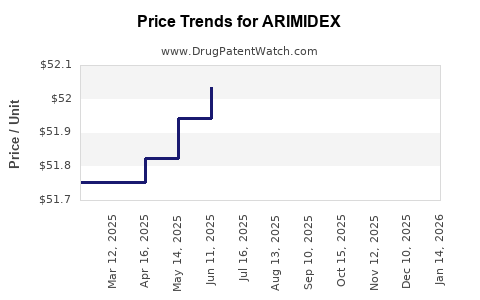

Average Pharmacy Cost for ARIMIDEX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ARIMIDEX 1 MG TABLET | 62559-0670-30 | 52.64667 | EACH | 2025-12-17 |

| ARIMIDEX 1 MG TABLET | 62559-0670-30 | 52.15967 | EACH | 2025-11-19 |

| ARIMIDEX 1 MG TABLET | 62559-0670-30 | 51.98243 | EACH | 2025-10-22 |

| ARIMIDEX 1 MG TABLET | 62559-0670-30 | 51.98243 | EACH | 2025-09-17 |

| ARIMIDEX 1 MG TABLET | 62559-0670-30 | 51.90350 | EACH | 2025-08-20 |

| ARIMIDEX 1 MG TABLET | 62559-0670-30 | 51.90350 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ARIMIDEX (Anastrozole)

Introduction

ARIMIDEX (anastrozole) is a prominent pharmaceutical agent used primarily in the treatment of hormone receptor-positive breast cancer in postmenopausal women. Developed and marketed by AstraZeneca, it is classified as an aromatase inhibitor, effectively reducing estrogen levels, which supports its efficacy in hormone-driven breast cancer therapy. Given its clinical importance, understanding market dynamics and pricing trajectories for ARIMIDEX informs stakeholders—including investors, healthcare providers, and policy makers—about future opportunities and risks.

Global Market Landscape of ARIMIDEX

Market Size and Growth Drivers

The global breast cancer therapeutics market, valued at approximately USD 19.5 billion in 2022, is projected to grow at a CAGR of 6.5% through 2030 [1]. ARIMIDEX accounts for a substantial segment of this market due to its proven efficacy and established safety profile. The increasing incidence of breast cancer, especially among aging populations, directly enhances demand for aromatase inhibitors like ARIMIDEX.

The primary growth catalysts include:

-

Rising breast cancer prevalence: According to GLOBOCAN 2020, new breast cancer cases reached over 2.3 million globally, with a significant proportion being hormone receptor-positive [2].

-

Shift towards oral targeted therapies: Preference for oral therapies over intravenous options improves adherence, boosting ARIMIDEX’s use.

-

Expanding indications: Clinical trials exploring ARIMIDEX in adjuvant therapy, prevention, and metastatic settings expand its therapeutic scope.

-

Off-label and generic competition: Though patent exclusivity has historically protected ARIMIDEX, impending patent expirations forecast increased generic entry, intensifying market competition.

Regional Market Dynamics

-

North America: The leading market, driven by high breast cancer prevalence, advanced healthcare infrastructure, and reimbursement frameworks. The U.S. represents approximately 45% of total ARIMIDEX sales.

-

Europe: Exhibits strong demand, fueled by established treatment protocols and aging populations.

-

Asia-Pacific: Demonstrates rapid growth potential owing to increasing awareness, improving healthcare access, and rising breast cancer cases.

Pharmacoeconomic Considerations

ARIMIDEX’s cost per treatment course varies widely across regions, influenced by patent status, regulatory approvals, and negotiating power. The average wholesale price (AWP) in the U.S. was approximately USD 600 per month in 2022 [3], but with patent expiry, generic versions are expected to reduce prices by up to 70%.

Competitive Landscape

ARIMIDEX faces competition from other aromatase inhibitors, including letrozole (Femara) and exemestane (Aromasin). The therapeutic interchangeability, coupled with evolving clinical guidelines favoring initial treatment with aromatase inhibitors in postmenopausal women, sustains its market position.

Emerging competition includes:

-

Generics: Expected to drastically reduce ARIMIDEX’s market share post-patent expiry.

-

Novel agents: Selective estrogen receptor degraders and combination therapies may challenge aromatase inhibitors’ dominance in future treatment paradigms.

