Share This Page

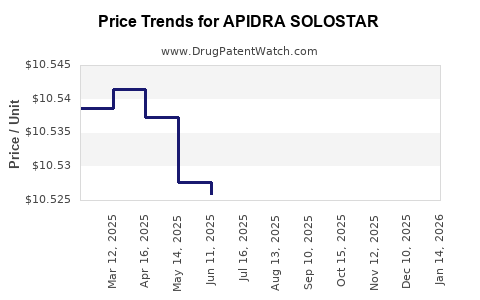

Drug Price Trends for APIDRA SOLOSTAR

✉ Email this page to a colleague

Average Pharmacy Cost for APIDRA SOLOSTAR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| APIDRA SOLOSTAR 100 UNIT/ML | 00088-2502-05 | 10.52014 | ML | 2025-11-19 |

| APIDRA SOLOSTAR 100 UNIT/ML | 00088-2502-05 | 10.51756 | ML | 2025-10-22 |

| APIDRA SOLOSTAR 100 UNIT/ML | 00088-2502-05 | 10.51203 | ML | 2025-09-17 |

| APIDRA SOLOSTAR 100 UNIT/ML | 00088-2502-05 | 10.51480 | ML | 2025-08-20 |

| APIDRA SOLOSTAR 100 UNIT/ML | 00088-2502-05 | 10.51865 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for APIDRA SOLOSTAR

Introduction

APIDRA SOLOSTAR, a long-established insulin analog, plays a pivotal role in managing diabetes mellitus, notably in patients requiring basal-bolus insulin therapy. Manufactured by Sanofi, APIDRA (insulin glulisine) is known for its rapid onset and short duration, providing flexibility and improved glycemic control for users. As the global diabetes epidemic persists, understanding market dynamics and pricing projections for APIDRA SOLOSTAR informs stakeholders on growth opportunities, competitive positioning, and monetary trends. This article offers a comprehensive analysis of market factors, competitive landscape, regulatory influences, and price trends relevant to APIDRA SOLOSTAR.

Market Overview

Global Diabetes Burden and Insulin Market Growth

The International Diabetes Federation (IDF) estimates approximately 537 million adults worldwide had diabetes in 2021, with projections exceeding 700 million by 2045 [1]. The rising prevalence, especially in developing economies, underscores robust demand for insulin products, including rapid-acting insulins like APIDRA. The insulin market was valued at around USD 20 billion in 2022, with a compound annual growth rate (CAGR) forecast of approximately 8% through 2027 [2].

Segment Positioning: Rapid-Acting Insulins

Rapid-acting insulins constitute a significant segment, accounting for nearly 30% of the total insulin market. APIDRA's attributes—fasted onset less than 15 minutes and duration of 4–5 hours—align with modern diabetes management guidelines favoring flexibility and tight glycemic control [3]. Its clinical advantages favor continued penetration despite competitive pressures.

Distribution Channels and Market Penetration

Key distribution channels include hospital pharmacies, retail outlets, and specialty clinics. The subscription-based, reusable SOLOSTAR pens enhance usability, which supports adoption among both patients and clinicians. Market penetration varies globally, with higher adoption in North America and Europe, driven by insurance coverage and healthcare infrastructure. Emerging markets demonstrate significant growth potential due to increasing diabetes prevalence and expanding healthcare access.

Competitive Landscape

Major Competitors

- Novo Nordisk’s NovoRapid (insulin aspart): The leading rapid-acting insulin, with extensive global distribution.

- Eli Lilly’s Humalog (insulin lispro): Competitor with comprehensive clinical offerings.

- Biocon/Becton Dickinson’s Insulin Lispro: Emerging biosimilar options.

- Emerging biosimilars: Several biosimilars in development or launched, potentially exerting downward pricing pressure.

Product Differentiation

APIDRA’s unique attributes, such as faster onset, enable it to stand out among traditional rapid-acting insulins. Its formulation in SOLOSTAR pens enhances ease of use and patient adherence. However, patent expiry and biosimilar entries threaten to commoditize the product over time.

Regulatory and Patent Considerations

Sanofi’s patent protections for APIDRA expired in select jurisdictions by 2019, paving the way for biosimilars entering the market. Regulatory pathways in major markets like the EU and US support biosimilar approvals, increasing competition [4].

Pricing Analysis

Historical Pricing Trends

APIDRA’s wholesale acquisition cost (WAC) has experienced modest increases over the past five years, aligning with inflation, manufacturing costs, and market dynamics. In the US, the average list price for a 10 mL vial hovered around USD 273 in 2021, with pens costing approximately USD 150–200 per 5-pack [5].

Cost Comparisons with Competitors

While APIDRA’s premium positioning allows for higher pricing, biosimilar competition drives downward pressure. Bioequivalent biosimilars generally sell at discounts of 15–30%, putting pricing pressure on branded products [6].

Impact of Biosimilars and Generic Entrants

Biosimilar insulins—such as Eli Lilly’s insulin lispro (Lyumjev) and biosimilars approved in Europe—have begun to influence pricing. The entry of biosimilars often results in a price reduction of 20-30% for branded analogs within the first year of market entry, suggesting APIDRA’s prices could decline gradually over time [7].

