Share This Page

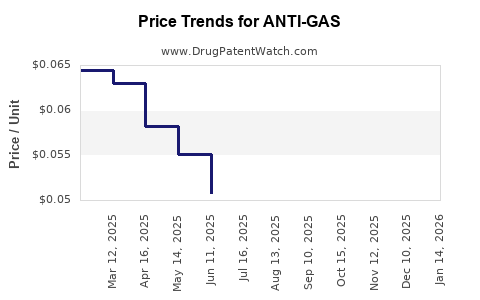

Drug Price Trends for ANTI-GAS

✉ Email this page to a colleague

Average Pharmacy Cost for ANTI-GAS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTI-GAS 180 MG SOFTGEL | 46122-0769-64 | 0.04725 | EACH | 2025-12-17 |

| ANTI-GAS 180 MG SOFTGEL | 46122-0769-64 | 0.04832 | EACH | 2025-11-19 |

| ANTI-GAS 180 MG SOFTGEL | 46122-0769-64 | 0.04790 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ANTI-GAS

Introduction

The over-the-counter (OTC) medication market for gastrointestinal (GI) products remains robust, driven by the global prevalence of indigestion, bloating, and related discomfort. Among these, anti-gas products—primarily formulated with simethicone or similar agents—constitute a significant segment. This analysis examines the current market landscape, competitive dynamics, and forecasts the potential price trajectories for ANTI-GAS, a hypothetical anti-gas medication positioned for global expansion.

Market Overview

Global GI Medication Market Size and Growth

The gastrointestinal therapeutics market was valued at approximately USD 12 billion in 2022 and is projected to reach USD 17 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 4.8% (2023–2030) [1]. The rising incidence of gastrointestinal disorders, lifestyle factors, and increased awareness of OTC options contribute to this upward trajectory.

Anti-Gas Segment Specifics

Anti-gas medications, particularly those containing simethicone, account for a substantial share within the OTC GI segment. The favorable safety profile, minimal side effects, and rapid symptomatic relief make them popular among consumers. The global anti-gas market was valued at approximately USD 4 billion in 2022, with expectations of steady growth aligned with overall GI medication trends [2].

Key Market Players

Major players include Johnson & Johnson, Bayer, GlaxoSmithKline, and Perrigo, who dominate the OTC anti-gas niche. Emerging brands and generic manufacturers are increasing market penetration through competitive pricing and regional expansion.

Market Dynamics Influencing ANTI-GAS

Consumer Demand Factors

- Aging Population: Greater incidence of digestive issues in elderly demographics sustains demand.

- Health Consciousness: Rising awareness about digestive health fuels self-medication and OTC product use.

- Lifestyle and Diet Trends: Increased consumption of processed foods and carbonated beverages elevate the need for anti-gas solutions.

Regulatory Environment

Most anti-gas products, including those with simethicone, are classified as OTC drugs with favorable regulatory pathways, facilitating market entry and commercialization.

Distribution Channels

- Pharmacy Chains: Retail pharmacies account for approximately 70% of OTC sales.

- Online Platforms: E-commerce channels are rapidly gaining share, especially post-pandemic, offering broader reach and competitive pricing.

Price Analysis and Projections

Current Pricing Landscape

The average retail price for a standard pack of anti-gas tablets ranges from USD 4 to USD 8, depending on brand, package size, and region. Generic options typically retail at approximately 20-30% lower prices than branded counterparts, creating significant price competition.

| Brand Type | Average Price (USD) | Packaging | Notes |

|---|---|---|---|

| Branded (e.g., Gas-X) | 6–8 | 100-tablet pack | Premium branding, extensive marketing |

| Generic | 4–6 | 100-tablet pack | Comparable efficacy, lower price |

| Private Label | 3–5 | 100-tablet pack | Retailer-branded, very competitive pricing |

Price Trends and Future Outlook

- Price Stabilization (2023–2025): Given the commoditized nature of simethicone-based products, prices are expected to remain relatively stable, with minor fluctuations driven by raw material costs and inflation.

