Share This Page

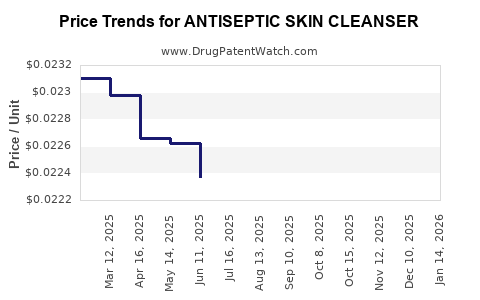

Drug Price Trends for ANTISEPTIC SKIN CLEANSER

✉ Email this page to a colleague

Average Pharmacy Cost for ANTISEPTIC SKIN CLEANSER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTISEPTIC SKIN CLEANSER 4% | 68599-5401-02 | 0.04981 | ML | 2025-12-17 |

| ANTISEPTIC SKIN CLEANSER 4% | 68599-5401-04 | 0.01839 | ML | 2025-12-17 |

| ANTISEPTIC SKIN CLEANSER 4% | 68599-5401-02 | 0.05153 | ML | 2025-11-19 |

| ANTISEPTIC SKIN CLEANSER 4% | 68599-5401-04 | 0.01767 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Antiseptic Skin Cleansers

Introduction

The antiseptic skin cleanser market has experienced notable growth driven by increasing awareness of hygiene, rising incidences of skin infections, and expanding healthcare applications. As global health consciousness escalates, the demand for effective disinfectant products, particularly antiseptic skin cleansers, continues to rise across consumer, clinical, and institutional segments. This analysis delves into current market dynamics, competitive landscapes, regulatory factors, and projects future price trends.

Market Overview

Industry Landscape and Scope

Antiseptic skin cleansers serve both healthcare and consumer markets. In healthcare, they are essential for preoperative skin preparation, wound management, and infection control. Consumer markets leverage these products for daily hygiene amid concerns over germs and pathogen transmission.

The global antiseptic skin cleanser market was valued at approximately $2.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030 [1]. Growth drivers include increased healthcare spending, rising infectious disease prevalence, and improved awareness of personal hygiene.

Key Regional Markets

- North America: Dominates due to high healthcare standards and consumer hygiene consciousness. The U.S. leads, accounting for over 35% of the global market.

- Europe: Growing demand fueled by stringent health regulations and increased hospital-acquired infection protocols.

- Asia-Pacific: The fastest-growing segment, driven by rising healthcare infrastructure, population growth, and urbanization. China and India are notable contributors.

- Rest of the World: Emerging markets with expanding healthcare systems and varying regulatory frameworks.

Market Drivers and Challenges

Drivers

- Healthcare-Related Demand: Surgical procedures, wound care, and infection prevention in hospitals sustain steady demand.

- Consumer Awareness: Increased hygiene practices due to COVID-19 pandemic incidents heightened overall product consumption.

- Regulatory Environment: Favorable policies promoting infection control standards incentivize product adoption.

Challenges

- Regulatory Hurdles: Stringent approval processes and evolving standards (e.g., FDA, EMA regulations) can delay product launches.

- Market Saturation: Mature segments face commoditization, exerting downward pressure on pricing.

- Competitor Pricing Strategies: Market players often engage in price wars, particularly in the generic segment.

Competitive Landscape

Major players like 3M, Johnson & Johnson, Reckitt Benckiser, and Henkel hold significant market shares. These companies focus on product innovation, brand loyalty, and expanding distribution channels. Smaller firms often compete through cost leadership, offering lower-priced formulations or niche products.

Product differentiation hinges on formulation effectiveness, skin compatibility, and packaging innovation. The shift towards alcohol-based formulations, especially those complying with regulatory standards, is notable.

Regulatory and Quality Considerations

Regulatory bodies globally oversee antiseptic products under different frameworks:

- United States: FDA’s Monograph for OTC antiseptics stipulates safety and efficacy standards.

