Share This Page

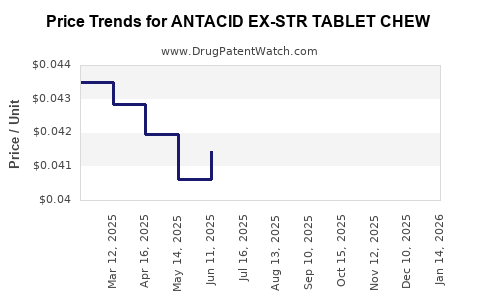

Drug Price Trends for ANTACID EX-STR TABLET CHEW

✉ Email this page to a colleague

Average Pharmacy Cost for ANTACID EX-STR TABLET CHEW

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTACID EX-STR TABLET CHEW | 70000-0234-01 | 0.04572 | EACH | 2025-12-17 |

| ANTACID EX-STR TABLET CHEW | 70000-0234-01 | 0.04571 | EACH | 2025-11-19 |

| ANTACID EX-STR TABLET CHEW | 70000-0234-01 | 0.04505 | EACH | 2025-10-22 |

| ANTACID EX-STR TABLET CHEW | 70000-0234-01 | 0.04447 | EACH | 2025-09-17 |

| ANTACID EX-STR TABLET CHEW | 70000-0234-01 | 0.04397 | EACH | 2025-08-20 |

| ANTACID EX-STR TABLET CHEW | 70000-0234-01 | 0.04242 | EACH | 2025-07-23 |

| ANTACID EX-STR TABLET CHEW | 70000-0234-01 | 0.04146 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ANTACID EX-STR TABLET CHEW

Introduction

The ANTACID EX-STR TABLET CHEW enters a competitive gastrointestinal (GI) medication landscape, targeting consumers seeking fast-acting relief from acid reflux, heartburn, and indigestion. With shifting consumer preferences toward convenient, chewable formulations, and an evolving regulatory environment, prospective investors and stakeholders must analyze current market dynamics, competitive positioning, and future pricing trajectories.

Market Landscape

Global and Regional Demand

Antacids, including chewable formulations like ANTACID EX-STR TABLET CHEW, enjoy widespread demand driven by rising incidences of gastroesophageal reflux disease (GERD), dietary patterns, and increased awareness of over-the-counter (OTC) remedies. The global antacid market was valued at approximately USD 3.4 billion in 2021 and projected to grow at a compound annual growth rate (CAGR) of around 3.6% through 2028 [1].

Regionally, North America dominates due to high prevalence rates and accessible healthcare infrastructure. The Asia-Pacific region shows the fastest growth potential, driven by expanding healthcare access, developing markets, and a rising middle class seeking self-medication options [2].

Market Segmentation

- Product Type: Chewables, liquids, suspensions, powders.

- Formulation: Aluminum-based, magnesium-based, calcium carbonate.

- Distribution Channel: OTC, pharmacies, hospitals, online sales.

Chewable antacids like ANTACID EX-STR TABLET CHEW cater to consumers prioritizing convenience and rapid relief, capturing a significant share within the OTC segment.

Competitive Environment

Major competitors include well-established OTC brands such as Tums (Calcium Carbonate), Rolaids (Calcium Carbonate and Magnesia), and Mylanta (Aluminum Hydroxide/Magnesium Hydroxide). Innovators are exploring combination formulations with adjunctive ingredients—such as simethicone for gas or bicarbonates—to add value.

Market differentiation hinges on:

- Efficacy and speed of relief

- Flavor and formulation palatability

- Pricing strategies

- Brand trust and marketing reach

Product Positioning and Unique Features of ANTACID EX-STR TABLET CHEW

ANTACID EX-STR TABLET CHEW uniquely combines potent antacid action with a palatable chewable format, indicating an emphasis on consumer convenience. If it includes additional benefits like longer-lasting relief, fewer side effects, or natural ingredients, these features could further enhance its USP.

Pricing Structure Analysis

Current Pricing Benchmarks

Existing market leaders price their antacid chewables in the range of USD 4.00 to USD 7.00 per package, typically containing 50 to 100 tablets, translating to approximately USD 0.08 to USD 0.14 per tablet.

Key factors influencing pricing include:

- Brand recognition

- Production costs

- Regulatory costs for approval

- Distribution margins

- Consumer willingness to pay

Cost Factors

- Manufacturing: Chewable formulations require specialized excipients and stabilization to ensure taste and bioavailability, slightly increasing costs.

- Regulatory Compliance: Variations across regions necessitate tailored regulatory submissions, impacting overall expenditure.

- Marketing & Distribution: Established brands benefit from extensive marketing, enabling premium pricing; newer entrants may initially adopt competitive pricing.