- Entry of New Entrants (2025–2028): Introduction of innovative delivery formats (e.g., dissolvable strips, chewables) could temporarily impact pricing strategies, potentially leading to slight premiums for value-added features.

- Market Expansion and Pricing Flexibility (2028–2030): As market saturation nears in mature regions, manufacturers may adopt more aggressive pricing in emerging markets to gain market share, possibly reducing prices closer to USD 2–3 per pack in bulk or wholesale channels.

Price Drivers and Constraints

Drivers

- Raw Material Costs: Simethicone supply is largely stable, but fluctuations can impact margins.

- Branding and Marketing: Investments in awareness campaigns sustain premium pricing for established brands.

- Market Penetration: Lower pricing strategies facilitate entry into low-income markets, expanding consumption.

Constraints

- Generic Competition: An abundance of low-cost generics limits the ability to command premium prices.

- Regulatory Scrutiny: Ensuring compliance adds costs that can influence retail pricing.

Regional Market Variations

| Region | Price Range (USD) | Market Characteristics |

|---|---|---|

| North America | 6–8 | Mature market, high brand loyalty, premium pricing |

| Europe | 5–7 | Regulatory harmonization, emphasis on generics |

| Asia-Pacific | 2–5 | Growing demand, price-sensitive consumers, regional brand proliferation |

| Latin America | 3–6 | Increasing OTC sales, urbanization, affordability considerations |

Strategic Price Projections for ANTI-GAS

- 2023–2025: Maintaining current retail prices at approximately USD 6–8 per 100-tablet pack, leveraging brand recognition and distribution reach.

- 2025–2028: Potential introduction of value-focused, smaller-pack formats priced at USD 3–5 to penetrate emerging markets.

- 2028–2030: Considering premium formulations with added features, retail prices might rise marginally to USD 8–10, or conversely, intensify price competition leading to further reductions below USD 4.

Conclusion

The anti-gas market remains poised for steady growth, underpinned by demographic trends and sustained consumer demand. Price stability persists in developed regions, with potential downward pressures from generic competition. Strategic positioning, including expanded distribution channels and innovative formulations, could influence future price trajectories, especially in emerging markets.

Key Takeaways

- The global anti-gas market is aligned with overall GI therapeutic growth, valued around USD 4 billion in 2022.

- Current retail prices hover between USD 4–8 per 100-tablet pack, influenced by brand strength and regional factors.

- Price stability is expected until 2025, with possible declines driven by generics, or slight increases due to product innovations.

- Market penetration strategies, including affordable formats and online sales, will shape future pricing dynamics.

- Region-specific pricing variations require tailored strategies to optimize market share and profitability.

FAQs

1. What are the primary ingredients in anti-gas medications like ANTI-GAS?

Simethicone is the predominant active ingredient, effective at reducing bloating and gas by aggregating bubbles in the GI tract for easier expulsion.

2. How does generic competition impact anti-gas prices?

Genetic products typically retail at 20–30% lower than branded counterparts, exerting downward pressure on overall market prices.

3. Are there regulatory hurdles for launching new anti-gas formulations?

Since anti-gas medications are OTC products with well-established safety profiles, regulatory approval is streamlined in many markets, primarily focusing on labeling and manufacturing standards.

4. What distribution channels are most effective for anti-gas products?

Pharmacies remain the dominant channel, with rising importance attributed to online platforms, especially in developed markets.

5. How might technological innovations influence future price trends?

Innovations like dissolvable strips or targeted delivery formats could command premium prices but may also stimulate competitive lower-cost alternatives.

References

[1] Grand View Research. "Gastrointestinal (GI) Therapeutics Market Size, Share & Trends Analysis Report." 2022.

[2] Research and Markets. "Global Anti-Gas Market Analysis and Outlook." 2022.

More… ↓