- European Union: Compliance with cosmetic and biocidal regulations.

- Asia-Pacific: Regulatory requirements vary; rapid approvals pose market entry opportunities but also hurdles.

Quality assurance remains paramount. Products must demonstrate antimicrobial efficacy, skin safety, and compliance with environmental standards to avoid legal setbacks.

Price Trends and Future Projections

Historical Pricing Dynamics

The average retail price of antiseptic skin cleansers ranges between $3 to $10 per 100 ml bottle, depending on formulation, brand, and packaging [2]. Economic and regulatory factors have historically influenced pricing, with some segments experiencing marginal declines due to market saturation.

Projected Price Trajectory (2023-2030)

- Short-Term (2023-2025): Prices are expected to stabilize amid market maturation, with minor fluctuations driven by raw material costs and regulatory updates.

- Medium to Long-Term (2026-2030): Prices will likely experience a gradual increase averaging 1.5% to 3% annually, owing to inflation, enhanced formulation standards, and packaging innovations.

Emergence of premium products—such as organic or hospital-grade antiseptics—may command higher pricing, while commoditized products in developing markets will maintain competitive, lower price points.

Factors Influencing Price Variations

- Raw Material Costs: Surges in alcohol, chlorhexidine, or antimicrobial agents influence manufacturing costs.

- Regulatory Compliance: Stringent standards necessitate reformulations, raising costs.

- Packaging Innovations: Eco-friendly, user-friendly packaging often incurs higher expenses, reflected in retail prices.

- Market Competition: Price wars and brand loyalty affect pricing strategies.

Emerging Trends Impacting Market and Prices

- Natural and Organic Formulations: Demand for eco-friendly antiseptics is rising. While premium, they may command higher prices, impacting the overall price structure.

- Enhanced Formulations: Development of skin-friendly, dermatologically tested products can justify higher pricing tiers.

- Digital and E-Commerce Expansion: Direct-to-consumer channels facilitate competitive pricing and may lead to price reductions.

Conclusion

The antiseptic skin cleanser market is positioned for steady growth, driven by heightened hygiene awareness and expanding healthcare needs. Prices are expected to trend upward gradually, influenced by regulatory requirements, raw material costs, and innovation levels. Stakeholders should focus on regulatory compliance, product differentiation, and sustainable sourcing to optimize profitability amidst competitive pressures.

Key Takeaways

- The global antiseptic skin cleanser market is projected to grow at a CAGR of approximately 6.2% through 2030.

- Current retail prices hover around $3–$10 per 100 ml, with future increases likely due to regulatory and formulation standards.

- Innovation, organic formulations, and packaging advancements will create premium segments, influencing overall pricing.

- Market dynamics emphasize the importance of regulatory adherence and efficient supply chain management.

- Competitive pressures may induce price stabilization or slight reductions in commoditized markets, whereas high-tier products will command premium pricing.

FAQs

1. What are the primary factors influencing antiseptic skin cleanser prices?

Raw material costs, regulatory compliance, formulation innovations, packaging, and market competition significantly influence pricing.

2. How will COVID-19 impact future demand and pricing?

The pandemic heightened hygiene awareness, resulting in increased demand. This trend sustains, contributing to stable or rising prices, especially for hospital-grade products.

3. Are natural or organic antiseptic cleansers more expensive?

Yes, natural and organic formulations typically involve higher production costs, leading to premium pricing compared to conventional antiseptics.

4. What regions are expected to see the fastest growth in antiseptic skin cleansers?

Asia-Pacific markets, driven by healthcare infrastructure development and urbanization, are poised for the fastest CAGR in demand and pricing.

5. What regulatory changes could impact market pricing?

Stringent safety and efficacy standards mandated by authorities like the FDA and EMA can increase R&D and compliance costs, prompting price adjustments.

Sources

[1] Market research reports and industry analyses, 2022.

[2] Retail pricing data from consumer health product catalogs, 2023.

More… ↓