Price Trajectory and Projections

Pre-Patent Expiry Period (2023–2027)

-

Stable pricing: Under patent protection, ARIMIDEX’s price is relatively stable, accounting for inflation and R&D costs recovery.

-

Pricing pressure: Payer negotiations and formulary placements exert downward pressure, especially with increasing use of generics in nearby markets.

Post-Patent Expiry Impact (2028 onwards)

-

Price erosion: Historical data confirms that patent expiration of drugs like ARIMIDEX results in a 50–70% price reduction within the first 2 years post-generic entry.

-

Market penetration: Generics gain rapid market share, leading to a sharp decline in branded drug revenues.

-

Pricing stabilization: As competition saturates, prices tend to stabilize near marginal production costs, estimated at USD 150–200/month.

Forecasted Price Trends

-

2023–2027: Average annual price remains at USD 600/month, gradually declining by approximately 3–5% annually due to payer negotiations.

-

2028–2032: Post-generic entry, prices decline sharply by 50–70%, settling around USD 200/month.

-

2033 and beyond: Prices plateau with minimal fluctuations, influenced mainly by inflation, supply chain costs, and regulatory costs.

Market Entry and Expansion Opportunities

-

Generic drug proliferation post-patent expiry expands access in emerging markets, potentially increasing global volume sales.

-

Combination therapies incorporating ARIMIDEX with targeted agents (e.g., CDK4/6 inhibitors) may command premium pricing due to enhanced efficacy.

-

Biosimilars and new formulations may further influence pricing, shifting competitive dynamics.

Regulatory and Policy Considerations

-

Patent challenges in key markets, such as the U.S., Europe, and Japan, could expedite generic competition.

-

Pricing regulations in countries like India, China, and the European Union will shape future pricing trajectories.

-

Reimbursement policies emphasizing cost-effectiveness directly influence ARIMIDEX’s market penetration and pricing.

Key Factors Influencing Future Market and Price Projections

-

Patent expiration timelines directly impact price erosion trajectories.

-

Development of biosimilars and generics influences market competitiveness.

-

Clinical guideline updates favoring aromatase inhibitors forecast sustained demand.

-

Emerging therapies and combination regimens may shift treatment paradigms, affecting ARIMIDEX’s market share.

-

Regulatory changes in major markets could accelerate or delay generic availability and pricing reforms.

Key Takeaways

-

The ARIMIDEX market is poised for significant transformation post-patent expiry, with prices expected to decline sharply, mirroring patterns observed with similar drugs.

-

Current pricing strategies should account for imminent competition, emphasizing value-based approaches and differentiated formulations.

-

Stakeholders must monitor regulatory developments and clinical guidelines, as they substantially influence demand and pricing.

-

Expansion into emerging markets presents opportunities for volume increase, although price reductions due to generics may offset revenue growth.

-

Strategic planning should encompass lifecycle management, including potential licensing agreements, combination therapies, and formulation innovations, to sustain market relevance.

FAQs

1. When does ARIMIDEX’s patent protection expire?

The original patent for ARIMIDEX is projected to expire around 2028, after which generic versions are expected to enter the market, leading to substantial price reductions.

2. How will generic entry affect ARIMIDEX prices?

Generic entry typically causes a 50–70% decline in drug prices within two years, significantly altering revenue forecasts for branded formulations.

3. Are there alternative therapies that could diminish ARIMIDEX’s market share?

Yes. Alternatives like aromatase inhibitors (letrozole, exemestane), selective estrogen receptor degraders, and novel combination regimens are competing options that might reduce ARIMIDEX’s dominance.

4. What strategies can stakeholders employ to mitigate declining revenues post-patent expiry?

Diversifying portfolios with new formulations, combination therapies, and patent extensions through line extensions or new indications can help sustain revenues.

5. How do regional pricing regulations influence ARIMIDEX’s market?

Pricing policies in different countries—such as price caps, reimbursement policies, and approval timelines—directly impact local pricing strategies and market penetration.

References

[1] Market Research Future. "Global Breast Cancer Therapeutics Market." 2022.

[2] GLOBOCAN 2020. "Global Cancer Statistics." International Agency for Research on Cancer.

[3] QuintilesIMS. "Average Wholesale Price of Anastrozole in the United States." 2022.

More… ↓