Regional Price Variations

Pricing differs markedly across regions due to regulatory settings, reimbursement policies, and healthcare infrastructure:

- United States: Prices are significantly higher, with patient copays influenced by insurance formularies.

- Europe: Price controls and negotiations reduce retail prices, often 20-50% lower than US levels.

- Emerging Markets: Prices are lower, but affordability and access remain critical barriers.

Market and Price Projection (2023–2030)

Growth Drivers

- Rising global diabetes prevalence.

- Preference for rapid-acting insulin in intensive glycemic control.

- Enhancements in insulin delivery devices—smart pens and connected devices.

- Increasing adoption in pediatrics and type 2 diabetes management.

Market Challenges

- Patent expirations and biosimilar competition.

- Cost containment pressures in public healthcare systems.

- Patient preferences shifting toward more convenient or digital health-integrated treatments.

Pricing Trajectory

Based on market trends and biosimilar competition, APIDRA SOLOSTAR’s price in mature markets is projected to decline by approximately 10-15% annually from 2023 to 2028, stabilizing through 2030. In regions with strong price regulation, the decline may be more pronounced (up to 20%), while in less regulated markets, prices may hold relatively steady but could face compression from biosimilar options. The adoption of generic biosimilars will likely result in a cumulative price reduction of 40-50% over the next five years.

Revenue Impact

Despite pricing pressures, volume growth driven by increasing global diabetes prevalence should offset some margin erosion. Sanofi’s strategic focus on innovation, patient engagement, and expanding access in emerging markets aims to sustain revenue streams.

Regulatory and Policy Influences

Government policies and healthcare reforms profoundly affect pricing and market access. Prioritization of cost-effective treatments in public payers, especially in Europe and North America, necessitates competitive pricing strategies. Additionally, accelerated approvals of biosimilars driven by initiatives such as the EU’s biosimilar uptake policies could sharpen market entry timelines for generic equivalents [8].

Conclusion

APIDRA SOLOSTAR remains a vital player in the rapid-acting insulin market, bolstered by its clinical profile and user-friendly delivery device. However, patent expirations and biosimilar proliferation will pressure prices downward over the coming years. The global increase in diabetes prevalence, coupled with evolving treatment paradigms and digital health integration, presents opportunities for market expansion, even as pricing reforms challenge margins.

Stakeholders must monitor biosimilar developments closely, adapt to regional policy shifts, and emphasize differentiation through innovation and value-added services. Overall, APIDRA SOLOSTAR’s market outlook reflects a dynamic landscape shaped by unmet patient needs, competitive forces, and regulatory trends.

Key Takeaways

- The global insulin market, valued at approximately USD 20 billion in 2022, is poised for sustained growth driven by escalating diabetes prevalence.

- APIDRA SOLOSTAR’s clinical advantages sustain its market relevance amid rising biosimilar competition.

- Pricing is expected to decline gradually, with an estimated 10-15% annual reduction from 2023 through 2028, influenced heavily by biosimilar entries.

- Regional price variations necessitate tailored market strategies; US prices are higher with greater variability, while Europe and emerging markets exhibit cost sensitivities.

- Success in future markets hinges on innovation, expanding access, and strategic positioning against biosimilar entrants and regulatory challenges.

FAQs

-

How does APIDRA SOLOSTAR compare to other rapid-acting insulins in terms of clinical efficacy?

APIDRA has a faster onset and shorter duration than many competitors, offering better postprandial glucose control, which can enhance glycemic management when used appropriately. -

What factors are most likely to influence APIDRA’s price reductions in the next five years?

Biosimilar approvals, regulatory price controls, healthcare payer negotiations, and market competition are primary drivers of price declines. -

Are biosimilars a significant threat to APIDRA’s market share?

Yes. Biosimilars targeting insulin glulisine are emerging, which could erode market share especially in regions with strict cost-containment policies. -

How is the increasing adoption of digital and connected insulin pens expected to impact APIDRA?

Digital insulin pens can improve adherence and dosing accuracy, adding value and potentially allowing premium pricing or market differentiation. -

What geographic markets offer the best growth opportunities for APIDRA SOLOSTAR?

Emerging markets in Asia and Africa, driven by rising diabetes prevalence and expanding healthcare infrastructure, constitute significant growth opportunities, despite price sensitivity.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition. 2021.

[2] MarketsandMarkets. Insulin Market by Product Type, Distribution Channel, and Region — Global Forecast to 2027. 2022.

[3] American Diabetes Association. Standards of Medical Care in Diabetes—2022.

[4] U.S. Food and Drug Administration. Biosimilar Approval and Regulatory Pathways. 2022.

[5] GoodRx. Average Insulin Prices — 2021.

[6] IQVIA. Biosimilar Insulin Market Trends. 2022.

[7] European Medicines Agency. Biosimilar Insulin Approvals. 2022.

[8] European Commission. Supporting the Uptake of Biosimilars — Policy Framework. 2021.

More… ↓