Pricing Projections

Short-term (1-2 Years):

- Entry pricing likely around USD 4.50–USD 5.50 per pack to penetrate the OTC market.

- Per tablet price approximating USD 0.09–USD 0.11.

- Promotional discounts or bundling may temporarily lower retail price points.

Medium to Long-term (3-5 Years):

- As market share consolidates and brand recognition improves, prices may stabilize near USD 6.00–USD 7.00 per pack.

- Possible premium pricing if the product contains additional ingredients or superior formulations.

- Pricing may also vary regionally, reflecting economic disparity and purchasing power.

Impact of Regulatory Changes and Consumer Trends:

- Increased demand for natural, preservative-free, or organic ingredients might justify a higher price premium.

- Regulatory approval in emerging markets could open avenues for lower entry costs but may also impose tariff or import duties, influencing retail prices.

Forecast Summary:

| Year | Approximate Price per Pack | Price per Tablet |

|---|---|---|

| 2023 | USD 4.50 – USD 5.50 | USD 0.09 – USD 0.11 |

| 2025 | USD 5.50 – USD 6.50 | USD 0.11 – USD 0.13 |

| 2027 | USD 6.00 – USD 7.00 | USD 0.12 – USD 0.14 |

Market Entry Strategies

- Pricing Tactics: Introductory discounts, loyalty programs, and bundling can accelerate adoption.

- Partnering: Collaborations with pharmacies and online platforms improve access.

- Differentiation: Emphasizing unique features, such as flavor options, faster relief, or natural ingredients, supports premium pricing.

Regulatory and Consumer Trends Impact

The increasing regulatory emphasis on safety and efficacy, coupled with heightened consumer awareness towards organic and additive-free products, challenges manufacturers to innovate. Progressive product development aligned with consumer preferences may allow for a strategic pricing bandwidth—positioning ANTACID EX-STR TABLET CHEW as both an affordable and premium option.

Key Risks and Challenges

- Market Saturation: Existing brands dominate; capturing significant market share requires aggressive marketing.

- Price Sensitivity: Consumers often prefer low-cost OTC remedies; premium pricing should not deter sales.

- Regulatory Hurdles: Delays or restrictions can impact market launch timelines and pricing strategies.

- Price Wars: Intense competition could lead to downward pressure on prices.

Conclusion

The ANTACID EX-STR TABLET CHEW situates itself within a stable, growing OTC antacid segment with opportunities for targeted positioning based on convenience and formulation benefits. Initially, competitive pricing near existing market leaders is essential. Over time, as brand recognition and product differentiation increase, a gradual premium pricing strategy can enhance profitability.

Robust marketing, strategic distribution, and product innovation aligned with regulatory and consumer trends will underpin successful market penetration and sustainable price evolution.

Key Takeaways

- The OTC antacid segment is projected to grow at a CAGR of 3.6%, bolstered by rising GERD prevalence and lifestyles.

- Pricing for ANTACID EX-STR TABLET CHEW should start around USD 4.50 – USD 5.50 per pack, aligning with current industry standards.

- Brand differentiation, natural formulations, and effective branding can enable premium pricing over time.

- Entry into emerging markets offers growth prospects but requires adaptations to local regulatory and economic conditions.

- Continuous monitoring of competition, consumer preferences, and regulatory updates is vital for sustainable pricing and market share expansion.

FAQs

-

What factors influence the pricing of antacid chewable tablets like ANTACID EX-STR?

Pricing is affected by manufacturing costs, formulation complexity, brand positioning, regulatory compliance, distribution channels, and competitive landscape. -

How does consumer demand affect the future price projections of antacids?

Increased demand from rising GERD cases and preference for convenience products allow for gradual price increases, especially if products incorporate innovative features or natural ingredients. -

Are natural or organic formulations likely to command higher prices?

Yes, consumers seeking natural remedies often pay a premium for ingredients perceived as safer or more effective, providing an opportunity for higher-margin products. -

What is the typical price range for chewable antacids in the market today?

Most brands price their packs between USD 4.00 and USD 7.00, translating to approximately USD 0.08 to USD 0.14 per tablet. -

What risks could impact the pricing strategy for ANTACID EX-STR TABLET CHEW?

Competitive price reductions, regulatory restrictions, raw material costs, and shifts in consumer preferences toward lower-cost options pose potential challenges.

Sources:

[1] Grand View Research. “Antacid Market Size, Share & Trends Analysis Report,” 2022.

[2] Fortune Business Insights. “Gastrointestinal Drugs Market Size, Share & Industry Analysis, 2021-2028.”

More… ↓